[ad_1]

This text initially appeared on Inside Climate News. It’s republished with permission. Join the e-newsletter right here.

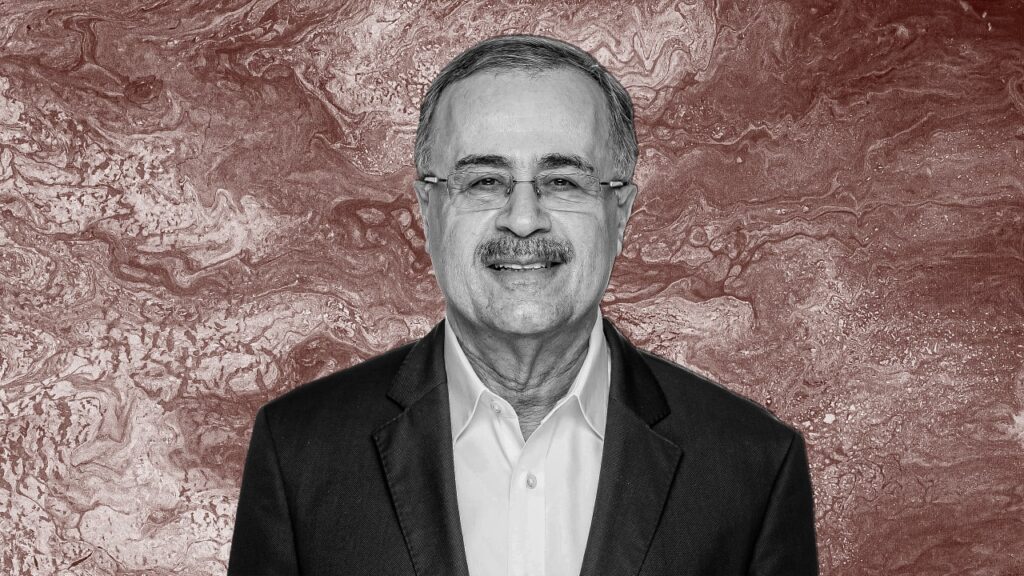

The CEO of Saudi Aramco mentioned final month that the transition to wash vitality “is visibly failing on most fronts.”

Amin H. Nasser, who has been president and CEO of the state-owned vitality firm since 2015, lamented that “our trade is painted as transition’s arch-enemy.”

The speech at CERAWeek, the annual vitality convention held in Houston, reveals how the oil trade views itself because the world embarks on a multi-generation shift away from fossil fuels. Nasser units up a straw man model of the vitality transition, by which progress is gradual and costly, then describes the oil and gasoline trade as a falsely maligned hero. It’s a panoramic one-two punch.

So, what’s actuality?

First, the plain: Fossil gas firms bear a big share of duty for the local weather disaster that threatens to make components of the world unrecognizable due to excessive warmth and sea stage rise. Most of the firms knew about the harm and did it anyway.

And what about Nasser’s critique of the vitality transition?

His argument comes all the way down to the concept that different vitality sources have been unable to displace fossil fuels on a big scale, regardless of the world spending greater than $9.5 trillion on the vitality transition within the final 20 years.

“We should always abandon the fantasy of phasing out oil and gasoline, and as an alternative spend money on them adequately, reflecting sensible demand assumptions,” he mentioned.

This reasoning verges on nihilism, declaring defeat on behalf of the governments, companies, and different organizations which might be working to scale back the injury that the oil trade has helped to trigger. It’s additionally dangerous for enterprise and the economic system, like telling Henry Ford in about 1910 that vehicles had failed to remodel the market, so give attention to enhancing horses and carriages.

David Victor, a professor of public coverage on the College of California, San Diego, was at CERAWeek and mentioned Nasser’s speech was well-received by the oil and gasoline trade of us who make up a big share of attendees. Victor is a prolific author and analyst of fresh vitality coverage and expertise.

One purpose the message went over properly was as a result of Nasser was “saying issues that lots of different executives are pondering however can’t say out loud as a result of they’re not working a state-owned firm primarily based within the Persian Gulf,” Victor mentioned. “They’re working publicly traded firms, with shareholders and different stakeholders that wish to nonetheless advance the vitality transition, and don’t wish to be seen as giving up.”

What concerning the substance of the speech?

“There was a form of nearly purposeful confusion or conflation,” Victor mentioned.

The issue, he mentioned, is the best way Nasser made a leap from arguing that the vitality transition isn’t residing as much as its objectives to saying a number of strains later that the transition has failed.

For instance, Victor mentioned, the world is unlikely to restrict temperature rise to 1.5 levels Celsius, which is a central objective for worldwide organizations, however that doesn’t imply the vitality transition is lifeless.

“The vitality transition will not be solely alive, it’s accelerating,” he mentioned.

The proof of that is throughout us: Global investment in energy transition technologies was $1.8 trillion last year in comparison with $1.1 trillion for fossil fuels, in response to BloombergNEF. The hole has steadily widened since 2020.

Renewable energy deployments continued to increase their growth rate final yr.

I don’t wish to gloss over some huge challenges. Automakers are struggling to make a revenue on EVs; U.S. offshore wind has been gradual to appreciate its potential; and wind and photo voltaic initiatives are running into problems with community acceptance and an insufficient grid.

However these are fixable points that replicate a transition in an early stage.

Kingsmill Bond, a senior principal on the analysis and advocacy group RMI, doesn’t really feel like he missed something by skipping CERAWeek.

“The factor that surprises me will not be that the fossil gas trade denies actuality, it’s that anybody cares,” he mentioned. “That is regular, for incumbents to disclaim the fact of change. The U.S. coal trade did it extraordinarily successfully, all the best way till they went bust.”

Bond co-authored a recent report that appears on the vitality transition as an financial race between China, the US, and the European Union. The report finds that China is successful the race proper now primarily based on the dimensions of its clear vitality funding, however there’s time for others to make up floor.

The underlying knowledge and tendencies present speedy progress for wind, photo voltaic, EVs, and associated applied sciences in all three areas, they usually present a bleak future for fossil fuels.

“The one main sector having fun with progress in fossil gas demand is transport, and there, the speedy progress of EVs signifies that transport demand for oil will shortly peak,” the report says.

However it’s also true that fossil fuels stay the world’s main sources of vitality. The conflict in worldviews between RMI and Saudi Aramco might be boiled all the way down to totally different outlooks about when fossil gas demand will peak.

Bond has written that the peak is happening right now, with a number of years of primarily flat demand that will likely be adopted by a downward curve.

Nasser mentioned in his speech “peak oil and gasoline is unlikely for a while to return, not to mention 2030.”

Victor and Bond, with out speaking to one another about it, every talked about a basic guide about enterprise, The Innovator’s Dilemma: When New Applied sciences Trigger Nice Companies to Fail by Clayton Christensen, printed in 1997. They mentioned the actions of huge oil firms are a superb illustration of how dominant companies can lose their skill to innovate within the face of upstart opponents which have a greater sense of the second.

My very own response to Nasser: I considered the years I labored for newspapers and the best way company executives talked concerning the trade’s shiny future. This concerned highlighting the great numbers and downplaying the dangerous ones, and specializing in how the product was indispensable.

The executives’ optimism made me really feel a bit higher within the second, however they were, of course, wrong.

[ad_2]

Source link