[ad_1]

JPMorgan CEO Jamie Dimon’s annual letter to shareholders, launched on Monday, touted the agency’s document $162.4 billion income in 2023 and dedication to shareholders whereas additionally zooming out to broader financial and technological points — just like the shrinking market of publicly traded corporations within the U.S. and the pivotal function of AI.

In an replace on particular points going through JPMorgan, Dimon introduced up AI’s influence on the corporate.

“Whereas we have no idea the complete impact or the exact price at which AI will change our enterprise — or the way it will have an effect on society at giant — we’re fully satisfied the implications shall be extraordinary,” Dimon wrote, evaluating AI to improvements just like the steam engine, electrical energy, and the Web.

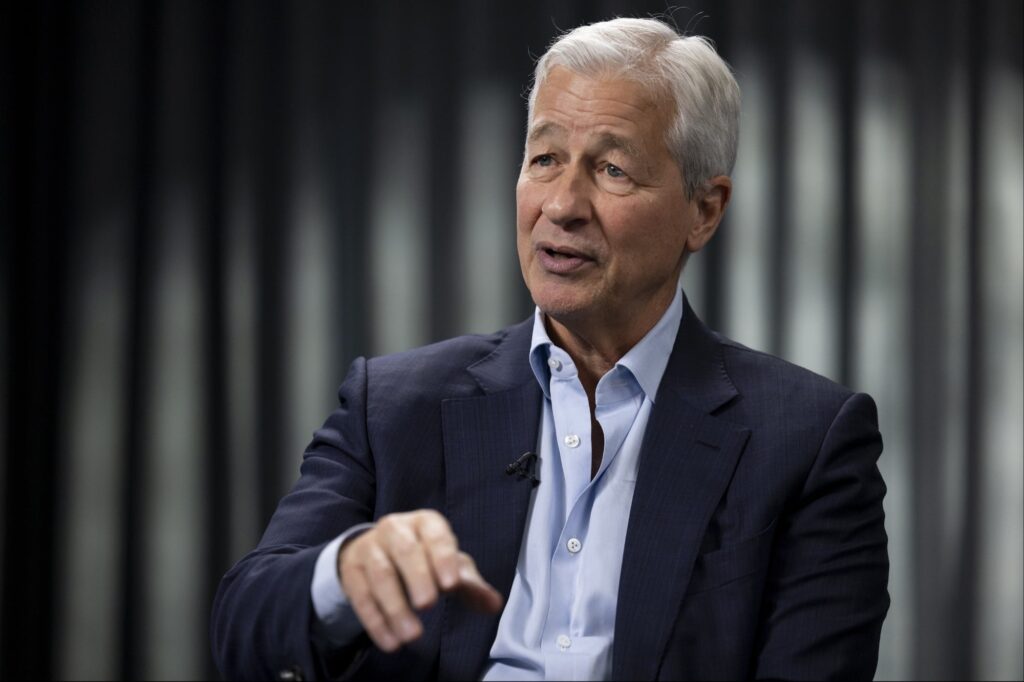

Photograph Credit score: Jason Alden/Bloomberg through Getty Photos

JPMorgan started utilizing AI over a decade in the past and first talked about it to shareholders in 2017, in response to Dimon’s letter. The corporate at the moment employs greater than 2,000 AI consultants and is experimenting with generative AI in customer support, software program engineering, and operations.

Sooner or later, Dimon predicts that AI might improve “nearly each job.”

AI might also “cut back sure job classes or roles, however it might create others as nicely,” Dimon wrote, including that the corporate would “aggressively retrain” present staff if their jobs had been affected by AI.

Associated: JPMorgan Says Its AI Cash Flow Software Cut Human Work By Almost 90%

Dimon later talked about within the letter that the variety of U.S. public corporations has dropped to 4,000 from 7,300 in 1996. In the meantime, personal U.S. corporations have grown almost six occasions in quantity over the previous 20 years, from 1,900 to 11,200 corporations.

He acknowledged that “the pressures to retreat from the general public market are mounting,” calling consideration to greater necessities for reporting info, shareholder activism, and elevated public consciousness about what’s occurring inside the firm.

Dimon known as for an alternative choice to the shareholder assembly, which he claimed was dominated by particular curiosity teams. He did not point out any particular examples of options however mentioned that the corporate was “continually speaking” with buyers.

Associated: Disney and CEO Bob Iger Triumph Over Hedge Funds and Investor Nelson Peltz, After Fierce Board Fight

He additionally acknowledged that the banking system is altering and going through new competitors from personal markets and fintech.

“Do not forget that many of those new gamers do not need the identical transparency or have to abide by the in depth guidelines and rules as conventional banks, even when they provide related merchandise — this usually offers them important benefit,” he wrote.

JPMorgan acknowledged final month that an AI cashflow software has helped a few of its purchasers reduce previously human-driven work by as much as 90%.

Dimon has previously spoken about AI’s potential to enhance the standard of life for human beings, stating that it might result in fewer workdays and longer lifespans.

Associated: JPMorgan CEO Jamie Dimon Says AI ‘Is Real’ and Will Eliminate the 5-Day Work Week

AI has additionally obtained backlash over the massive swaths of training data it requires to advance, together with presumably copyrighted knowledge.

[ad_2]

Source link