[ad_1]

On February 1, Meta Platforms Inc. (Meta) declared the initiation of its quarterly dividend cost as a part of its full-year 2023 outcomes. The corporate introduced a $0.50 quarterly cost, which represents an approximate $5 billion money outlay and places Meta within the high 30 of U.S. dividend payers and the highest 50 of all dividend payers worldwide.

It is a main growth for Meta, as a dividend cost indicators that an organization’s administration has confidence in its enterprise and the money flows related to it. It’s also a serious market growth, as Meta turns into the most important firm (measured in market capitalization) to provoke its dividend cost since Apple in 2012.

For context, Meta’s preliminary dividend cost represents about 12% of its annual earnings, which continues to be conservative with respect to its friends and the broader U.S. market. This implies there’s room for Meta’s dividends to develop.

Annual Dividend as % of Earnings

WisdomTree’s Response

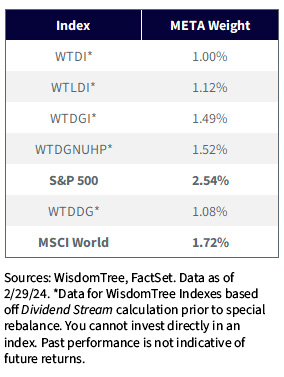

Given this main market growth and WisdomTree’s emphasis on creating best-in-class dividend-focused methods, we introduced a particular rebalance set to happen after the shut of buying and selling on March 15. As a part of this particular rebalance, Meta will probably be added to the next eligible Indexes and weighted in response to its Dividend Stream®:

WisdomTree creates indexes with efficiency as the highest aim. Whereas we consider in passive methodologies, we at all times search for altering or distinctive market situations that create alternatives. Meta’s first dividend was vital sufficient that it warranted an early addition to our index household.

Implications for High quality Dividend Development Methods

WTDGI, WTDGNUHP and WTDDG are all a part of the WisdomTree High quality Dividend Development suite. These methods goal to put money into dividend-paying firms whose profitability and progress prospects point out higher-than-market dividend growth.

Most rivals within the dividend progress area have backward-looking progress screens to find out an organization’s eligibility. For instance, the S&P U.S. Dividend Growers and S&P 500 Dividend Aristocrats Indexes (with a mixed $88 billion plus of belongings monitoring them) have a 10- and 25-year dividend progress display, respectively. Which means that Meta will develop into eligible for inclusion in 2034 and 2049 if it continues to develop dividends yearly.

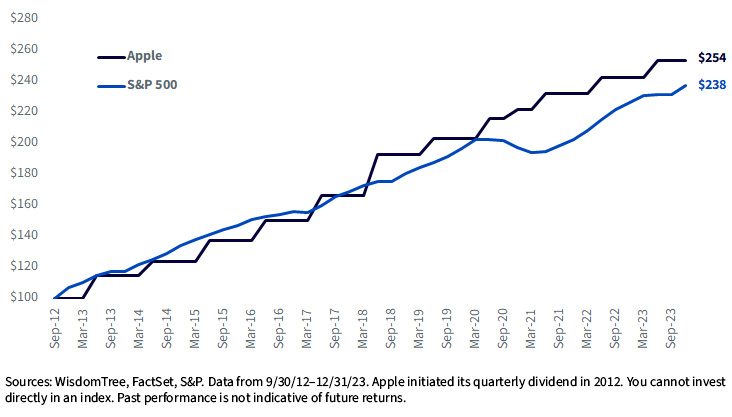

As we just lately revealed, new dividend payers tend to grow their payments faster than the market. Within the beneath chart, we are able to see how Apple’s dividend progress since 2012 has outpaced the broad S&P 500 by 0.6% yearly.

Development of $100: Cumulative Dividend Development

Analyzing the efficiency of WTDGI versus the S&P 500 gives additional perception into its methodology. Since its inception in April 2013, WTDGI has outperformed the S&P 500 by 34 basis points yearly,1 doing so with out holding non-dividend-paying tech firms like Amazon, Tesla, Meta and Google, which have been the primary efficiency drivers for the market.

The standard dividend progress franchise choice course of focuses on extremely worthwhile high quality companies. We frequently allude to this because the Buffett think about inventory choice—as Buffett typically talks about shifting from the Ben Graham value faculty, which focuses on truthful companies at good worth like costs, towards specializing in nice companies at truthful costs.

Within the latest Berkshire letter, Buffett wrote a tribute to Charlie Munger within the opening pages, calling Munger the architect of Berkshire Hathaway’s course of that satisfied Buffett he shouldn’t be shopping for low cost “worth” like shares however the high-quality companies. Warren’s newest letter places Munger as the unique architect of our high quality fashion of investing.

What are Meta’s quality and growth attributes that exhibit why it’s a nice enterprise and make us assured it ought to be a dividend progress chief over the approaching years?

- Effectivity: Meta was in a position to decrease headcount by greater than 20% whereas additionally rising income by greater than 20% within the final 12 months—it is a signal of its scale and investments in expertise paying off. Paying the primary dividend is a dedication to shareholders that they’ll harvest their R&D investments through the years into money flows for shareholders.

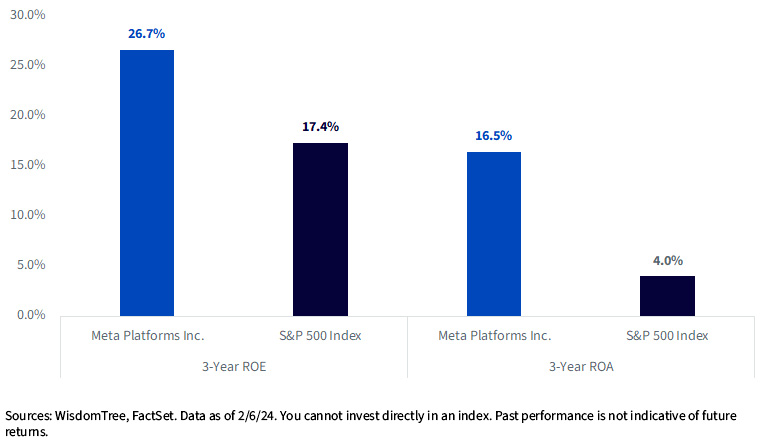

- High quality: Meta’s trailing three-year return on equity (ROE) and return on assets (ROA) exceed the market.

High quality Metrics

- Composite Rank: WTDGI makes use of a composite rating combining an organization’s high quality (ROE and ROA) and estimated earnings progress to rank and choose securities. Meta ranks within the high 20 out of 550+ securities in scope on this composite measure with its stable high quality quantity and an 18% estimated earnings progress over the following few years.

Implications for Broad Dividend Methods

The implications of including Meta to WTDI and WTLDI might be analyzed within the context of holdings overlap and monitoring error versus the broad market. On the time of Meta’s dividend announcement, its weight in broad fairness benchmarks just like the S&P 500, Russell 1000 and MSCI USA Indexes ranged round 2%. Upon inclusion in WTDI and WTLDI, we anticipate the under-weight in Meta to be considerably decreased however nonetheless exist, given its present market capitalization weight in comparison with its Dividend Stream weight.

1 Sources: WisdomTree, FactSet. Information from 4/11/13–1/31/24.

[ad_2]

Source link