[ad_1]

Affiliate Director, Analysis

The Nasdaq 100 Index is taken into account by many because the default benchmark for growth shares.

The methodology is simple—the 100 largest non-financial corporations by market capitalization listed on the Nasdaq Alternate. Securities are weighted by modified market cap.

One of many drawbacks to this simplicity for a progress benchmark is that mature, slow-growth corporations can populate the index due to the absence of basic choice standards.

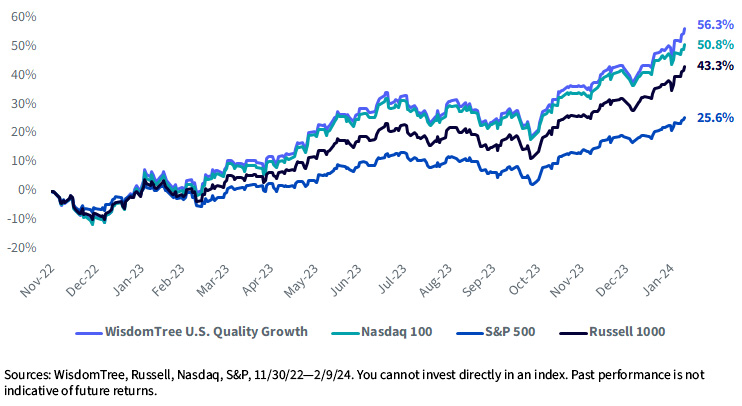

In our view, WisdomTree has created a greater option to seize progress—the WisdomTree U.S. Quality Growth Index. Since its launch close to the tip of 2022, it has outperformed the Nasdaq 100 whereas being extra instantly focused to high-growth, high-profitability corporations.

Cumulative Index Complete Returns since 11/30/22

The returns for each the WisdomTree U.S. High quality Development Index and Nasdaq 100 have, unsurprisingly, benefitted from a optimistic market backdrop for progress over the past 15 months.

WisdomTree’s Index reconstitutes on a semi-annual foundation every June and December, refreshing its publicity to corporations with the basic traits of excessive profitability and excessive progress.

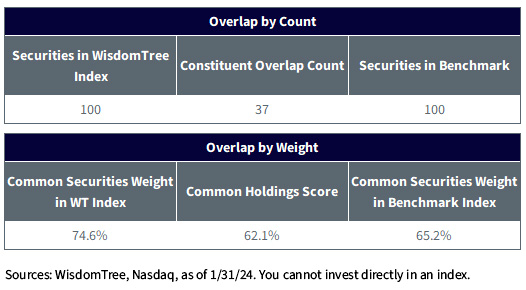

Just like the Nasdaq 100, the WisdomTree Index selects 100 securities. The Indexes maintain 37 securities in frequent with a typical holdings rating (or overlap) of 62%.

WisdomTree U.S. High quality Development Index and Nasdaq 100 Index (Benchmark) Holdings Overlap

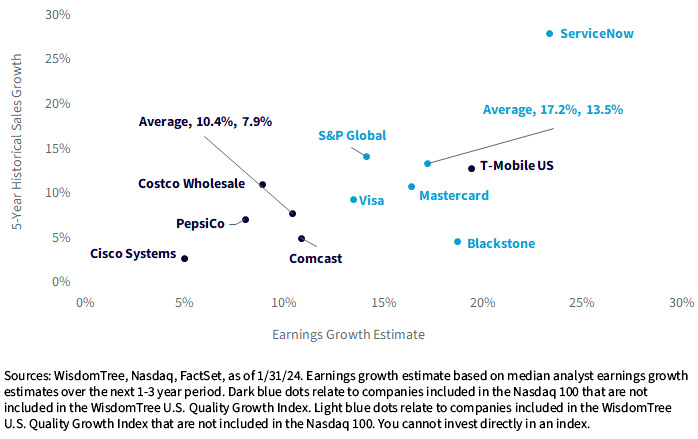

For instance the emphasis on earnings progress/gross sales progress traits for the WisdomTree Index, we spotlight two units of corporations within the under chart:

