[ad_1]

The Indian financial system, but once more, has outdone investor expectations with progress up by 8.4% within the third quarter of the 2024 monetary yr,1 marking the quickest tempo seen in six quarters. In the course of the quarter, manufacturing (which accounts for 17% of the financial system) posted the very best progress at 11.6% yr on yr (YOY), whereas agriculture (15% of the financial system) remained a drag at -0.8% YOY on account of uneven rain.2 The providers sector remained resilient, posting a rise of seven% YOY.2

GDP Development Anticipated to Rise 7.6% in F2024

Weak world demand has been driving exports of products and providers decrease with a rise of solely 3.4% (vs. 5.3% in Q2).2 With providers positioned favorably, imports are rising at a sooner clip of 8.3% (vs. 11.9% in Q2).2 Regardless of the uptick in third-quarter GDP, underlying progress continues to be supported by funding, which grew at 10.6% YOY, led by authorities spending and residential actual property.1 Personal remaining consumption expenditure, an indicator of consumption demand, lagged with solely a 3.5% enhance, under the broader financial system.2

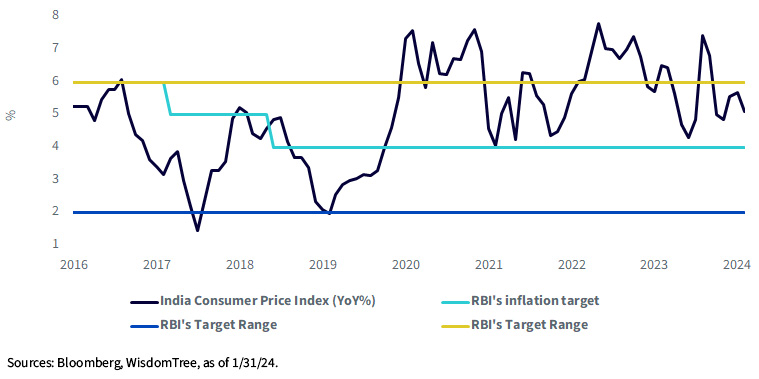

Optimistic GDP Shock Ought to Not Make the RBI Hawkish

The Reserve Financial institution of India’s (RBI) projection for progress within the third quarter, of 6.5%, was in keeping with gross value added (GVA), which grew at 6.5%.2 The hole between GDP and GVA within the quarter may be defined by rising tax collections and a decline in authorities subsidies. Financial exercise is anticipated to reasonable over the approaching quarters. The GVA, which excludes internet oblique taxes, supplies a greater measure of underlying momentum within the financial system.

There have additionally been encouraging indicators of easing inflationary stress, particularly the moderation in meals costs inflation. The RBI has saved rates of interest unchanged at 6.5% and maintained a hawkish stance for many of 2023. As we don’t discover indicators of over-heating within the Q3 GDP information, we anticipate the RBI to keep up its February view of “ready a bit longer” to chop again on the resilient progress.

Inflation Is Approaching the RBI’s Inflation Goal

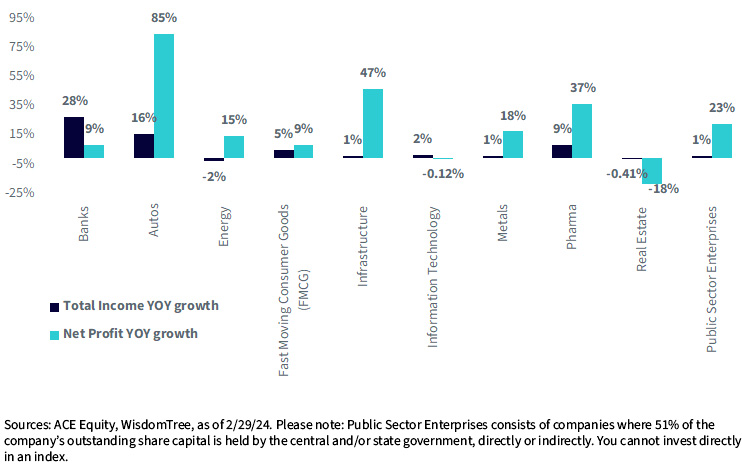

Resilient Earnings Ends in Third Quarter

The Nifty 50 Index reported income progress of 9% within the third quarter alongside a internet revenue progress of 15%, exceeding consensus expectations. This highlights a slight decline in income growth (14% over the previous 5 quarters) but was offset by increased profitability progress (12% over the previous 5 quarters). Banks remained on the forefront from the facet of income technology, whereas cars stood out among the many high performers each from a income and earnings standpoint.

