[ad_1]

When Clark Valberg talks about InVision, the corporate he based with Ben Nadel, it nearly sounds as if he can’t consider its story.

It’s a Silicon Valley story with a traditional arc: Two engineers begin an organization, nearly accidentally. The corporate soars to success, and in lower than a decade, it has grown to a workers of almost 1,000 and is valued at $1.9 billion.

Then, 5 years after reaching its peak, the corporate abruptly broadcasts it’s shuttering.

For these within the design neighborhood, InVision’s failure felt disappointing. The corporate had been one among design’s first and largest cheerleaders within the enterprise sphere, main the cost to deliver design into the C-suite of main companies. However the firm’s trajectory, ultimately, is a well-recognized enterprise allegory. It’s a narrative so quotidian within the expertise world, but stunning to anybody who isn’t accustomed to how straightforward it’s for a corporation to fall from grace with a couple of improper strikes.

So what did it take to kill a unicorn?

“Know-how sadly failed us, and there was a basic shift out there,” says Valberg, who left his CEO submit at InVision two years in the past. “I can admit each mistake.”

From prototype to product

In 2011, Valberg and Nadel had been working collectively on constructing an organization known as Epicenter Consulting that created customized cellular and net apps to assist companies increase effectivity. The 2 engineers have been renting area inside a small workplace in Manhattan, with an eye fixed to increasing past their two desks. However lease was costly, so as an alternative of paying for extra workplace area, they determined to make Epicenter a completely distant enterprise.

That call allowed the pair to faucet unimaginable expertise no matter geography, but it surely additionally got here with its personal challenges. It was exhausting to foster empathy amongst teammates, and gathering constant, productive suggestions was powerful, as was monitoring real-time undertaking standing. Valberg and Nadel realized that they might take the identical software-based method they used with their prospects and apply it to Epicenter and its shopper work.

As a form of inside ardour undertaking, Valberg and Nadel started coding a bit of software program that they describe as “a approach to flip your Photoshop design right into a simulation of a product in a browser.” It was meant to fast-track the messy course of between creating an early design iteration, getting suggestions, after which lastly coding it to be stunning and interactive.

The software program allowed the complete Epicenter staff—from designers to coders to nontechnical workers—to have interaction with the company’s workflow in a completely new manner. Better of all, it democratized Epicenter’s software program improvement course of and trickled all the way down to the company’s purchasers, making the complete expertise extra inclusive.

Valberg and Nadel started referring to the software program as InVision, as a result of it allowed the person to “envision” a product expertise early within the design course of. Sensing he and his staff had developed one thing larger than simply an inside software, Valberg determined to pressure-test it with designers he knew. He weren’t positive if anybody would truly pay for it. “The concept somebody was going to pay you for software program for a month wasn’t a factor,” says Valberg of InVision’s early days. However folks appreciated the software program, so he and Nadel determined to show it into an actual product whereas protecting their expectations low. Valberg says on the time, he and Nadel have been simply hoping to pay their lease and Equinox memberships with earnings from the software program. However InVision rapidly morphed into one thing a lot, a lot larger.

In 2011, Valberg and Nadel quietly launched InVision with an $8 greenback month-to-month subscription plan. “The primary paid subscription was launched on my wedding ceremony day,” says Valberg. “We have been on the chuppah and my spouse was like, ‘Cease your telephone!’ I used to be watching the primary particular person buy a subscription. Individuals simply began signing up like loopy.”

What occurred subsequent is now historical tech historical past. InVision’s software program took off, gaining rogue momentum and reaching a $1.9 billion valuation in 2019. The corporate snagged lots of of thousands and thousands in capital funding and amassed a roughly 1,000-person headcount over its 13 years in enterprise. Throughout its heyday, InVision was used in any respect Fortune 100 firms.

For some time, the corporate appeared unstoppable. “The enterprise was screaming sizzling till it wasn’t,” Valberg says.

On January 4, 2024, InVision’s present CEO, Michael Shenkman, posted a letter on InVision’s web site addressed to its neighborhood, asserting that the corporate could be closing down by the tip of 2024.

