[ad_1]

In 2023, a dominant theme for markets was the return of earnings in mounted earnings. Quick-forward to 2024, and regardless of a big rally in spreads and a fall in yields in the course of the fourth quarter, we imagine this theme remains to be alive and properly. As a matter of reality, yields of U.S. high-yield and investment-grade corporates nonetheless relaxation within the high quintile and decile of ranges skilled over the past 10 years.

Nevertheless, one phase of the market that has gone beneath the radar has been emerging markets debt, particularly rising market corporates. On this piece, we’ll have a look at this sector and look at the case for together with rising market corporates’ debt in traders’ portfolios relative to U.S. company bonds and the dollar-denominated debt of rising market sovereigns.

Enticing Yield Potential

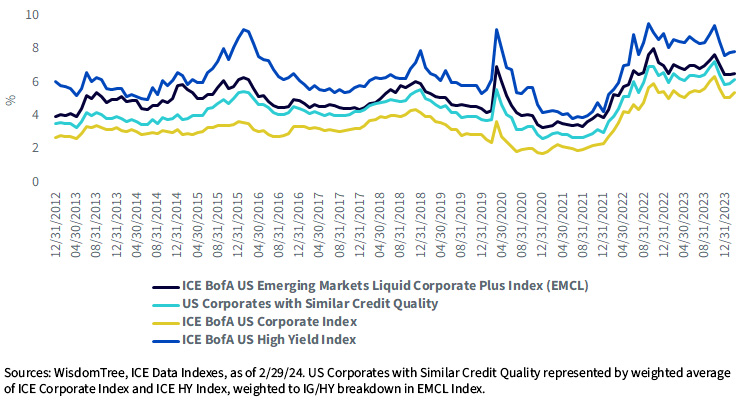

Even after a big rally of 444 basis points (bps) in spreads from the highs throughout COVID-19 (653 bps in March 2020), rising market corporates proceed to supply a horny all-in yield. In actual fact, the all-in yield of 6.58% on the finish of February stands within the high tenth percentile of yield supplied by the sector previously 10 years.

Rising Market Corporates

For definitions of phrases within the chart above, please go to the glossary.

Rising market corporates not solely supply the next yield in comparison with what they’ve supplied previously but additionally in comparison with a portfolio of their U.S. counterparts with related credit ratings (represented by the weighted common of the ICE corporate index and ICE HY index, weighted to the investment-grade/high-yield breakdown within the EMCL Index) (69% investment-grade and 31% high-yield as of February 29, 2024), they’ve constantly offered traders with larger earnings.

YTW

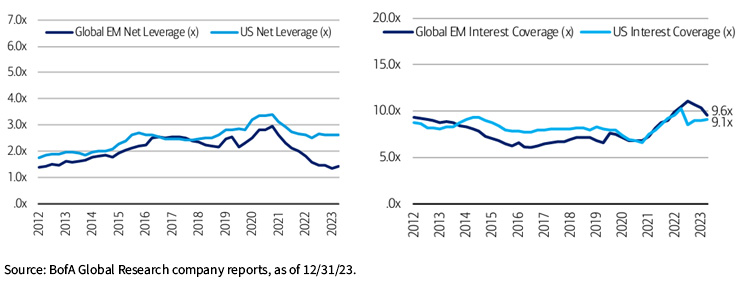

Robust Fundamentals

One of many greatest issues with rising market securities, particularly corporates, and the primary purpose they’ve constantly supplied larger earnings in comparison with a portfolio of U.S. corporates with an analogous credit standing combination, is their fundamentals. Nevertheless, by wanting beneath the hood, one can see rising market corporates have improved their fundamentals. The gross and internet leverage in EM corporates are a number of the lowest previously decade and in addition decrease relative to U.S. corporates. The identical could be stated about their interest coverage ratio. Though their IC has fallen just lately, they nonetheless fare higher than U.S. corporates.

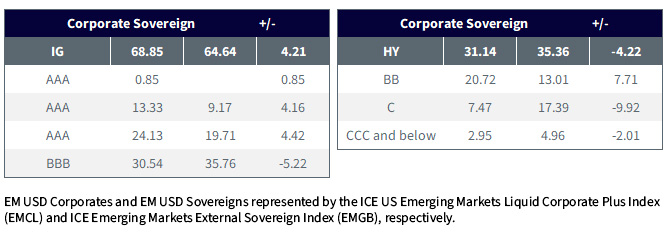

Higher Credit score High quality and Much less Curiosity Fee Threat Than EM USD Sovereigns

One other ceaselessly used jibe at rising market corporates is that if an investor needs to put money into rising markets, they will put money into “larger high quality, much less dangerous” sovereigns. Nevertheless, that is one other misnomer about rising market corporates issuing in USD. The USD-Denominated Rising Market Company Index has the next allocation to investment-grade issuers than to USD-denominated EM sovereigns.

