[ad_1]

Article content material

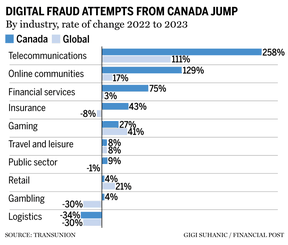

Suspected digital fraud makes an attempt in Canada shot up nearly 40 per cent in 2023, the third-highest enhance amongst 19 international locations, a TransUnion examine says.

New knowledge evaluation from the credit score reporting company discovered that “5 per cent of all digital transactions originating from Canada had been suspected to be fraudulent.”

Article content material

Sixty per cent of Canadians surveyed mentioned they’d been targeted by fraud and 10 per cent mentioned they fell for it.

Article content material

The best price of suspected digital fraud was within the retail sector, the place eight in 100 transactions are suspected of being fraudulent (8.4 per cent). Communities like chat boards and on-line relationship had a 6.2 per cent fraud price and video gaming, 4.6 per cent.

Together with the drastic enhance in fraud makes an attempt, Canadians reported a various combination of schemes from phishing to third-party vendor scams.

Phishing, the place fraudulent hyperlinks are circulated by way of electronic mail and different telecommunications, was reported by half of Canadian respondents.

In the meantime, third-party vendor scams, the place fraudulent posts for merchandise are posted on legit retail web sites, had been reported by 22 per cent of respondents.

The rise of digital transactions throughout the pandemic introduced a brand new actuality for Canadians, mentioned TransUnion. Extra transactions meant extra alternative for fraudsters, and suspected digital fraud makes an attempt skyrocketed 202 per cent from 2019 to 2023.

“It’s vital to be good from the very starting and be cautious to offer any private data, whether or not you suppose it’s your loved ones, your financial institution, or doubtlessly one in all your utility firms, or somebody that you simply transact with,” mentioned Patrick Boudreau, head of id administration and fraud options at TransUnion, including that fraudulent schemes will typically stress victims to offer private data.

Article content material

The TransUnion survey discovered that Canadians take fraud and digital safety dangers significantly, and these considerations affect who they do enterprise with. Greater than 70 per cent of Canadians mentioned they might not return to a web site if they’d fraud considerations, and 42 per cent have deserted their on-line buying carts due to safety considerations.

A latest ballot by The Financial institution of Nova Scotia suggests newcomers, adults who got here to Canada throughout the previous 10 years, are extra proactive in taking precautions to forestall monetary fraud.

Newcomers are 47 per cent extra prone to talk about monetary safety and fraud prevention than different Canadians, and 16 per cent extra prone to steadily replace their passwords to guard on-line accounts. Nonetheless, 38 per cent of newcomers report that they’ve fallen for a fraudulent scheme no less than as soon as, a lot larger than different Canadians.

Advisable from Editorial

“You will need to be hypervigilant and just be sure you double and triple test the data that’s coming via earlier than you click on any hyperlinks, reply to anybody or present any data,” Boudreau mentioned.

Share this text in your social community

[ad_2]

Source link