[ad_1]

Affiliate Director, Analysis

We’re all conversant in the primary fairness market storylines of 2023:

- The recession extensively anticipated by Wall Avenue and Most important Avenue by no means materialized

- Higher-than-expected financial progress resulted in strong positive aspects throughout fairness markets

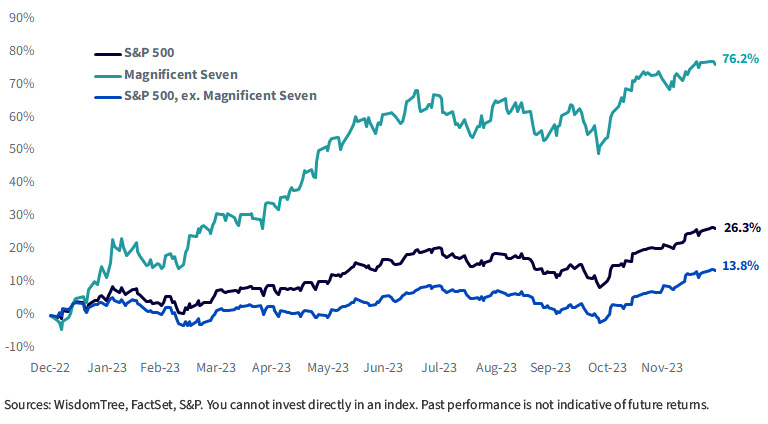

No phase of the market captured more attention than the Magnificent Seven: Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia and Tesla.

These firms collectively accounted for 20% of the S&P 500’s weight at first of 2023 (growing to twenty-eight% by year-end) and drove roughly half of the Index’s 26% return.

Nearly any funding technique that wasn’t over-weight on this handful of names struggled to outperform.

2023 Cumulative Returns

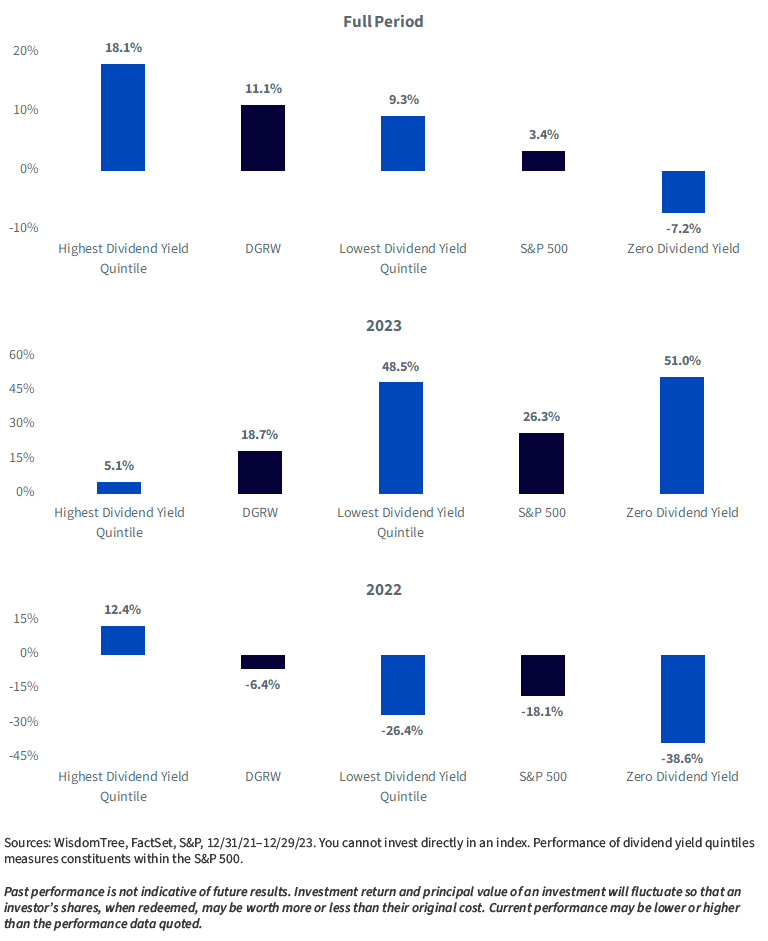

The market management was a 180-degree reversal from 2022, when firms that didn’t pay dividends skilled a decline of practically 39%, considerably larger than the 18% drop within the total S&P 500.

