[ad_1]

Although U.S. fairness markets are at all-time highs, regional banks stay mired within the fallout from final 12 months’s disaster that felled a number of firms in dramatic style.

Silicon Valley Financial institution’s failure in March 2023 stoked panic promoting throughout the sector amid fears of contagion and prompted scrutiny of different banks’ liquidity positions and asset-liability profiles.

Right now, business actual property exposures are the preeminent concern, and markets stay deeply unsettled. The newest irritant contaminating sentiment is New York Neighborhood Financial institution, which wanted a $1 billion capital injection from a consortium of outdoor traders to maintain it afloat. It put in a brand new CEO and created a number of new board seats for the investor group because of this. Its shares are on life assist after falling 67%1 to start the year.

The KBW Regional Banking Index and S&P Regional Banks Select Industry Index have every fallen by about 15% because the onset of the disaster final March.1 In the meantime, the S&P 500 is up 30%, demonstrating the severity of markets’ issues in regards to the well being of the regional banking system.

Poor sentiment stays a headwind for small and mid-cap fairness indexes, which have notable allocations to regional banks, regardless of broader fairness market energy. The Russell 2000 and 2000 Value Indexes (up 10% and 5.6%, respectively) are nonetheless lagging large caps by greater than 20% during the last 12 months. Mid-caps have barely fared any higher with the Russell Midcap and Midcap Value indexes up 15.5% and 10.9% over the identical interval.

U.S. Giant Caps Have Been the Most Dependable Market For the reason that 2023 Regional Banking Disaster

Regardless of the pessimism pervading the trade, we consider there are nonetheless methods to keep up publicity to regional banks inside small and mid-cap fairness allocations with out struggling drastically poor efficiency or sacrificing enterprise high quality.

However we additionally perceive that headline dangers affect market narratives and course, so it’s necessary to overview the composition of WisdomTree’s small and mid-cap merchandise to determine and perceive current exposures.

Firm Nightmares Had Little Affect

Among the many banks that made headlines in 2023, we had minimal publicity to PacWest Bancorp (PACW) and Signature Financial institution (SBNY) throughout the WisdomTree U.S. MidCap (EZM), U.S. MidCap Dividend (DON) and U.S. SmallCap Dividend (DES) Funds, leading to negligible efficiency impacts through the disaster.

Neither Silicon Valley Financial institution (previously SIVB) nor First Republic Financial institution (previously FRC) was held in any WisdomTree small-cap or mid-cap product once they failed and had not been in eight years.

The newest headache, New York Neighborhood Bancorp (NYCB), is held inside EZM and DON and has clearly weighed on efficiency, however not as a lot because the collapse in share worth would possibly recommend.

Market-Like Exposures inside WisdomTree Small Caps

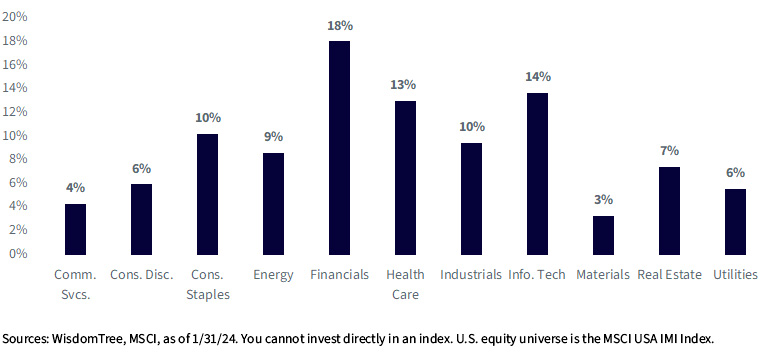

Banks typically exhibit traits synonymous with value investing, together with low price-to-earnings (P/E) multiples and huge dividend funds. Financials often pay the most important proportion of dividends amongst U.S. sectors, typically dwarfing different heavyweight payers like Well being Care and Info Expertise by 4% to five%.

Sector Contribution to Dividend Stream- MSCI USA IMI Index

Consequently, worth indexes are likely to have bigger exposures to banks than these predicated on different funding types.