Obstacles to Innovation

InVision’s success was, in some ways, a product of its time. Its software program rode the crest of design’s ascent within the business world—a second when firms like IBM were investing millions in constructing out their in-house design expertise, and “design pondering” as a enterprise worth was arising in enterprise publications, such because the Harvard Business Review. “Individuals understood that nice design merchandise win,” says Valberg.

In the course of the mid-2010s, InVision’s hottest software program product, V6, had amassed greater than 8 million customers. However the staff had larger aspirations. InVision had all the time functioned as a “companion platform.” Designers would create a wireframe or design of their chosen design software, often Sketch or an Adobe product, then port it over to InVision the place groups might collaboratively iterate and supply suggestions on the design. “It catalyzed design and improvement,” says Valberg. “It helped transfer design earlier within the course of, but it surely additionally helped these organizations that have been already forward-thinking. For designing buyer expertise, this grew to become a approach to have efficient conversations.”

In 2015, the product staff started engaged on a brand new model of InVision, V7, that may broaden the product from a collaboration software to a extra holistic design software the place designers might do every little thing on InVision’s platform. On the identical time, this model would transfer InVision from Adobe’s ColdFusion backend software program to a extra trendy tech stack. InVision hoped V7 would permit the corporate to maneuver sooner and appeal to new tech expertise who possibly wasn’t eager to work on the outdated expertise.

Billy Kiely, a designer who spent greater than eight years at InVision (with the final six-plus within the function of VP product design up till Could 2021), says the updates have been overdue, however they got here at a time of superfast development for the corporate when it was quickly rising its enterprise shopper base. “It tied up a major quantity of our engineering workers,” Kiely recollects. “We stored operating into boundaries and partitions . . . A big proportion of our firm was engaged on one thing that wasn’t but customer-facing, and we have been having bother making it customer-facing. It was a spotlight distraction.”

Kiely says that whereas “V6 had a small (however mighty) staff protecting the lights on,” the corporate selected to not proceed innovating on V6 as a result of V7 felt “proper across the nook.” As a substitute of constructing options twice—for V6 and V7—InVision poured its efforts into the brand new software program, permitting the model its prospects have been utilizing to languish.

However V7 was taking longer to construct and ship than Valberg had anticipated. “It went on for 4 years,” says Valberg. “You couldn’t again out of it. This severely restricted our capacity to launch fast updates to our core customers—little creature comforts. That is the undertaking that sucked all of the vitality, this re-platforming.”

Design software program meets its market

Whereas InVision was engaged on its replace, a nascent trade of design collaboration instruments started to take form. Sketch had been an integral companion to InVision for years, so Valberg didn’t view it as an instantaneous menace to the enterprise. Then in 2015, Figma, a San Francisco-based design software startup, got here out with a direct problem to InVision.

Each InVision and Figma supplied prospects real-time communication and an accelerated inventive cadence, however Figma’s software program gave designers a approach to create, collaborate, give suggestions, and make sooner selections all from a single platform. The 2 have been additionally priced in a different way. Because the incumbent, InVision was seen as much less versatile and costlier than Figma. Designers started to note.

Survey outcomes revealed by UXTools confirmed that in 2017, fewer than 10% of respondents used Figma, whereas 60% used InVision. By 2019, the variety of designers utilizing Figma started to eclipse these utilizing InVision for prototyping. (Figma’s founders declined an interview request for this story; management at Sketch and InVision additionally didn’t reply to requests for remark.)

Designers are notoriously non-discriminant in terms of their instruments, and so they’ll swap to new merchandise that work finest in the meanwhile. Whereas InVision was seen as an trade commonplace for a while, loads of designers had no qualms about migrating from InVision to different merchandise as they emerged.

Mia Blume, a former design chief at Pinterest and Ideo and founding father of San Francisco-based design management consultancy Design Dept., says this race for relevance is the place InVision fell behind. There was a interval when InVision supplied a software that helped designers break freed from the Adobe product suite, however in the end, the corporate was hindered by its lack of ability to ship new options on the charge its prospects required.

