[ad_1]

Affiliate Director, Analysis

We just lately wrote concerning the rising correlations between stocks and bonds, in addition to the more and more destructive correlation between the U.S. greenback and shares.

To rephrase the destructive correlation between the U.S. greenback and the S&P 500, an funding in U.S. equities is, partly, a guess towards a powerful greenback.

For international asset allocators, this raises an essential query: Why double down on a weak greenback publicity in U.S. equities when investing internationally?

In our view, currency-hedged positions must be thought-about extra as a default and strategic allocation that’s impartial on the greenback’s path, whereas unhedged investments compound an current weak greenback guess buyers have already got inside U.S. equities.

No Diversification from Being Unhedged

One of the crucial frequent arguments we hear in favor of unhedged worldwide allocations is that there are diversification advantages from foreign money publicity.

The info doesn’t assist this larger diversification principle.

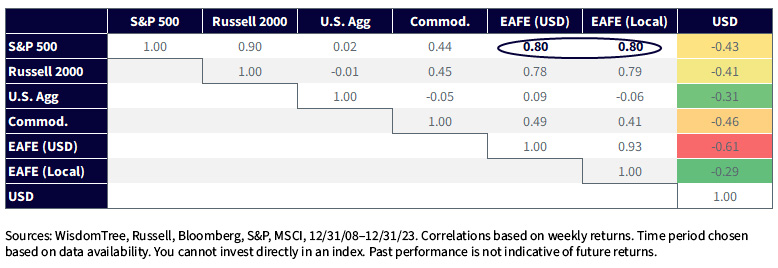

The correlation between U.S. greenback investments within the EAFE (Europe, Australasia and Far East) area (consultant of unhedged) and native foreign money EAFE investments (consultant of hedged) with respect to the S&P 500 is the same 0.80. In different phrases, there is no such thing as a important diversification impact from having foreign money publicity.

Wanting on the right-most column, we observe the correlations of every index with U.S. greenback returns.

- The S&P 500 and the Russell 2000 exhibit correlations of -0.43 and -0.41, respectively. This exhibits the weak greenback bias of core U.S. equities exposures, even in small caps which have decrease abroad earnings.

- The MSCI EAFE (USD) exhibits a good larger weak greenback guess throughout this era, with a -0.61 correlation to the greenback.

- The MSCI EAFE (Native) additionally has a destructive correlation to the greenback, however its correlation of -0.29 is simply half that of the MSCI EAFE (USD)

In abstract, we imagine that investing internationally with out the foreign money hedge compounds the prevailing weak greenback guess that buyers have already got with their U.S. equities publicity.

Correlation Matrix: 12/31/08–12/31/23

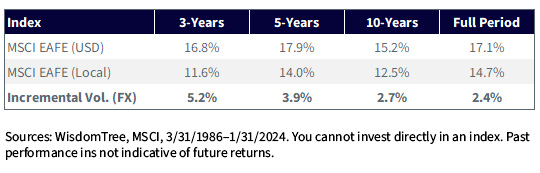

Over the long-run, returns are related between the MSCI EAFE Index in USD and native foreign money—justifying the idea amongst many buyers that foreign money returns are a wash over time.

Although returns are related, we see larger volatility in each customary interval from being unhedged, with the incremental volatility from FX rising to greater than 5% in the newest three-year interval.

Index Normal Deviation

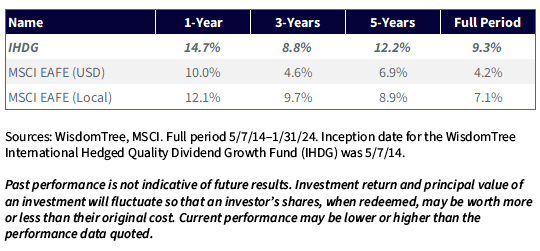

For buyers contemplating a currency-hedged allocation for worldwide publicity, the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) has practically 10 years of reside observe document.

The Fund has outperformed each the MSCI EAFE (USD) and MSCI EAFE (Native) indexes since its inception, doing so with 3% decrease volatility than the MSCI EAFE (USD).

Efficiency as of 1/31/24

For the newest month-end and standardized performances and to obtain the Fund prospectus, click on here.

Necessary Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. International investing includes particular dangers, resembling threat of loss from foreign money fluctuation or political or financial uncertainty. To the extent the Fund invests a good portion of its belongings within the securities of firms of a single nation or area, it’s more likely to be impacted by the occasions or circumstances affecting that nation or area. Dividends are usually not assured and an organization presently paying dividends might stop paying dividends at any time. Investments in foreign money contain extra particular dangers, resembling credit score threat and rate of interest fluctuations. By-product investments may be risky and these investments could also be much less liquid than different securities, and extra delicate to the impact of various financial circumstances. As this Fund can have a excessive focus in some issuers, the Fund may be adversely impacted by adjustments affecting these issuers. The Fund invests within the securities included in, or consultant of, its Index no matter their funding advantage and the Fund doesn’t try to outperform its Index or take defensive positions in declining markets. As a result of funding technique of this Fund it might make larger capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link