WisdomTree’s three oldest U.S. small-cap Indexes additionally skew towards worth by emphasizing comparable fundamentals, like earnings and dividends, that in the end place banks in the identical class.

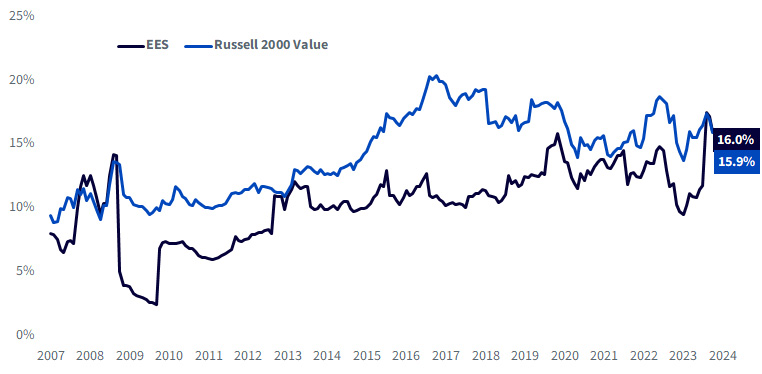

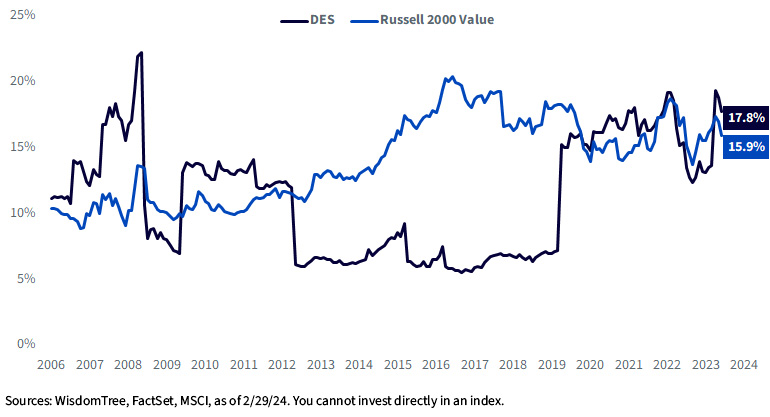

Each the earnings-weighted WisdomTree U.S. SmallCap Fund (EES) and dividend-weighted DES exhibit market-like regional financial institution exposures at this time, although they’ve traditionally been under-weight within the Russell 2000 Worth Index.

Weight in Regional Banks over Time: EES vs. Russell 2000 Worth

Weight in Regional Banks over Time: DES vs. Russell 2000 Worth

The current pickups resulted from our annual rebalance course of in December 2023, and replicate regional banks’ rising proportion of combination earnings and dividends amongst U.S. small caps, regardless of headline noise regarding particular firms.

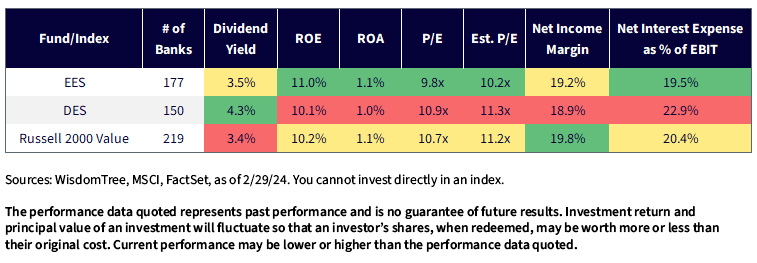

Among the many regional banks inside DES, dividends are the first function. Collectively, they provide practically 100 basis points of further yield over these within the Russell 2000 Worth whereas approximating the Russell index throughout most different metrics.

EES’s regional banks, that are earnings-weighted, end in a better high quality composite than these within the Russell 2000 Worth. There’s a notable enchancment in earnings and return on equity (ROE) that reduces prevailing P/E multiples by about one level every. It additionally shaves a proportion level off banks’ combination web curiosity expense as a proportion of EBIT, maybe signaling a more healthy debt burden.

