[ad_1]

Gold costs have reached new highs, with front-month futures hitting US$2,203/oz (March 8, 2024).1 The rally is supported by a pointy rise in speculative lengthy positioning in gold futures markets, marking a constructive shift in sentiment following months of decline. This rally has had a fast ascent. Neither Treasury Inflation-Protected Securities (TIPS) nor silver or gold miners have saved up over the previous three months. These belongings are often strongly correlated with gold, however the velocity of gold’s latest strikes left these different associated belongings behind.

We consider there may be catch-up potential. Gold miners have lagged behind gold bullion since their vital drawdown in the course of the world monetary disaster of 2008 and 2009 and have largely proven virtually no positive aspects during the last 20 years. But, not too long ago, they’ve proven indicators of performing higher: over one-month trailing returns to March 8, 2024, miners are up 8.8% versus 7.0% for gold.

Determine 1: Gold vs. Gold Miners Again to 1993

Hedge Funds Are Shopping for Gold Miners

Hedge funds have began to concentrate. Fund managers like Stanley Druckenmiller (of Duquesne Household Workplace) are reported of their newest 13F filings to have been shopping for gold miners like Barrick Gold and Newmont, transferring away from expertise corporations like Amazon and Alibaba.2

Gold Rally Ought to Drive Miner Profitability Greater

Analysts have pointed to declining ore grades, harder working situations—together with greater labor and vitality prices—and fewer geopolitical stability as a few of the causes that miners have struggled within the latest previous.

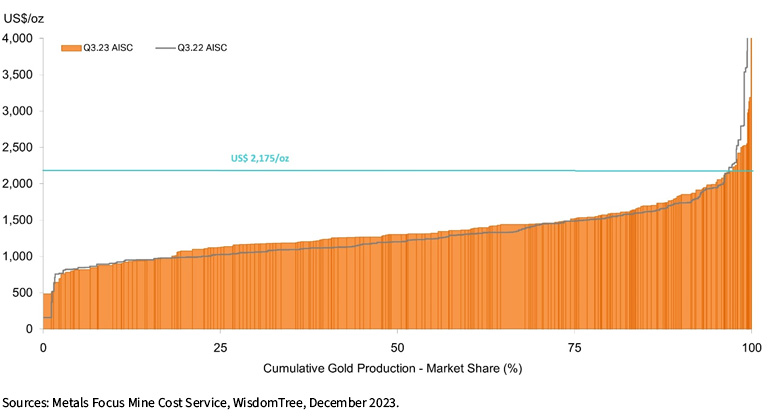

Nonetheless, the profitability of gold miners will enhance considerably. Utilizing Metals Focus’s All-in-Sustaining Prices (AISC)3 curve, we estimate more than 95% of global gold production is profitable at current prices. And at the 50th percentile, we could have miners with greater than US$700/oz AISC margin. If current gold prices are sustained, we believe that gold miners could see substantial improvements to margins. Moreover, current prices should encourage mine expansion, adding volume to current operations.

Figure 2: Gold Miners’ All-in-Sustaining Costs Curve

Consolidation and Share Buybacks

The drift between gold prices and miners may also drive consolidation in the industry as miners seek to become more operationally efficient. Last year, Newmont announced the purchase of Newcrest.

Harmony Gold CEO Peter Steenkamp told Reuters, “I think it’s going to be inevitable that there will be some sort of consolidation, because exploration has been lacking for such a long time and for people to replace assets they will have to look at what their neighbors have and what the opportunities will be.”4

In January 2024, Perseus Mining announced a takeover bid for Silvercorp.5 Small- to medium-sized miners are likely to be deal-making targets.

Miners may also seek to make buybacks to use surplus cash. Kinross Gold, under pressure from activist investor Elliott Management, has done precisely that, and its stock has rallied 47% in the past year (March 13, 2013, to March 12, 2024).6

