[ad_1]

Key Takeaways

- Most corporations surpassed earnings expectations within the final quarter of 2023, with development shares, significantly within the S&P 500 Progress Index, exhibiting important earnings development over worth shares.

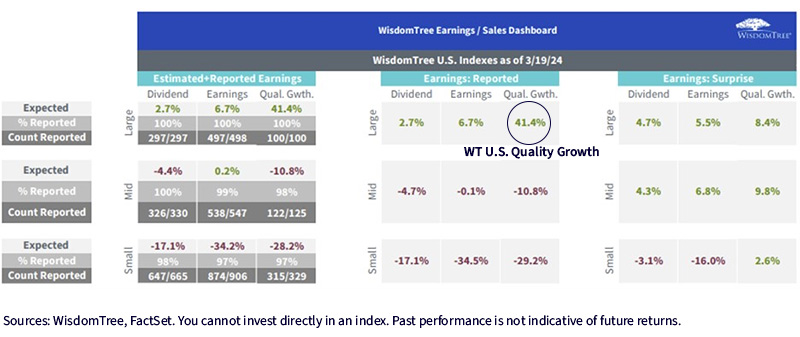

- The WisdomTree U.S. High quality Progress Index outperformed different indexes, reporting earnings development of 41.4%, almost double that of the S&P 500 Progress Index, regardless of being under-weight within the largest S&P 500 shares.

Earnings season for the final quarter of 2023 has wrapped up. Regardless of recession fears early within the 12 months, most reporting corporations made it throughout the end line with higher company earnings than analysts had anticipated.

We predict it’s a good time to revisit the Every day Earnings Snapshot, accessible within the Earnings Path tool in our Portfolio Analysis Tools Hub (PATH).

Among the many S&P SmallCap 600, S&P MidCap 400 and S&P 500 indexes and their respective fashion (value and growth) baskets, all however the SmallCap 600 and its worth variant beat earnings expectations. Progress once more took middle stage this quarter, with the S&P 500 Growth reporting 22.1% earnings development—nicely forward of the broader S&P 500’s 4.7% development.

The theme of development shares over worth shares endured final quarter, with development names considerably outpacing worth names by way of earnings development. Small caps reported damaging earnings development throughout the board, with solely the S&P SmallCap 600 Progress Index reporting a constructive earnings shock.

Earnings Snapshot, S&P Indexes

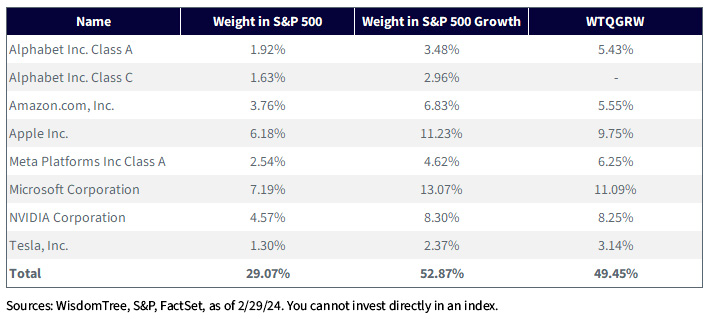

There was one basket whose earnings development blew these benchmark indexes out of the water: high quality development. Regardless of being narrowly under-weight within the the Magnificent Seven—the seven largest shares within the S&P 500 that drove a lot of the index’s returns all through 2023—relative to the S&P 500 Progress, the WisdomTree U.S. Quality Growth Index (WTQGRW) was capable of seize a considerably bigger diploma of EPS development than both the S&P 500 or its development counterpart.