“This serves as a beneficial reminder to designers that good design and even the promise of potential is inadequate for enterprise success,” she says. “Staying aggressive in evolving landscapes is essential for efficient design—and in the end, enterprise.”

Benjamin Goldman, who spent greater than 5 years at InVision as director of InVision Movies and group inventive director, recollects an electronic mail from a senior account government “sounding the alarm on Figma,” which was despatched to some C-level execs and leaders working in InVision’s gross sales group. “I keep in mind that it stated he was dropping increasingly enterprise to a small upstart known as Figma,” says Goldman, who on the time was managing the corporate’s gross sales enablement and content material technique.

In 2016, Figma was a small competitor, says Goldman. The corporate was simply starting to seize a few of InVision’s buyer base. Wanting again, they’d been improper. “There was a way that management didn’t totally admire the aggressive menace Figma posed,” he says. “Lots of people intuited that this was an irreversible trajectory.” By the point Goldman left InVision in 2021, he says, “most individuals acknowledged it was recreation over. The indicators have been very clear.”

Valberg admits that at the moment, he was extra nervous that Adobe would sweep the market. For years, he had fixated on attempting to companion with Sketch in a manner which may make Adobe a much less formidable opponent. “I stated, ‘Give me any stage of dedication you’re prepared to have the place we will struggle this battle collectively,’” Valberg recollects of conversations with Sketch cofounder and creator, Pieter Omvlee. Finally, Omvlee declined, and Valberg continued to deal with a race towards Adobe, whereas his product staff floundered with V7, which in the end by no means reached the market.

“What might we have now carried out in a different way?” Valberg says on a latest Zoom name, with a quick smirk. “We might have constructed one thing higher than Figma, earlier than Figma.”

Constructing a neighborhood

Regardless of Figma casting a shadow over InVision’s future, InVision reached unicorn standing in 2019 with an almost $2 billion valuation, constructed largely on its advertising and marketing savvy. Whereas the product aspect of InVision was struggling, its content material arm was thriving.

With Valberg’s advertising and marketing genius on the helm, InVision grew to become a vocal advocate for design as a vital enterprise vertical, proselytizing the self-discipline as a powerhouse of collaboration and problem-solving. It was a classy method to content material advertising and marketing—one which few design firms have been exploring within the mid-2010s.

“The advertising and marketing group there was unimaginable; not like something I’d skilled,” says Goldman. Goldman’s arm of the enterprise created podcasts, movies, and books, all within the identify of training enterprise leaders on design’s worth. He says the corporate was “not the form of startup to purchase billboards in San Francisco and spend huge on advert campaigns.” As a substitute, InVision’s content material engine did a variety of the heavy lifting.

