[ad_1]

No inventory has been hotter on this artificial intelligence (AI) cycle than Nvidia, which lately eclipsed a market capitalization of $2 trillion.

Whether or not it may proceed at this tempo is a way more tough query. We scoured a universe of thematic fairness exchange-traded funds (ETFs) listed within the U.S. market and located a quantity with greater than 10% publicity to this single identify.1

If you’re evaluating these ETFs, which tend to be theme-based, there may be some options for exposure to those themes with more diversification.

Three Strategies with Weight of 10% or More in Nvidia

We found three strategies with greater than 10% weight to Nvidia as of March 1, 2024:

- The VanEck Semiconductor ETF (SMH) is a method that seeks to copy as intently as potential, earlier than charges and bills, the worth and yield efficiency of the MVIS US Listed Semiconductor 25 Index, which is meant to trace the general efficiency of firms concerned in semiconductor manufacturing and gear.

- The iShares Semiconductor ETF (SOXX) seeks to trace the funding outcomes of the NYSE Semiconductor Index, which consists of U.S.-listed equities within the semiconductor sector.

- The Global X Robotics & Artificial Intelligence ETF (BOTZ) seeks to spend money on firms that probably stand to profit from elevated adoption and utilization of robotics and AI, together with these concerned with industrial robotics and automation, non-industrial robots and autonomous automobiles. The ETF seeks to supply funding outcomes that correspond usually to the worth and yield efficiency, earlier than charges and bills, of the Indxx World Robotics & Synthetic Intelligence Thematic Index.

We evaluate these methods—related to AI as a catalyst—to the WisdomTree Artificial Intelligence and Innovation Fund (WTAI).

WTAI is monitoring an index designed to think about a extra full-ecosystem publicity to AI versus concentrating on a selected space. Typically the market’s efficiency will favor concentrating on a specific place, like Nvidia, and generally it favors diversifying extra broadly.

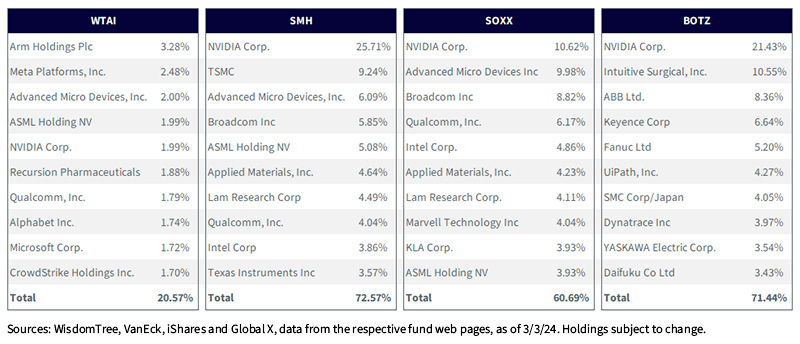

Determine 1 supplies, by exhibiting the highest 10 positions in every fund, a way of the focus within the single Nvidia place in addition to inside the general prime 10.

A better determine signifies that extra of the general technique efficiency is being pushed by the names seen on this determine versus the remainder of the technique’s holdings.

Determine 1: Comparability of High 10 Holdings

For present WTAI Fund holdings, please click on here. Holdings are topic to danger and alter.

Quantifying the Efficiency Wave

Nvidia’s share worth after the launch of ChatGPT in November 2022 has been historic. Buyers that we communicate to are sometimes nervous as a result of they’re merely undecided how lengthy it may proceed, significantly if they’re initiating positions at current in 2024. All of us acknowledge {that a} inventory with a $2 trillion market capitalization can drop by 25% and nonetheless be price $1.5 trillion—a really large quantity.

WTAI, SMH, SOXX and BOTZ all had completely different exposures to Nvidia in determine 1—figures 2a, b and c showcase variations in efficiency throughout these 4 methods.

- In determine 2a, we see the standardized efficiency as of year-end 2023, the place it’s clear that SMH and SOXX had the stronger returns in 2023, at the least relative to WTAI and BOTZ. Recall that SMH and SOXX might be regarded as “semiconductors,” whereas WTAI and BOTZ—in their very own distinct methods—are searching for to be “broader AI.”

- In determine 2b, we see that WTAI and BOTZ had a downdraft from roughly the tip of June 2023 by means of the tip of October 2023, and it was this downturn that was the first driver of their underperformance relative to SMH and SOXX. All 4 of the methods rallied throughout November and December 2023.

- In determine 2c, we are able to see that the reign of Nvidia continued, and it continued to be higher to easily deal with semiconductors versus broader AI, at the least if we’re utilizing efficiency to evaluate the consequence. SMH had the largest publicity to Nvidia and it did the most effective. It’s notable that BOTZ had the second-biggest publicity to Nvidia, however because of the broader publicity throughout robotics it was pulled down under the return of SOXX over this era, roughly the primary two months of 2024. WTAI, with the broadest focus of the 4 funds, lagged.

Determine 2a: Standardized Returns

For the newest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on the related ticker: WTAI, SMH, SOXX and BOTZ.

Determine 2b: The 2023 Yr (12/31/22–12/31/23)

For the newest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on the related ticker: WTAI, SMH, SOXX and BOTZ.

Determine 2c: The First Two Months of 2024 (12/31/23–3/1/24)

For the newest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on the related ticker: WTAI, SMH, SOXX and BOTZ.

Conclusion: $2 Trillion Is a Quite Massive Quantity for a Agency’s Market Capitalization

Whereas we are able to agree there may be not essentially an higher restrict that defines how large any agency might be by means of market capitalization, execution takes time. Even when Nvidia’s revenues and earnings march upwards, the share worth incorporates a mixture of these fundamentals alongside the hopes and desires and aspirations of the broader crowd.

These aspirations and finally expectations can get forward of actuality, and it’s potential the share worth should pause and let the execution and fundamentals catch up. The setting of the continuous upward changes to the dimensions of the AI accelerator chip market will ultimately change, and the expansion will ultimately sluggish.

We remind buyers that AI, the theme, has been marching ahead for many years, even when the mix of social media and smartphones put the headlines into the palms of our palms each minute of on daily basis at the moment, and the arrival of processing energy and low-cost knowledge storage enable for higher and higher breakthroughs.

In case you can’t predict the place the hype would possibly go subsequent, we advocate a extra holistic, broad ecosystem method, like WTAI, such that there’s a higher probability of capturing that subsequent large AI subject.

Determine 3: Vital Additional Details about the Funds Talked about

In case you are all for diving extra into the comparability of those Funds, please take a look at our Fund Comparison Tool.

1 Supply: WisdomTree’s thematic universe is a month-to-month report obtainable here that features measures of all U.S. listed thematic fairness funds.

Vital Dangers Associated to this Article

For present Fund holdings, please click on here. Holdings are topic to danger and alter.

There are dangers related to investing, together with the potential lack of principal. The Fund invests in firms primarily concerned within the funding theme of synthetic intelligence (AI) and innovation. Corporations engaged in AI usually face intense competitors and probably speedy product obsolescence. These firms are additionally closely depending on mental property rights and could also be adversely affected by loss or impairment of these rights. Moreover, AI firms usually make investments vital quantities of spending on analysis and improvement, and there’s no assure that the services or products produced by these firms will probably be profitable. Corporations which might be capitalizing on innovation and growing applied sciences to displace older applied sciences or create new markets might not be profitable. The Fund invests within the securities included in, or consultant of, its Index no matter their funding benefit and the Fund doesn’t try to outperform its Index or take defensive positions in declining markets. The composition of the Index is ruled by an Index Committee and the Index could not carry out as meant. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

[ad_2]

Source link