[ad_1]

Most managed futures methods purpose to generate returns by using leverage and having a excessive diploma of focus in particular person contracts and asset lessons.

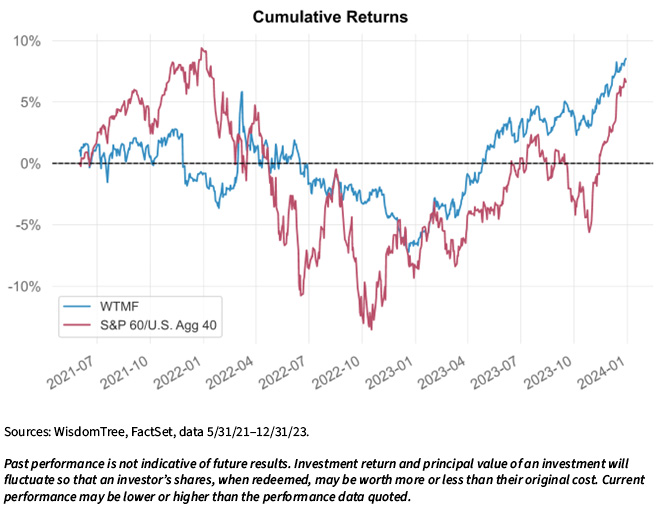

In 2022, the business benefited from this leverage and persevering with development in charges and currencies, which noticed a robust reversal throughout 2023.

The WisdomTree Managed Futures Strategy Fund (WTMF) is diversified throughout asset lessons, doesn’t use leverage and goals to ship decrease volatility and improved risk-adjusted returns. The technique makes use of a complete listing of 21 commodities and individually determines long-short positions derived by subsector-specific momentum indicators.

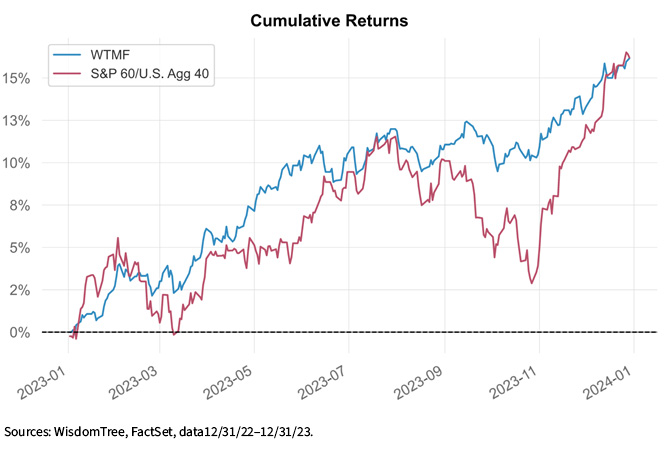

This method contributed to the technique having decrease volatility than its friends and outperforming its benchmark, which is constructed by combining 60% within the S&P 500 Index and 40% within the Bloomberg U.S. Aggregate Index (S&P60/AGG40), on each a risk-adjusted and absolute foundation over 2023.

WisdomTree Managed Futures Technique Fund (WTMF)

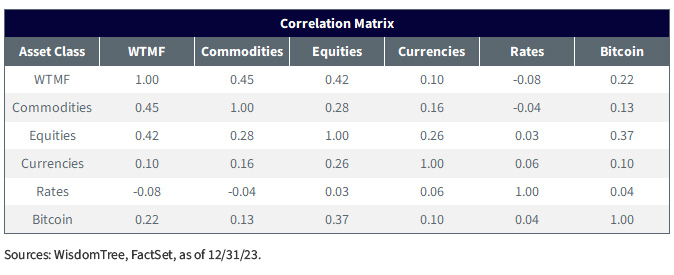

WTMF goals to outperform the S&P60/AGG40 benchmark on a risk-adjusted foundation, whereas having low correlation to main asset lessons like equities and bonds. WTMF has a goal publicity to 5 asset lessons with the weights listed within the desk beneath. Publicity to every asset class, and contracts inside asset class, is derived by subsector-specific momentum signals.

For the latest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on here.

Efficiency in 2023

In 2023, the technique ranked on the prime amongst its peer group in line with Morningstar,1 returning 16.16%. Notably, the technique additionally had a Sharpe ratio of two.82 in comparison with 1.75 for the S&P60/AGG40 benchmark.