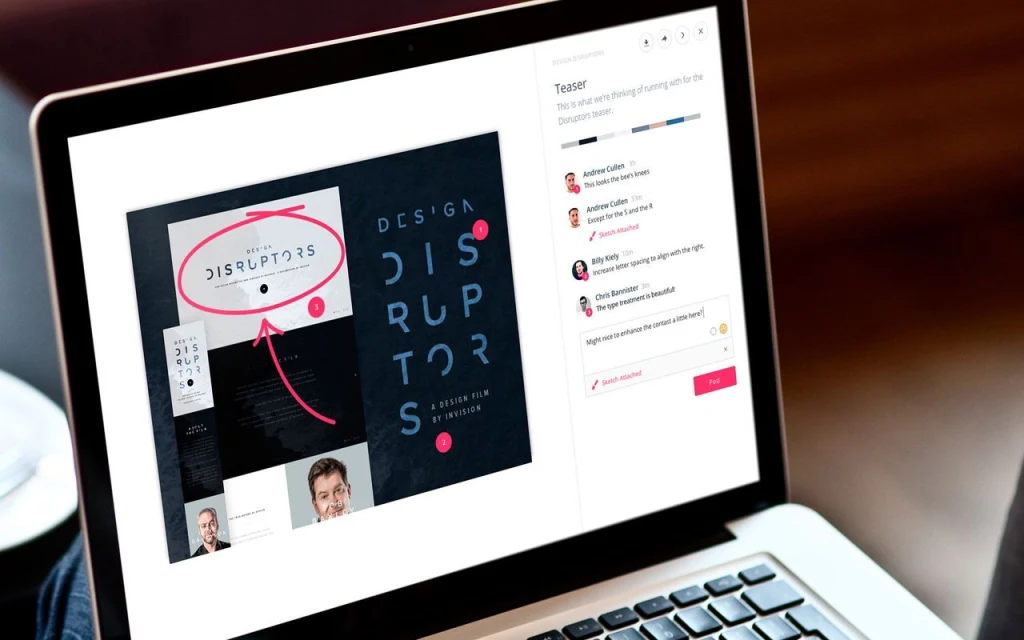

The corporate’s e-newsletter organically drew in 2 million subscribers, whereas documentary movies reminiscent of Squads (which broke down the internal workings of a product staff) and Design Disruptors (detailing tales of design’s success in varied industries) landed repeat publicity for the corporate at screenings held at native AIGA chapters, regional startup conferences, faculties, and unbiased design companies.

InVision fairly clearly benefited from its thought management. It satisfied a legion of enterprise leaders that design (and by extension, InVision) was an necessary piece of the enterprise puzzle. “[InVision] helped form the way in which the trade participated in essential conversations concerning the worth of design,” says Blume. “I’ll all the time be glad about that funding in the neighborhood. In some ways, I consider that this impression was far higher than the impression of their product itself.”

With the information of InVision’s closing, some within the design trade have advised that Valberg overspent on content material—presumably spending extra on advertising and marketing the product than on the product. “For advertising and marketing, it was very seen the place we have been pouring our cash. However on the product aspect, there was a lot behind the scenes that didn’t make it to the stage on the finish of the day,” says Kiely. “That was a big a part of our funding . . . We have been in a continuing state of attempting to play catch-up.”

A part of the problem was merely the corporate’s stage of development, Kiely admits. When InVision was younger and scrappy with a much smaller person base, it was a lot simpler for InVision to plan for and scale innovation. Managing a re-platforming and the associated information migration amid quick development proved powerful. “Clients noticed a product that remained stale and fell behind [in V6],” says Kiely. “We truly constructed a ton of actually nice merchandise and options on V7, we simply did not get it into our prospects’ arms in time.”

These efforts have been exacerbated by the truth that the corporate was totally distant from the start. As the corporate grew, the pure checks and balances of “who’s who within the zoo,” as Valberg says, didn’t occur as readily. Mockingly, working remotely made working collaboratively more durable because the group scaled.

“It was a hyper-growth firm,” says Aaron Walter, who joined InVision in 2016 as VP of design training earlier than leaving in 2020. “We have been attempting to determine issues out. We had an enormous leap and some huge cash . . . When there’s a change in management, there’s a change in technique, and that comes with a coordination tax.”

When requested to zoom out a bit on the corporate’s unraveling, Valberg says that ultimately, he believes the corporate’s failure to launch V7 is irrelevant. He says InVision merely didn’t ship in the way in which it wanted to, and because of this, the corporate confronted each quintessential enterprise drawback associated to quick development and scale. “This can be a winner-takes-all market,” he says. “Designers will take the very best software, it doesn’t matter what. Even if you happen to eliminated all of our tech challenges, it doesn’t clear up the enterprise drawback.”

Nonetheless, he likes to suppose that InVision’s impression goes past the product it did—or didn’t—launch. The corporate constructed a neighborhood round designers and managed to enlarge the worth of design for a enterprise world that took a very long time to note it. “Design is the very best auditorium for enterprise technique,” Valberg says. “It’s not, ‘How do you give design a seat on the desk?’ It’s, ‘How do you make enterprise folks really feel like they need to be on the design desk?’”

[ad_2]

Source link