[ad_1]

A few of America’s greatest firms, together with Tesla, T-Cell, and Netflix, had been entrance and middle in a brand new report that reveals how a lot firms paid in federal earnings taxes — in comparison with how a lot they made in revenue, and what they paid their high executives.

The Institute for Coverage Research and Individuals for Tax Equity launched a report Wednesday that highlighted “a big quantity” of main U.S. firms, 35 in complete, that paid its high 5 executives greater than they paid in federal earnings taxes between 2018 and 2022.

Elon Musk’s Tesla was No. 1 on the record. The corporate paid its high 5 executives $2.5 billion over 5 years whereas bringing in $4.4 billion in U.S. revenue.

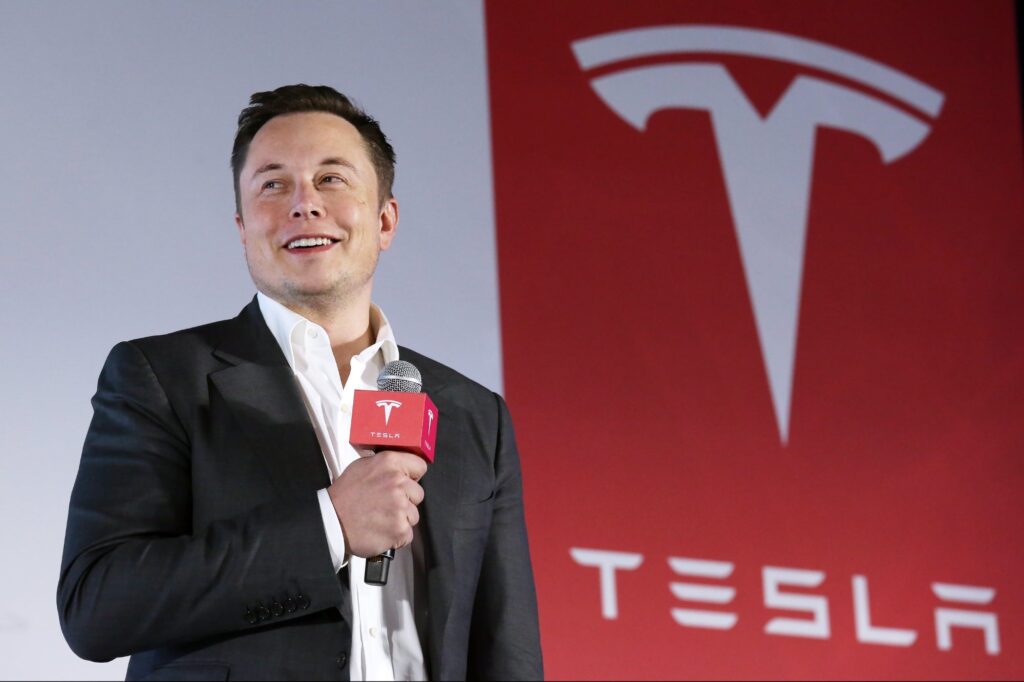

Tesla Motors CEO Elon Musk speaks to the media subsequent to its Mannequin S throughout a press convention in Hong Kong. 25JAN16 SCMP/ Nora Tam (Photograph by Nora Tam/South China Morning Submit through Getty Photos)

Musk has a web price of round $184 billion, with about $69.7 billion of that complete primarily based on the worth of his Tesla inventory, in accordance with the Bloomberg Billionaires Index. Musk is likely one of the high three richest individuals on the earth.

The report factors out that regardless of Tesla’s record profits, the corporate “has by no means paid a nickel in federal earnings taxes.” A possible reason for this pattern, in accordance with the report, could possibly be Tesla carrying losses ahead from earlier than it turned worthwhile.

“These loss carryforwards clean out the customarily boom-bust nature of company funds,” the report reads.

Associated: ‘Next Tesla’ Electric Car Startups Hit Speed Bump: ‘Investors Want To See Demand’

T-Cell was second on the record, with a revenue of $17.9 billion within the U.S. over 5 years and nil web federal earnings taxes. The highest 5 executives there have been paid $675 million from 2018-2022, in accordance with the report, with CEO and president Mike Sievert receiving $158 million of that complete.

There are a selection of tax avoidance, or tax minimizing, methods talked about within the report, together with shifting American earnings to offshore tax havens or utilizing inventory possibility tax deductions.

The report doesn’t take state, native, or payroll taxes into consideration.

Associated: Elon Musk Warns Tesla Workers They’ll Be Sleeping on the Production Line to Build Its New Mass-Market EV

[ad_2]

Source link