Magnificent Seven Weights, Choose S&P Indexes vs. WisdomTree U.S. High quality Progress Index

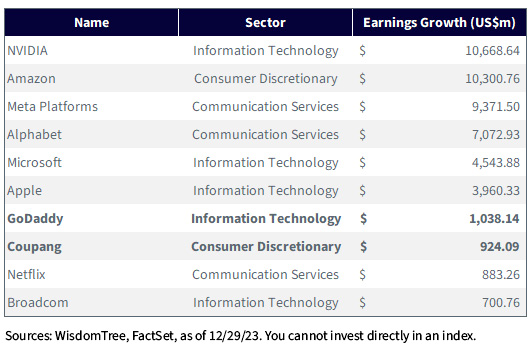

Trying on the largest earnings growers within the WisdomTree U.S. High quality Progress Index, the highest 10 corporations that had the biggest greenback quantities of earnings development have been all unsurprisingly within the Info Expertise, Communication Companies and Client Discretionary sectors. The Index was additionally capable of seize important earnings development from corporations not held within the S&P 500 Progress index, comparable to GoDaddy Inc. and Coupang Inc.

High 10 Earnings Growers within the WisdomTree U.S. High quality Progress Index

The WisdomTree U.S. High quality Progress Index, which invests in development shares with sturdy high quality metrics, had a reported earnings development fee of 41.4%, nearly double the 22.1% of the S&P 500 Progress Index.

Earnings Snapshot, Choose WisdomTree Indexes

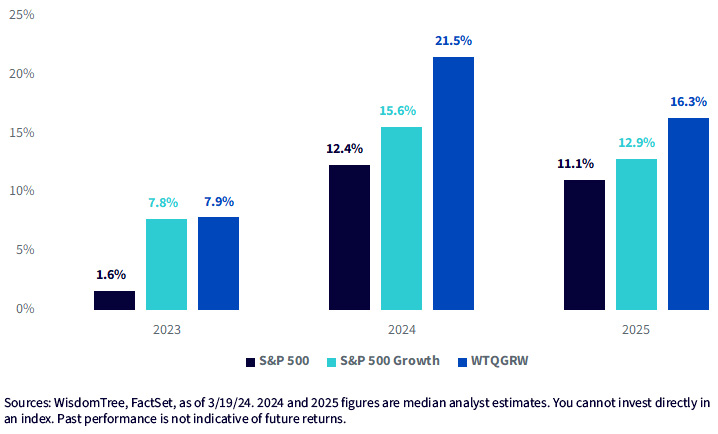

Over the 2023 calendar 12 months, the WisdomTree U.S. High quality Progress Index reported comparable working earnings development to the S&P 500 Progress, and much forward of the broader S&P 500. Analyst forecasts for 2024 and 2025 name for higher relative development.

Reported Working Earnings and Forecasts

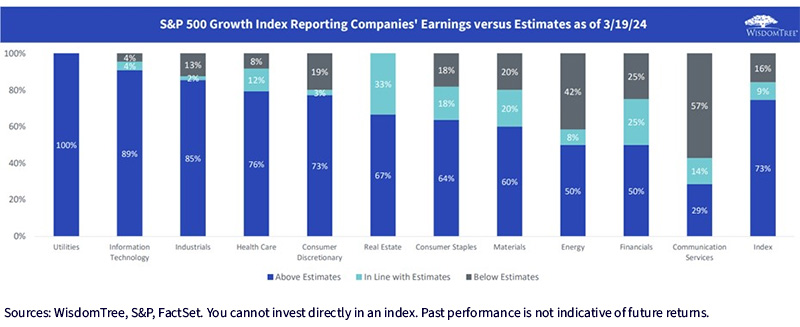

Throughout all sectors within the S&P 500 Progress Index, most corporations confirmed constructive earnings surprises, with over 73% of corporations within the index beating analyst earnings estimates. Other than the Utilities sector (which has just one firm within the Index), the data know-how sector had the best earnings shock among the many sectors, with 40 out of 45 reporting corporations beating estimates. Then again, 4 out of seven reporting Communications Companies corporations reported earnings beneath analyst estimates.

Earnings Snapshot, S&P 500 Progress Earnings Shock Sector Breakdown

Closing Ideas

The Daily Earnings Snapshot is a helpful asset for buyers to get a broad understanding of what earnings appear to be throughout indexes and sectors and evaluate WisdomTree Indexes and ETFs to benchmarks. As the primary quarter of 2024 wraps up and the primary earnings season of the 12 months begins, we hope buyers can leverage the Snapshot in addition to the rising suite of instruments in our PATH hub to make knowledgeable selections.

[ad_2]

Source link