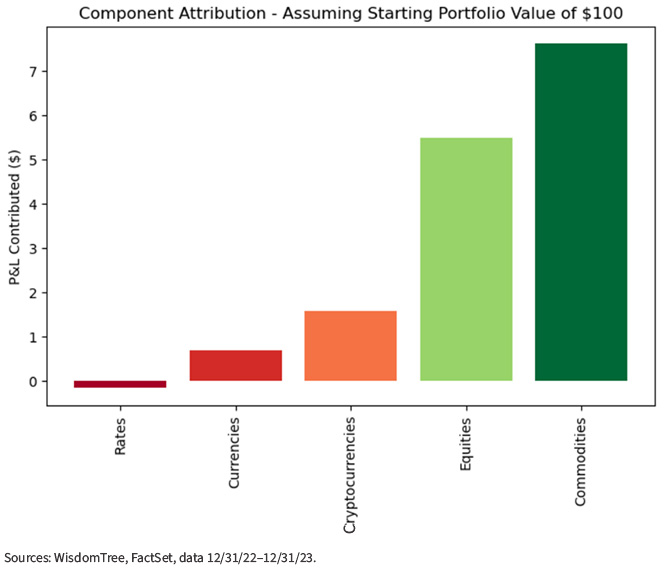

In 2023, all asset lessons throughout the technique contributed to efficiency with each equities and commodities main the way in which. This info is up to date on a quarterly foundation and revealed in our on-line Attribution Report.

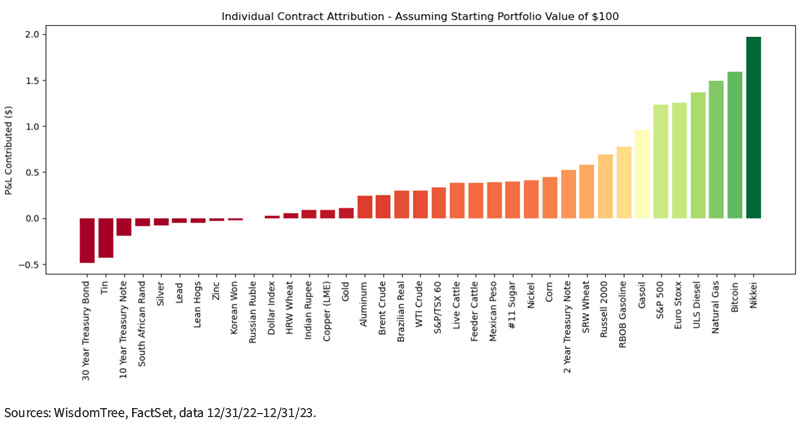

If we click on into every one of many asset lessons and have a look at particular person contracts, we are able to see their contribution to efficiency. It’s good to see that, for the total 12 months in 2023, most particular person contracts contributed to efficiency, displaying the effectiveness of momentum indicators which can be chosen in line with subsector.

Conclusion

WTMF gives traders with differentiated returns in comparison with the remainder of the funds within the class. With a mix of macro indicators and momentum indicators which can be particular to every subsector for particular person contracts, the technique goals to mix macroeconomic outlook with idiosyncratic indicators to attain superior risk-adjusted returns relative to its S&P60/AGG40 benchmark.

A standard S&P60/AGG40 portfolio goals to offer traders with publicity to equities with draw back mitigation via an allocation to Treasuries.

We’ve made the case for the environment friendly use of capital via a leveraged S&P60/AGG40 portfolio, constructing on the seminal research of Cliff Asness, launching the WisdomTree U.S. Efficient Core Fund (NTSX) in 2018. A leveraged S&P60/AGG40 portfolio, mixed with another asset class corresponding to managed futures, can enable traders to deploy their capital extra effectively than with conventional asset allocation.

With one of many lowest volatilities in its peer group and low correlations throughout its underlying asset lessons, WTMF makes for an interesting allocation to enhance diversification and risk-adjusted efficiency of an investor’s total portfolio.

1 Supply: Morningstar, as of 12/31/23. Class: Systematic Development. General rank primarily based on 66 funds in class, 3-year percentile rank primarily based on 66 funds in class, 5-year percentile rank primarily based on 64 funds in class, 10-year percentile rank primarily based on 41 funds in class. As of 12.31.23

The Morningstar Ranking™ for funds, or “star score,” is calculated for managed merchandise with not less than a three-year historical past. Trade-traded funds and open-ended mutual funds are thought of a single inhabitants for comparative functions. It’s calculated primarily based on a Morningstar Threat-Adjusted Return measure that accounts for variation in a managed product’s month-to-month extra efficiency, inserting extra emphasis on downward variations and rewarding constant efficiency.

The highest 10% of merchandise in every product class obtain 5 stars, the following 22.5% obtain 4 stars, the following 35% obtain three stars, the following 22.5% obtain two stars, and the underside 10% obtain one star. The General Morningstar Ranking for a managed product is derived from a weighted common of the efficiency figures related to its three- and five-year Morningstar Ranking metrics. The weights are: 100% three-year score for 36-59 months of complete returns, 60% five-year score/40% three-year score for 60-119 months of complete returns.

