[ad_1]

One of many extra noteworthy tales for the cash and bond markets to date in 2024 is the altering notion of the Fed coverage outlook. With fee cuts now being the first focus, the dialog has revolved round when such a transfer might happen and what the trail would finally appear like. Whereas Fed officers proceed to acknowledge that rate cuts appear doubtless later this 12 months, a more moderen growth within the information was the comparability to the speed chopping cycle that occurred in 1995/1996. In opposition to this backdrop, I assumed it might be fascinating to supply the reader with some context and description what Fed coverage regarded like almost 30 years in the past.

Earlier than we have a look at the 1995/1996 expertise, it’s pure to ask why I’m even bothering to weblog on one thing that occurred virtually three a long time in the past. Does it actually have any relevance to 2024? Nicely, the reason being fairly easy. The Fed has seemingly been united in its current messaging that financial coverage, aka fee cuts, this 12 months could be “methodical,” “cautious,” and “affected person,” however Vice Chair Jefferson not too long ago launched a brand new facet to the dialogue when he talked about the mid-1990’s fee chopping episode may be one of the best parallel to the present state of affairs. Particularly, that coverage easing occurred as a consequence of reducing inflation, not financial weak spot, i.e., a tender touchdown.

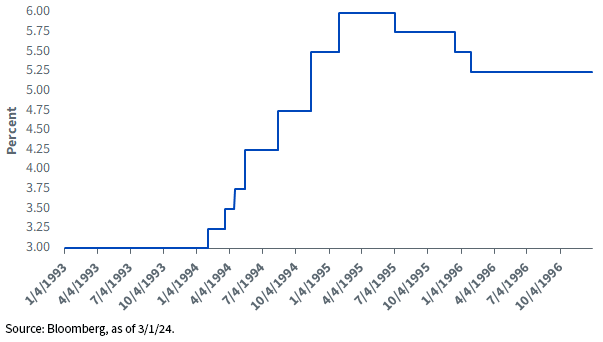

Fed Funds Goal Mid Level of Vary

OK, so what occurred within the mid-Nineties? First up, the Fed launched into an aggressive tightening cycle in 1994/1995. Certainly, the coverage maker raised the Fed Funds goal by 300 foundation factors (bps), with the speed hikes finally reaching a peak of 6%. Curiously, the speed hike intervals themselves considerably resembled the episode that not too long ago transpired, as 25-bp will increase initially of the 1994/1995 cycle shifted into larger gears of 50-bp after which 75-bp strikes—sound acquainted?

By mid-1995, the Fed had launched into a fee reduce coverage. Nonetheless, as highlighted by the above graph, the decline within the Fed Funds goal was not uniform in any trend. The primary 25-bp lower got here in July of that 12 months, however the subsequent quarter-point transfer didn’t happen till 5 months later in December. The ultimate fee reduce on this easing cycle got here in late January 1996, one other 25-bp transfer, which took the Fed Funds Fee down to five.25%. To sum it up, the 1995/1996 fee reduce episode consisted of solely three decreases price 75 bps in complete.

Presently, as we’ve mentioned over the previous few months, the market has lastly “come to the Fed” with respect to fee reduce expectations for 2024. In different phrases, as February got here to a detailed, implied possibilities for Fed Funds Futures noticed solely three fee cuts this 12 months, similar to the Fed’s newest dot-plot. Bear in mind, we got here into this 12 months with the market pricing in six fee cuts.

Conclusion

If you would like some additional fascinating context, the 2019/pre-COVID-19 fee reduce cycle additionally consisted of solely three fee cuts, and it additionally started in July, like in 1995. By the way in which, this was one other non-recession-induced fee reduce timeframe as nicely. Now, I’m not saying that is going to be the template for this 12 months, however you must admit these are fascinating little financial coverage tidbits. The underside line is that any potential fee cuts for 2024 are going to be data-dependent, and to date, the soft-landing state of affairs has been aligning with what occurred almost 30 years in the past. Does that imply that three fee cuts starting at this 12 months’s July FOMC assembly must be a given? Keep tuned…

[ad_2]

Source link