[ad_1]

Housing stock ranges in Florida are up probably the most within the nation on a year-over-year foundation (34%), however the bulk of the rise is admittedly concentrated in sections of Southwest Florida. Specifically, in markets like Cape Coral and Fort Myers, which have been hard-hit by Hurricane Ian in September 2022.

Hurricane Ian left behind hundreds of broken houses, and the next want for renovations has resulted in a surge of obtainable housing stock. In keeping with the Nationwide Oceanic and Atmospheric Administration (NOAA), Hurricane Ian prompted an estimated $112.9 billion value of whole harm, making Ian the third-costliest U.S. hurricane on record.

Along with residential property harm, the hurricane coincided with spiked home insurance costs. This mixture of elevated housing provide on the market—the broken houses, mixed with strained demand, the ensuing spiked house costs, spiked mortgage charges, increased insurance coverage premiums, and better HOAs—has translated into market softening throughout a lot of Southwest Florida.

Click here to view an interactive model of the map beneath.

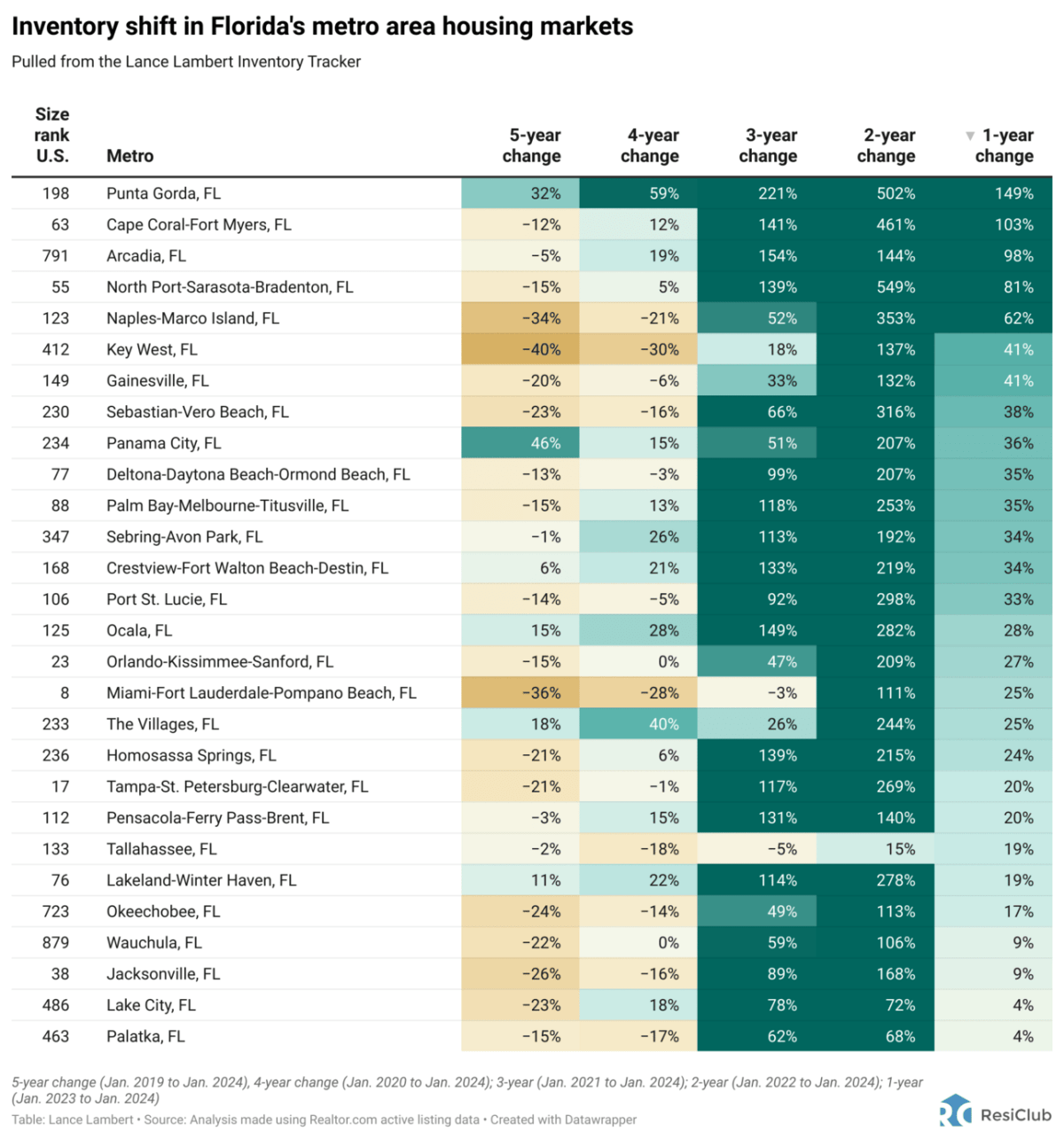

Certainly, the 5 Florida housing markets which have seen the most important bounce in energetic listings between January 2023 and January 2024 (see beneath) have been all impacted, to various levels, by Hurricane Ian.

Click here to view an interactive model of the chart beneath.

The overwhelming majority of these “broken” houses on the market are within the very components of Southwest Florida the place stock has spiked over the previous 12 months.

A few of the houses on the market in Cape Coral solely have “harm” of their description as a result of they wish to make it clear to potential consumers that there’s no flood or wind harm from Hurricane Ian.

The reason is, after all, is that so many houses on the market in Cape Coral do have property harm from Hurricane Ian. Look no additional than this three-bedroom foreclosures property, which states in its itemizing description that the “house was broken by Hurricane Ian & requires a brand new roof.”

What about house costs in Florida?

In keeping with the Zillow House Worth Index, there don’t seem like sharp house worth corrections throughout Florida. One large motive is that the majority Florida housing markets nonetheless have stock ranges properly beneath pre-pandemic 2019 ranges.

However we’re seeing softening and delicate house worth declines in Southwest Florida markets, reminiscent of round Cape Coral, the place stock has spiked to or close to pre-pandemic 2019 stock ranges.

Click here to view an interactive model of the map beneath.

If stock continues to mount, might extra components of Southwest Florida see house worth declines?

If housing affordability stays constrained and energetic listings/months of provide proceed to spike in components of Southwest Florida, costs might additional soften.

“What I inform my mates and purchasers is we’re nonetheless within the peak greed portion of the true property cycle in Naples,” Tim McLean, a long-time lender in Naples, tells ResiClub. “Nevertheless, I consider the cycle will begin turning to worry after the 2024 vacationer season ends in April. My guess is the consumers can be in cost throughout the subsequent 60 days. Possibly they already are.”

[ad_2]

Source link