Nifty Index Earnings Outcomes

India’s monetary sector has been an vital pillar for stability and progress prospects. The banking sector exhibited wholesome enterprise progress within the third quarter. Nevertheless persistent net interest margin (NIM) stress and excessive operational expenditure brought on a dip in margins. Credit score progress was pushed by the retail sector. Retail loans fashioned 31% of banking credit score adopted by providers at 27.8%, industries at 23.5% and agriculture at 13%. The company sector noticed a gradual choose up aided by medium-sized enterprises.

The automotive sector offered stellar outcomes over the quarter, aided by the decline in commodity costs, alleviation of supply-chain challenges and stability in FX charges. The USD-INR (Indian rupee) held inside a slender 3% vary in 2023, principally between 80.00 and 83.50. INR depreciated by simply 0.6% relative to USD in 2023 in comparison with over 10% in 2022. Auto volumes (excluding tractors) grew at 16% yearly led by a wholesome restoration in two-wheelers and steady progress throughout different segments. Two-wheelers witnessed the sharpest progress of almost 19% YOY throughout Q3. Demand for premium automobiles additionally remained sturdy, primarily within the city areas.

The subdued outcomes of the data know-how sector have been influenced by macroeconomic situations, decrease discretionary spending and seasonality. Attrition charges hit all-time lows for India’s IT sector within the quarter.

Whereas the true property sector dragged down total earnings efficiency for the Nifty Index, the vitality, pharma, metals and public sector enterprises (PSE) sectors displayed regular annual earnings progress in Q3.

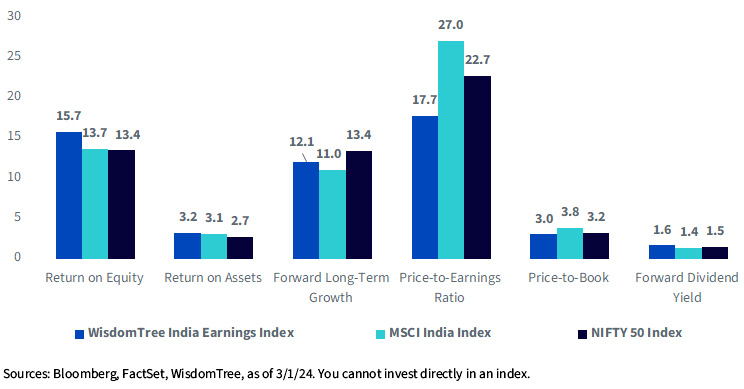

Adopting an Earnings Bias to Faucet into Indian Equities

For buyers seeking to faucet into India’s buoyant earnings progress at a reduction, the WisdomTree India Earnings Fund (EPI), which seeks to trace the WisdomTree India Earnings Index, presents a singular alternative because it goals to decrease the valuation danger inherent in shopping for Indian equities. EPI’s technique represents the broadest potential cross-section of investable and worthwhile Indian firms.

At WisdomTree, we optimize valuation, by weighting by earnings and eliminating unprofitable firms, thereby permitting the extra worthwhile firms to dominate the weighting within the Index. The distinctive earnings tilt permits EPI to supply buyers with entry to the broad market however at a extra cheap valuation, evident from the chart under.