Small Caps—Weighted Common Fundamentals of Regional Banks in Every Fund/Index

For the latest month-end standardized efficiency, please the respective ticker: EES, DES.

WisdomTree’s Excessive-High quality Small Caps Are an Exception

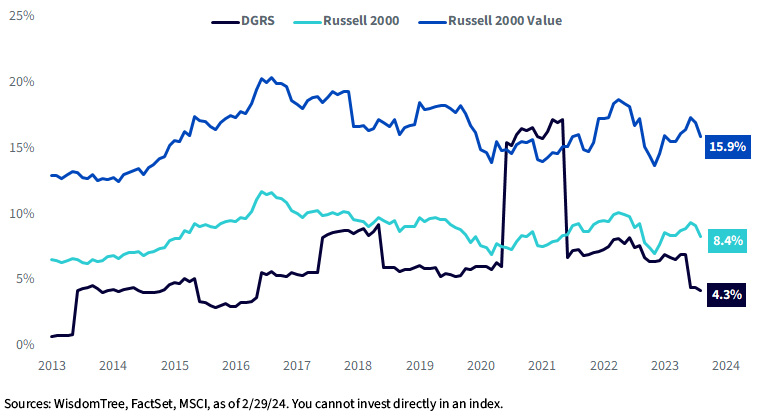

The WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS), nevertheless, introduces one other part that not directly reduces regional financial institution exposures relative to the broader market. DGRS systematically selects the highest 50% firms throughout the dividend-paying U.S. small-cap universe with the best high quality scores. By screening for ROE and return on assets (ROA) inside our high quality definition, many regional banks are prevented since they have an inclination to report excessive ROE however decrease ROA by nature of their enterprise.

Weight in Regional Banks over Time: DGRS vs. Russell Small Cap Indexes

By design, DGRS’s regional financial institution publicity is repeatedly under-weight within the Russell 2000 and 2000 Worth indexes.

The only real exception was a results of our 2020 rebalance and the extra emphasis on earnings development estimates in our high quality framework. Banks had excessive earnings development estimates within the aftermath of the pandemic and have been rewarded with bigger allocations. This proved to be helpful as Financials have been the highest sector contributor for DGRS throughout 2021 relative to the Russell 2000 Worth Index.

All through its full historical past, nevertheless, DGRS has routinely been under-weight in regional banks by selling high-quality small caps.

Modest Over-Weight Allocations throughout WisdomTree Mid-Cap Indexes

Though regional banks aren’t as prevalent in market cap-weighted mid-cap indexes as they’re in small-cap indexes, dividend- and earnings-weighted methodologies have comparable influences on general exposures.