Credit score High quality of ICE Rising Market Debt Indexes – USD Company vs. USD Sovereign

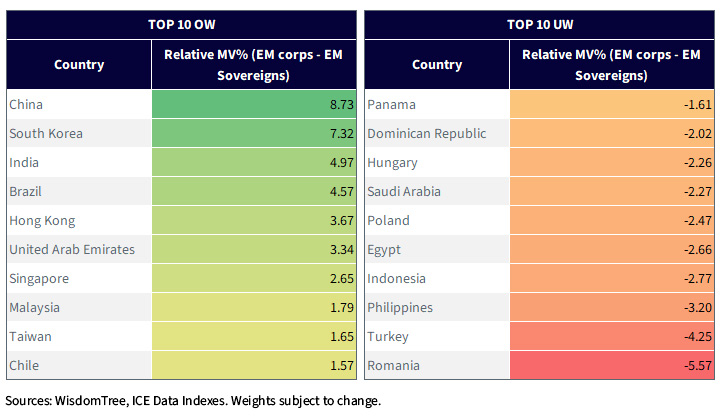

Trying on the nation of threat of the issuers in these two indexes, the EM Company Index has a a lot larger allocation to international locations with higher fundamentals and a decrease allocation to international locations with struggling financial situations. In lots of instances, the governments of the extra developed rising market international locations safe most of their financing by means of debt denominated in their very own forex.

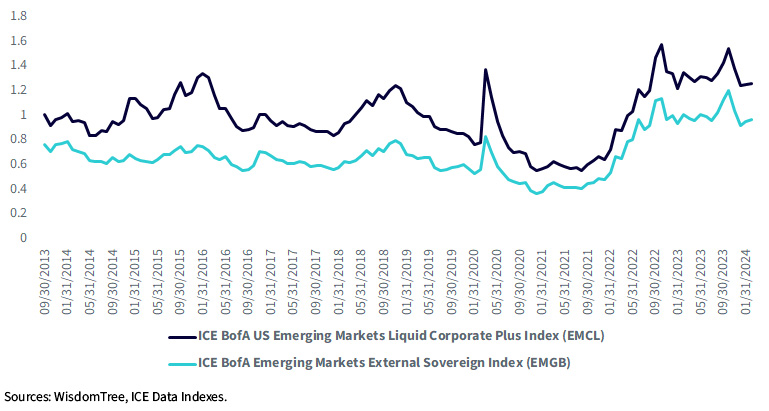

Lastly, many rising market firms largely situation intermediate maturity debt, whereas EM sovereigns situation additional out the curve, leading to a constantly sharp period distinction between the 2 universes. (At the moment, the universe for EM corporates has a mean period of 5.21 versus 6.98 for the universe of EM USD sovereigns.) Regardless of the period distinction, the combination yield sacrifice supplied by EM corporates to EM is comparatively modest, averaging about 27 bps over the past 10 years. Consequently, EM company portfolios have a considerably larger potential yield, given the quantity of rate of interest threat or yield per unit of period, than EM USD sovereigns, as outlined by their broad benchmarks.

Yield Per Unit of Length

Choice Is the Key

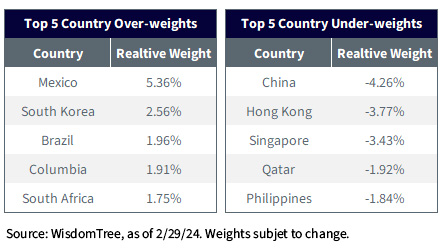

As talked about earlier than, EM company fundamentals stay resilient, and monetary coverage stays prudent. As such, the default charge is predicted to be decrease as properly. Nevertheless, like every other phase of the market, traders have to be selective and select issuers/areas which have higher fundamentals. And that’s the method that the administration staff of the WisdomTree Emerging Market Corporate Bond Fund (EMCB) takes. EMCB is positioned with an over-weight (relative to the JPMorgan CEMBI Diversified Index) to Latin America and an under-weight to Africa and choose international locations in Asia, most notably China. China’s strengthened coverage response seems to have stabilized exercise; nevertheless, development is more likely to sluggish additional this 12 months as housing and personal sector confidence stay destructive.

Vital Dangers Associated to this Article

There are dangers related to investing, together with the doable lack of principal. International investing entails particular dangers, similar to threat of loss from forex fluctuation or political or financial uncertainty. Investments in rising, offshore or frontier markets are typically much less liquid and fewer environment friendly than investments in developed markets and are topic to further dangers, similar to dangers of antagonistic governmental regulation and intervention or political developments. Spinoff investments could be unstable, and these investments could also be much less liquid than different securities and extra delicate to the results of various financial situations.

Fastened earnings investments are topic to rate of interest threat; their worth will usually decline as rates of interest rise. As well as, when rates of interest fall, earnings might decline. Fastened earnings investments are additionally topic to credit score threat, the chance that the issuer of a bond will fail to pay curiosity and principal in a well timed method or that destructive perceptions of the issuer’s capacity to make such funds will trigger the worth of that bond to say no. In contrast to typical exchange-traded funds, there is no such thing as a index that the Fund makes an attempt to trace or replicate. Thus, the power of the Fund to attain its goal will depend upon the effectiveness of the portfolio supervisor. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link