Comparability of Fundamentals

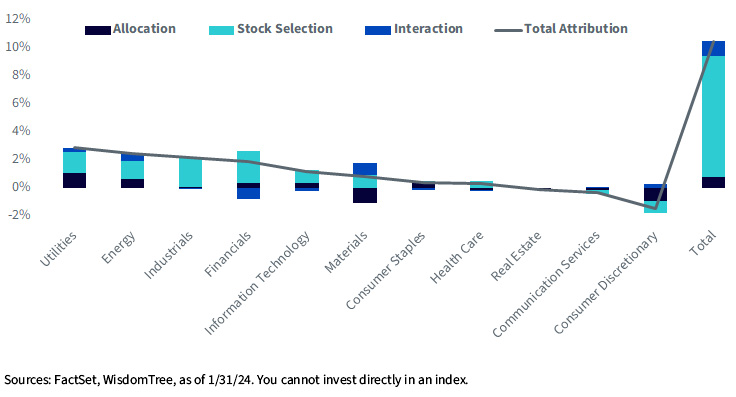

By earnings-weighting our technique, the portfolio takes on some distinctive sector tilts in comparison with a market cap-weighted strategy. Over the previous yr, utilities, vitality, industrials and financials offered the very best contributions throughout sectors, enabling the WisdomTree India Earnings Index to outperform the MSCI India Index by 10.49%.

Sector Attribution: 1-12 months

Much less Focus and Better Diversification

The Q3 FY24 earnings outcomes for the Nifty 50 Index (market cap-weighted) confirmed that Tata Motors, HDFC Financial institution, Tata Metal, ICICI Financial institution and JSW Metal contributed 56% of incremental YOY accretion in earnings. That, in our view, seems to be fairly concentrated publicity inside the Nifty 50 Index. The WisdomTree India Earnings Index’s earnings-weighted technique allows much less focus. The contribution to earnings progress from Tata Motors, HDFC Financial institution, Tata Metal, ICICI Financial institution and JSW Metal is far decrease, at 26% for WisdomTree India Earnings Fund versus the Nifty 50 Index at 56% and even MSCI India at 33.6%.

The earnings-weighted methodology of the WisdomTree India Earnings Index additionally permits for larger diversification throughout measurement. Whereas MSCI India has a a lot increased publicity to massive caps at 84%, WisdomTree’s India Earnings Index has 64% of its weight in massive caps and the remainder distributed throughout mid-caps at 25% and small caps at 11.2%. The attribution by measurement illustrates the advantage of diversification throughout measurement over the long run (three years) that helped WisdomTree India Earnings Index outperform the MSCI India Index by 7.51%

Dimension Attribution: 3 Years

Conclusion

India is the fifth-largest financial system on this planet and stays the quickest rising among the many massive economies with sustainable actual GDP progress of 6%–7% each year predicted over the following a number of years. Authorities reforms, a scientific clean-up of the system and digitization have been the important thing catalysts in boosting its progress trajectory. If one considers the primary 9 months of India’s monetary yr, ending March 31, we’ve got seen shares on the Nifty Index ship 26% earnings progress.3 Expectations for earnings per share (EPS) progress stay excessive at 21% and 17% in FY24 and FY25. India seems well-cushioned in opposition to exterior vulnerabilities and is positioned favorably inside world fairness allocations.

1 October to December, Q3 in monetary yr, ending 3/31/24

2 Supply: Nationwide Statistics Workplace

3 Supply: ACE Fairness

Vital Dangers Associated to this Article

Previous efficiency will not be indicative of future outcomes. Funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when redeemed, could also be price roughly than their unique price. Present efficiency could also be decrease or increased than the efficiency information quoted.

For the newest month-end and standardized efficiency and to obtain the respective Fund prospectus please click on here.

For present Fund holdings, please click on here. Holdings are topic to danger and alter.

There are dangers related to investing, together with the potential lack of principal. Overseas investing includes particular dangers, akin to danger of loss from foreign money fluctuation or political or financial uncertainty. This Fund focuses its investments in India, thereby growing the influence of occasions and developments related to the area which may adversely have an effect on efficiency. Investments in rising, offshore or frontier markets akin to India are usually much less liquid and fewer environment friendly than investments in developed markets and are topic to further dangers, akin to dangers of adversarial governmental regulation and intervention or political developments. As this Fund has a excessive focus in some sectors, the Fund may be adversely affected by modifications in these sectors. As a result of funding technique of this Fund it could make increased capital acquire distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

[ad_2]

Source link