- Mild blue dots—5 largest holdings within the WisdomTree U.S. High quality Development Index that aren’t included within the Nasdaq 100 attributable to itemizing on the New York Inventory Alternate:

- Mastercard, Visa, S&P World, Blackstone, ServiceNow

- Darkish blue dots—5 largest holdings within the Nasdaq 100 that aren’t included within the WisdomTree U.S. High quality Development Index (attributable to profitability/progress screens):

- Costco Wholesale, PepsiCo, Comcast, Cisco Methods, T-Cell US

Just a few observations:

- Larger progress in shares distinctive to WisdomTree—The common earnings and gross sales progress for corporations included within the WisdomTree Index however excluded from the Nasdaq 100 is 17.2% and 13.5%, respectively

- ServiceNow, which has a market cap over $150 billion, supplies a very good instance of the kind of fast-growth firm excluded from the Nasdaq 100 due to its itemizing on the NYSE—it has grown gross sales 28% annualized over the past 5 years, and is projected by analysts to develop earnings by over 20% over the following a number of years

- Decrease progress in shares distinctive to Nasdaq—The common earnings and gross sales progress for corporations included within the Nasdaq 100 however excluded from WisdomTree Index is simply 10.4% and seven.9%, respectively

- Cisco Methods, then again, has grown its gross sales at simply 3% annualized and analysts count on earnings progress of simply 5% going ahead. Although not a progress firm primarily based on conventional basic metrics, the corporate is included within the Nasdaq 100 due to its market cap and itemizing on the Nasdaq

Development Traits

A Higher Strategy to Development: The WisdomTree U.S. High quality Development Fund

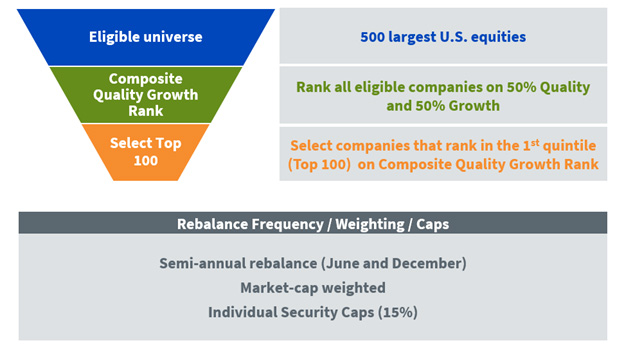

The WisdomTree U.S. High quality Development Index is a market-cap weighted Index that consists of corporations with quality and progress traits. The highest 500 U.S. corporations by market cap—listed on any of the foremost U.S. exchanges—are ranked on a composite rating of two basic components: progress and high quality, that are equally weighted.

The Index is comprised of the 100 U.S. corporations (the primary quintile) with the best composite scores.

Development issue: The expansion issue is set by an organization’s rating primarily based on a 50% weight in its median analyst earnings progress forecast, a 25% weight in its trailing five-year EBITDA (i.e., earnings earlier than curiosity, taxes, depreciation and amortization) progress and a 25% weight in its trailing five-year gross sales progress.

High quality issue: The standard issue is set by an organization’s rating primarily based on a 50% weight to every of its trailing three-year common return on fairness and trailing three-year common return on belongings.

The WisdomTree U.S. Quality Growth Fund was launched in December 2022 to hunt to trace the value and yield efficiency, earlier than charges and bills, of the WisdomTree U.S. High quality Development Index.

Funding Course of

Essential Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. Development shares, as a bunch, could also be out of favor with the market and underperform worth shares or the general fairness market. Development shares are usually extra delicate to market actions than different sorts of shares. The Fund is non-diversified and, in consequence, adjustments available in the market worth of a single safety may trigger larger fluctuations within the worth of Fund shares than would happen in a diversified fund. The Fund invests within the securities included in, or consultant of, its Index no matter their funding benefit. The Fund doesn’t try and outperform its Index or take defensive positions in declining markets and the Index might not carry out as supposed. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link