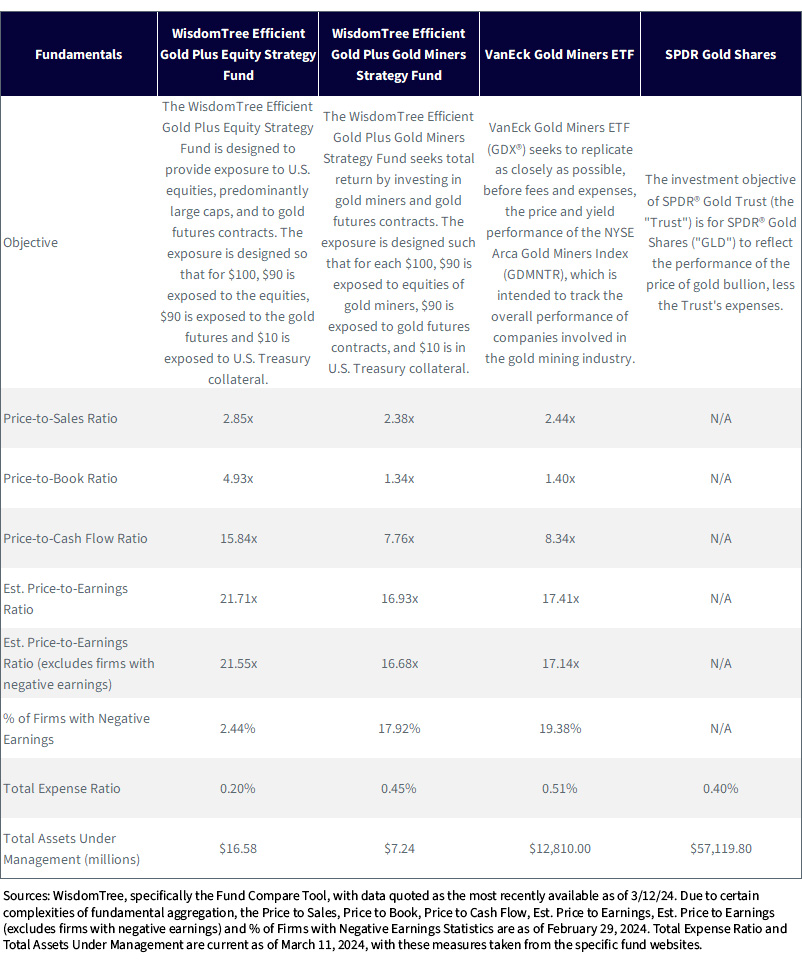

WisdomTree Solutions

WisdomTree offers gold-related “efficient-core” options to assist deliver gold right into a portfolio and supplier better portfolio diversification with out sacrificing different slots in a complete portfolio pie.

Environment friendly-core options tied to gold provide publicity to an fairness benchmark and add gold futures on a leveraged foundation. As a result of the gold publicity is leveraged, a $100 publicity to the technique may give you $90 publicity to the precise equities, $90 publicity to gold futures and $10 money collateral (incomes charges akin to U.S. Treasury bills).

WisdomTree presents two efficient-core methods with gold: one with an publicity to broad U.S. equities (WisdomTree Efficient Gold Plus Equity Strategy Fund, GDE) and the opposite with an publicity to gold miners (WisdomTree Efficient Gold Plus Gold Miners Strategy Fund, GDMN). With gold and broad equities each rallying, the case for GDE has been compelling for a while.

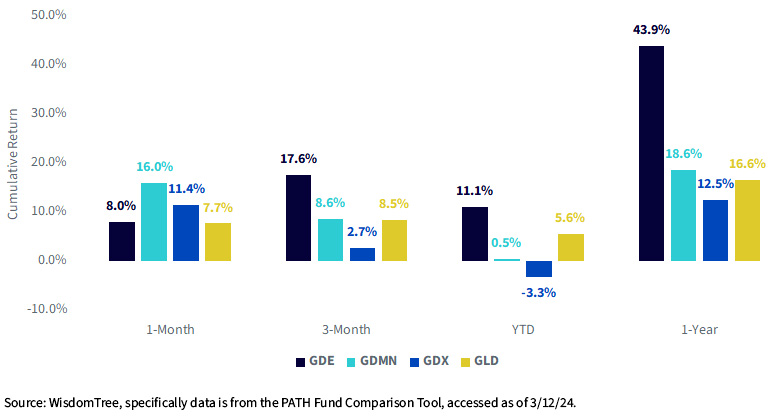

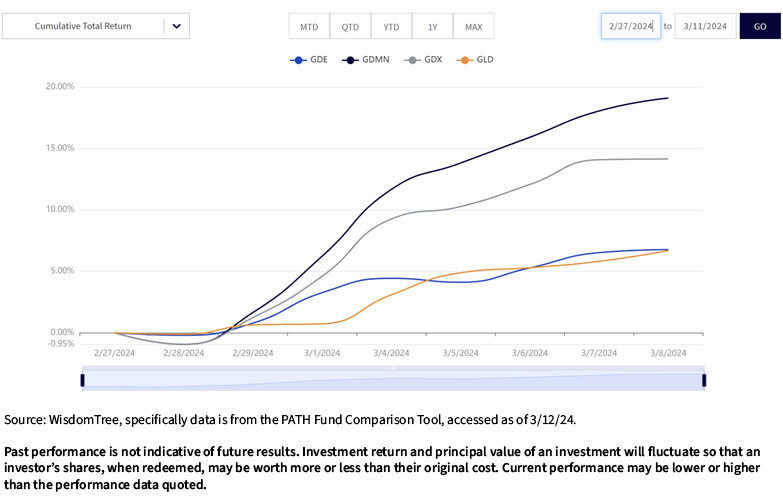

With miners now at an thrilling inflection level, we consider it’s time to take into consideration GDMN. The Fund has risen nearly 20% between February 27, 2024, and March 11, 2024, taking part in off each gold and gold miner rallies, which we are going to see in determine 3c.