Essential Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. An funding on this Fund is speculative, includes a considerable diploma of danger, and shouldn’t represent an investor’s total portfolio. One of many dangers related to the Fund is the complexity of the various factors which contribute to the Fund’s efficiency, in addition to its correlation (or non-correlation) to different asset lessons. These components embody use of lengthy and quick positions in commodity futures contracts, forex ahead contracts, swaps and different derivatives. Derivatives may be risky and could also be much less liquid than different securities and extra delicate to the consequences of various financial circumstances. As well as, bitcoin and bitcoin futures are a comparatively new asset class. They’re topic to distinctive and substantial dangers, and traditionally, have been topic to vital worth volatility. Whereas the bitcoin futures market has grown considerably since bitcoin futures commenced buying and selling, there may be no assurance that this progress will proceed. The Fund shouldn’t be used as a proxy for taking lengthy solely (or quick solely) positions in commodities or currencies. The Fund may lose vital worth during times when lengthy solely indexes rise (or quick solely) indexes decline. The Fund’s funding goal is predicated on historic worth traits. There may be no assurance that such traits shall be mirrored in future market actions. The Fund usually doesn’t make intra-month changes and subsequently is topic to substantial losses if the market strikes in opposition to the Fund’s established positions on an intra-month foundation. In markets with out sustained worth traits or markets that rapidly reverse or “whipsaw,” the Fund could undergo vital losses. The Fund is actively managed thus the flexibility of the Fund to attain its aims will rely on the effectiveness of the portfolio supervisor. Because of the funding technique of this Fund it could make larger capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

Morningstar percentile rankings are primarily based on a fund’s common annual complete return relative to all funds in the identical Morningstar class, which incorporates each mutual funds and ETFs and doesn’t embody the impact of gross sales prices. Fund efficiency used throughout the rating displays sure payment waivers, with out which returns and Morningstar rankings would have been decrease. The best (or most favorable) percentile rank is 1, and the bottom (or least favorable) percentile rank is 100. Previous efficiency doesn’t assure future outcomes.

Morningstar, Inc. All Rights Reserved. The data herein: (1) is proprietary to Morningstar and/or its content material suppliers; (2) might not be copied or distributed; and (3) will not be warranted to be correct, full or well timed. Neither Morningstar nor its content material suppliers are accountable for any damages or losses arising from any use of this info.

The Morningstar Medalist RatingTM is the abstract expression of Morningstar’s forward-looking evaluation of funding methods as provided through particular automobiles utilizing a score scale of Gold, Silver, Bronze, Impartial, and Detrimental. The Medalist Scores point out which investments Morningstar believes are prone to outperform a related index or peer group common on a risk-adjusted foundation over time. Funding merchandise are evaluated on three key pillars (Individuals, Father or mother, and Course of) which, when coupled with a payment evaluation, varieties the idea for Morningstar’s conviction in these merchandise’ funding deserves and determines the Medalist Ranking they’re assigned. Pillar scores take the type of Low, Beneath Common, Common, Above Common, and Excessive. Pillars could also be evaluated through an analyst’s qualitative evaluation (both on to a car the analyst covers or not directly when the pillar scores of a lined car are mapped to a associated uncovered car) or utilizing algorithmic strategies. Automobiles are sorted by their anticipated efficiency into score teams outlined by their Morningstar Class and their energetic or passive standing. When analysts straight cowl a car, they assign the three pillar scores primarily based on their qualitative evaluation, topic to the oversight of the Analyst Ranking Committee, and monitor and reevaluate them not less than each 14 months. When the automobiles are lined both not directly by analysts or by algorithm, the scores are assigned month-to-month. For extra detailed details about these scores, together with their methodology, please go to world.morningstar.com/managerdisclosures/. The Morningstar Medalist Scores usually are not statements of truth, nor are they credit score or danger scores. The Morningstar Medalist Ranking (i) shouldn’t be used as the only real foundation in evaluating an funding product, (ii) includes unknown dangers and uncertainties which can trigger expectations to not happen or to vary considerably from what was anticipated, (iii) usually are not assured to be primarily based on full or correct assumptions or fashions when decided algorithmically, (iv) contain the chance that the return goal is not going to be met resulting from things like unexpected modifications in administration, expertise, financial growth, rate of interest growth, working and/or materials prices, aggressive strain, supervisory legislation, trade fee, tax charges, trade fee modifications, and/or modifications in political and social circumstances, and (v) shouldn’t be thought of a suggestion or solicitation to purchase or promote the funding product. A change within the basic components underlying the Morningstar Medalist Ranking can imply that the score is subsequently not correct.

[ad_2]

Source link