Conversely, firms with the best dividend yields delivered a powerful efficiency in 2022, with constructive returns exceeding 12%.

The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) strategically selects dividend-paying firms primarily based on their excessive profitability and progress traits. In 2022, DGRW outperformed the S&P 500 by greater than 11%, primarily attributable to its under-weight publicity to non-dividend-paying tech firms.

In 2023, the Fund lagged the S&P 500 by 7.6%. This underperformance was largely pushed by its collective under-weight within the Magnificent Seven (averaging 10.5% under-weight), accounting for five% of whole underperformance (or practically 70% of the full underperformance).

Over the complete interval, DGRW maintained an edge over the S&P 500 of greater than 700 basis points cumulatively.

For the newest month-end and standardized performances and to obtain the Fund prospectus, click on here.

For definitions of phrases within the charts above, please go to the glossary.

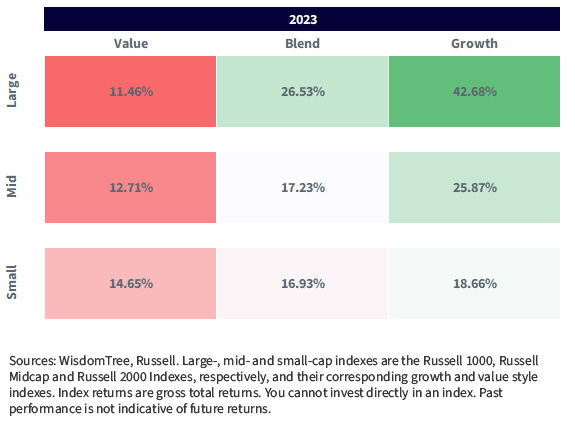

Although mega-cap progress garnered probably the most consideration final yr, buyers needs to be reminded that every fashion index was up nicely over 10%.

Type Field Efficiency

Conclusion

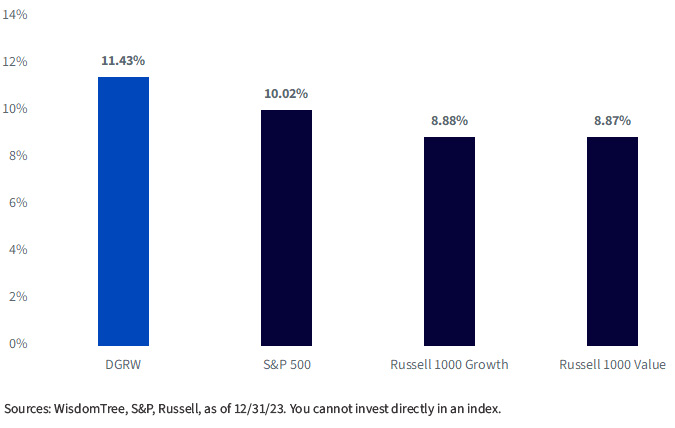

By way of the choppiness of the final a number of years, DGRW outperformed the S&P 500 by greater than 1.4% annualized. It has been a smoother trip by all of the volatility once you zoom out.

Usually, buyers assume a dividend fund requires worth management for outperformance—this outperformance got here amid a backdrop of a directionless marketplace for value versus growth, justifying an allocation for DGRW on the core of an investor’s portfolio.

Annualized Three-Yr Return

Vital Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. Funds focusing their investments on sure sectors improve their vulnerability to any single financial or regulatory growth. This will likely lead to larger share value volatility. Dividends usually are not assured, and an organization presently paying dividends might stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link