Clearly, gold’s value has appreciated, however the metallic has diverged from the miners for the final 20 years. Many allocate to each individually, and GDMN permits an environment friendly bundle of each in a single.

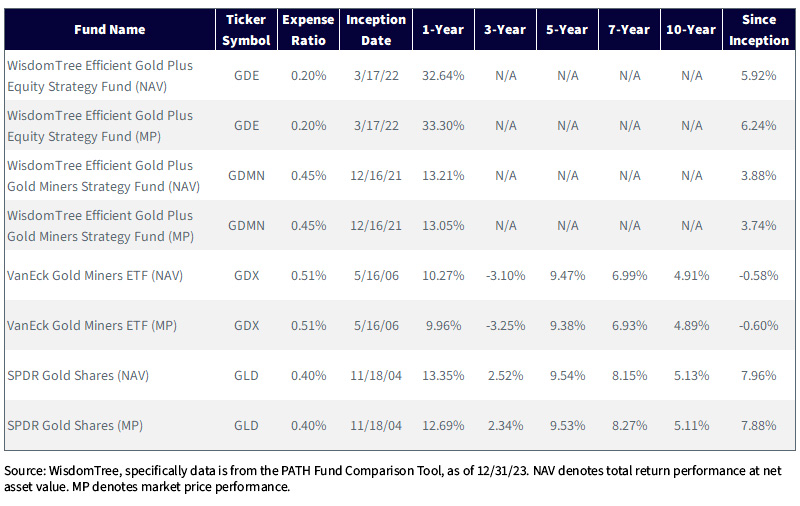

In figures 3a and 3b, we showcase a few of the efficiency of each GDE and GDMN, in comparison with the next:

- VanEck Gold Miners ETF (GDX): This has been the biggest ETF within the area. GDMN is a unique publicity, as we defined, which has a .90 beta publicity to these associated equities however provides the .90 beta to gold futures as effectively.

- SPDR Gold Shares (GLD): GLD is the biggest technique offering publicity to bodily gold. This helps present how the straight equities and combo with gold futures evaluate to the bodily metallic.

After we are eager about miners (GDX), capital-efficient gold plus miners (GDMN) and capital-efficient gold plus equities (GDE), it’s vital to deliver the dialogue again to how these exposures evaluate to that of the worth of gold.

Determine 3a: Standardized Efficiency Comparability

Determine 3b: Gauging the Latest Inflection, with Information as of three/11/24

Determine 3c: The Latest Miner Rally from February 27, 2024, to March 11, 2024

For the newest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on the related ticker: GDE, GDMN, GDX, GLD

When Contemplating Equities, One Can’t Neglect the Fundamentals

Whereas short-term momentum will be good and “confidence-inspiring,” it’s vital to additionally look underneath the hood to notice the basics. A brief-term rally supported by fundamentals has a greater likelihood of sustaining into the medium and even long term.

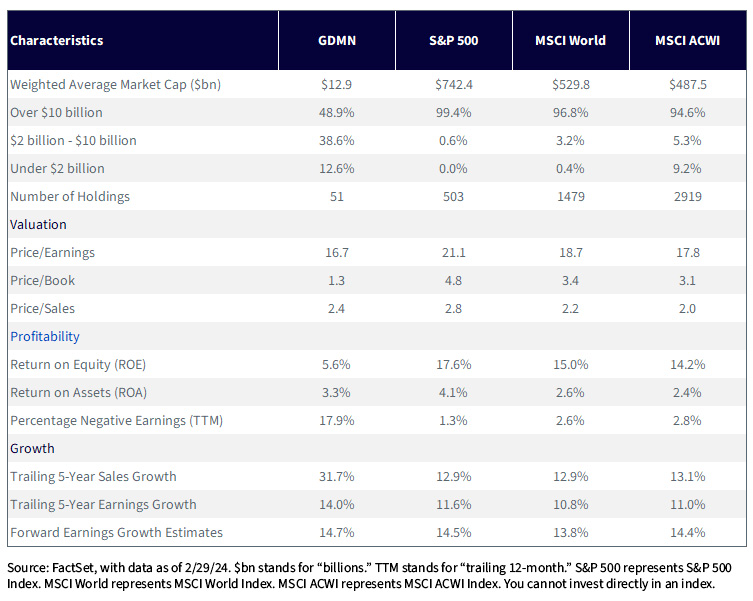

Taking a look at determine 4, we see:

- GDMN’s gold mining shares will seemingly by no means look as robust on a return-on-equity or profitability foundation. With the present exposures of the world’s largest firms within the S&P 500, MSCI World and MSCI ACWI Indexes, it might be robust to see mining shares competing on a profitability foundation.

- GDMN’s trailing gross sales development, trailing earnings development and ahead earnings development estimates look very robust in opposition to even the tech-heavy S&P 500. The ahead estimates could not even account for the record-high gold costs growing the profitability of those firms. If share costs reply to those fundamentals, it might sign a noteworthy alternative.

Determine 4: GDMN’s Gold Mining Shares on a Basic Foundation in opposition to Main Fairness Benchmarks (as of two/29/24)

Determine 5: Vital Info Relating to Funds inside This Report

If you’re excited about diving extra into the comparability of those Funds, please take a look at our Fund Comparison Tool.

1 Supply: Bloomberg.

2 “DUQUESNE FAMILY OFFICE LLC”, Whale Knowledge, https://whalewisdom.com/filer/duquesne-family-office-llc

3 All-in sustaining prices is a non-GAAP (usually accepted accounting rules) metric launched in 2013 and adopted by most gold miners. It gives a comparable metric that displays as intently as attainable the total value of manufacturing and promoting an oz. of gold. The “sustaining” nature of the metric contains each working and capital expenditure. The associated fee curve acknowledges that every mine has a unique value construction. The amount of gold manufacturing will be learn throughout the horizontal axis, and manufacturing is ordered from lowest to highest value producer.

4 Supply: Nelson Banya, “Concord Gold CEO says gold sector consolidation ‘inevitable,’” Reuters, 3/1/23.

5 Supply: “Perseus Mining broadcasts intention to make takeover bid for OreCorp Ltd”, Globe Newswire, https://www.globenewswire.com/news-release/2024/01/22/2812645/0/en/Perseus-Mining-announces-intention-to-make-takeover-bid-for-OreCorp-Ltd.html

6 Supply: Bloomberg.

Vital Dangers Associated to this Article

Nitesh Shah is an worker of WisdomTree UK Restricted, a European subsidiary of WisdomTree Asset Administration Inc.’s guardian firm, WisdomTree Investments, Inc.

For present Fund holdings, please click on the respective ticker: GDE, GDMN. Holdings are topic to danger and alter.

GDE: There are dangers related to investing, together with the attainable lack of principal. The Fund is actively managed and invests in U.S.-listed gold futures and U.S. fairness securities. The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying positive aspects and losses and inflicting the Fund to be extra unstable than if it had not been leveraged. Furthermore, the worth actions in gold and gold futures contracts could fluctuate rapidly and dramatically and have a traditionally low correlation with the returns of the inventory and bond markets. U.S. fairness securities, resembling widespread shares, are topic to market, financial and enterprise dangers that will trigger their costs to fluctuate. The Fund’s funding technique can even require it to redeem shares for money or to in any other case embrace money as a part of its redemption proceeds, which can trigger the Fund to acknowledge capital positive aspects. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

GDMN: There are dangers related to investing, together with the attainable lack of principal. The Fund is actively managed and invests in U.S.-listed gold futures and world fairness securities issued by firms that derive at the least 50% of their income from the gold mining enterprise (“gold miners”). The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying positive aspects and losses and inflicting the Fund to be extra unstable than if it had not been leveraged. Furthermore, the worth actions in gold and gold futures contracts could fluctuate rapidly and dramatically and have a traditionally low correlation with the returns of the inventory and bond markets. By investing within the fairness securities of gold miners, the Fund could also be prone to monetary, financial, political or market occasions that affect the gold mining sub-industry, together with commodity costs and the success of exploration tasks. The Fund could make investments a good portion of its belongings within the securities of firms of a single nation or area, together with rising markets, and thus, the Fund is extra more likely to be impacted by occasions and political, financial or regulatory situations affecting that nation or area or rising markets usually. The Fund’s funding technique can even require it to redeem shares for money or to in any other case embrace money as a part of its redemption proceeds, which can trigger the Fund to acknowledge capital positive aspects. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

[ad_2]

Source link