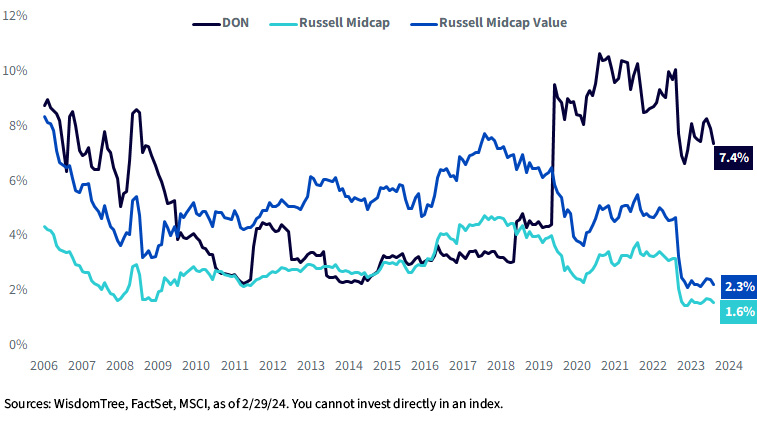

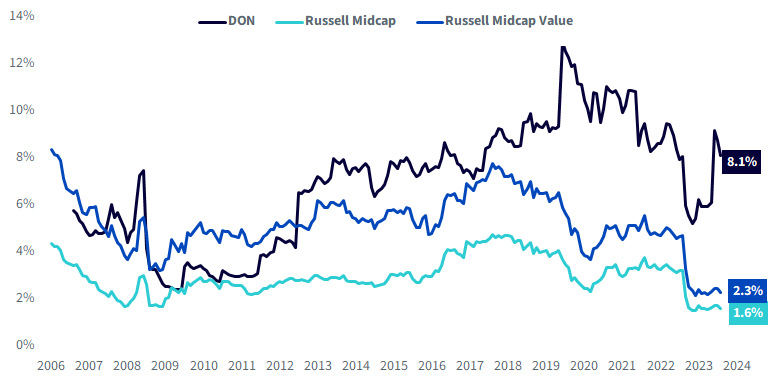

The common over-weight allocation to regional banks inside DON is a byproduct of their choice for dividends and bigger relative contribution to the U.S. mid-cap Dividend Stream™.

Weight in Regional Banks over Time: DON vs. Russell Midcap Indexes

There’s the same impact inside EZM, which weights by earnings quite than dividends.

Weight in Regional Banks over Time: EZM vs. Russell Midcap Indexes

Right here, over-weight allocations replicate publicity to firms already producing substantial income throughout the combination U.S. mid-cap Earnings Stream™.

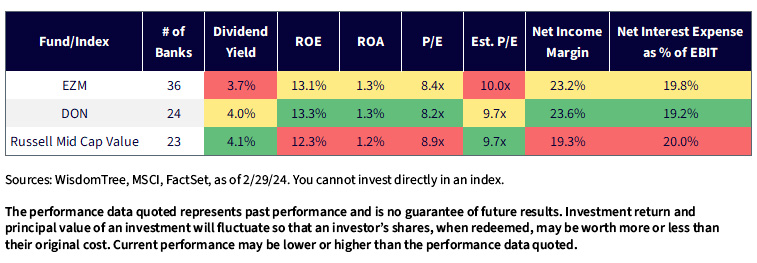

Each the dividend- and earnings-weighted approaches enhance upon the basics of the regional banks throughout the Russell Midcap Worth Index, most notably in high quality metrics. Every provides a bit extra to ROE and ROA whereas decreasing trailing P/Es by about half some extent.

Maybe most necessary, nevertheless, is the development in web revenue margin, which provides about 4% versus the market in every Index. That is paired with slight reductions in curiosity bills as a proportion of EBIT, which conveys that financial institution exposures in every Index presently supply more healthy income with proportionally decreased financing prices.

Mid-Caps—Weighted Common Fundamentals of Regional Banks in Every Fund/Index

For the latest month-end standardized efficiency, please the respective ticker: EZM, DON.

Happily, ahead multiples aren’t sacrificed for these enhancements, both. Estimated P/Es for the financial institution exposures stay much like these of the Russell Midcap Worth.

A Choice for Essentially Weighted Small/Mid-Caps

Total, we consider that earnings- and dividend-weighted allocations to regional banks could also be a most well-liked option to endure the trade’s headwinds with out promoting right into a down market, as they provide basic enhancements that will higher insulate financial institution holdings from ongoing volatility.

And if traders just like the valuations throughout the small-cap worth phase of the market however wish to keep away from additional deterioration in regional banks, the DGRS might match that invoice.

Extra broadly, we’re optimistic on U.S. small-caps and mid-caps and chubby dimension inside WisdomTree’s Mannequin Portfolios, with a concentrate on dividend-payers and decreased multiples that have been priced for recession. In step with Professor Siegel’s views, we anticipate broader fairness market participation throughout 2024 (versus final 12 months’s concentrated, slender management inside mega-cap know-how names) to be fueled by decreased chances of recession. The potential for a subsequent “catch-up” rally as recession dangers subside and the Fed pivots to extra accommodative financial coverage helps assist our upgraded view on dimension.

Our Mannequin Portfolio Funding Committee (MPIC) added to DGRS on the finish of 2023 to enact our views, and we’re optimistic that the wedding of dimension and high quality shall be additive in 2024.

1 Supply: Bloomberg, as of three/8/24.

[ad_2]

Source link