[ad_1]

Director of Analysis, WisdomTree Europe

Gold is a particular asset. Concurrently a commodity and a foreign exchange instrument. Cyclical and defensive on the identical time. Used as a retailer of worth and medium for alternate for millennia. With references to the metallic within the Torah, Bible, Qur’an and Bhagavad Gita, its historic attract to people verges on empyrean.

Completely different and Resilient

Within the monetary world, its distinctive behavioral traits1 make it an ideal diversifier to a portfolio:

- It’s a nice geopolitical shock hedging instrument

- It’s a nice monetary shock hedging instrument

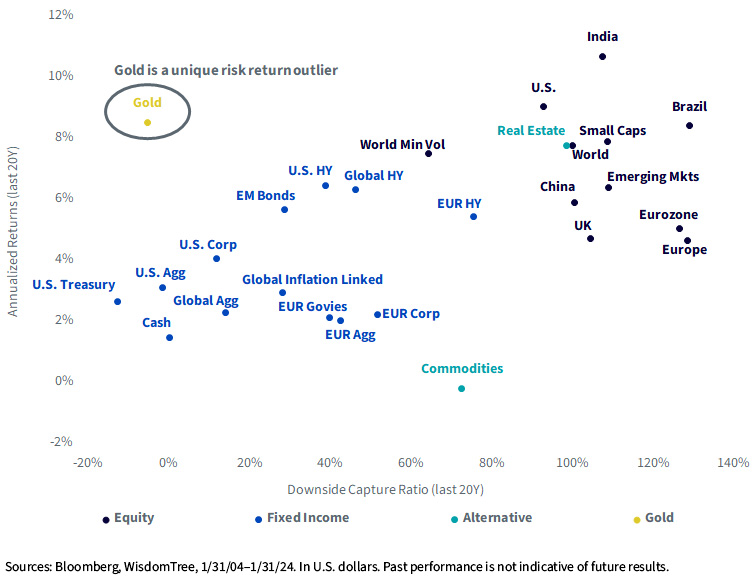

This stability between downside protection and capability to generate optimistic return over the long run is exclusive to gold. As illustrated in determine 1, returns for many belongings are broadly proportional to risk. Property with excessive equity-like returns over the past 20 years have exhibited downside capture (vs. fairness markets) of round 100%. Property with decrease draw back seize, like fastened revenue, are inclined to have decrease returns too.

Gold bucks these traits: it has exhibited equity-like returns of 8.5% each year over the past 20 years with very minimal draw back seize. Gold subsequently is a uniquely suited asset to extend diversification and scale back threat in a portfolio with out weighing on long-term efficiency.

Determine 1: Lengthy-Time period Efficiency and Draw back Threat for Completely different Asset over the Final 20 Years

The Good Diversification Device…

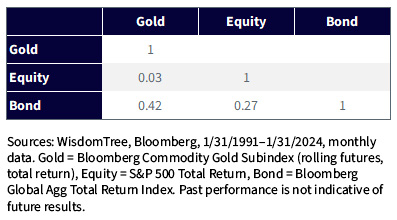

Because the late Markovitz stated, the one free lunch on this planet of investing is diversification. That diversification is enhanced by low correlations. As determine 2 illustrates, gold’s correlations to equites and bonds are low.

Determine 2: Asset Correlation Matrix

…but Shunned by Many Buyers At present

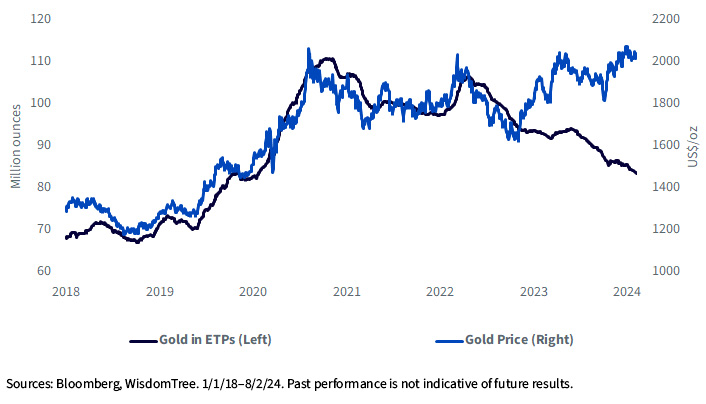

Judging by flows out of bodily gold exchange-traded funds (ETFs) over the previous three years, skilled gold buyers seem to have turned their backs on the metallic (determine 3). With repeated makes an attempt to interrupt above the $2,050 per ounce mark, there was no tailwind from the ETF market. If gold efficiently will get above that degree, we may see ETF buyers return and that would gas a stronger rally.

Determine 3: Gold Worth and ETP Holdings

Gold Poised to Attain a New Excessive

Though delicate landings have traditionally not supplied one of the best setting for gold to shine, on this fee cycle now we have seen gold hit a contemporary excessive in December 2023, when markets have been anticipating a decisive Federal Reserve (Fed) pivot in 2024. A few of these beneficial properties have been given again as markets reassessed the Fed’s urgency, however our Gold Mannequin factors to gold rising to a higher high by the end of this year, on account of bond yields declining and the U.S. greenback depreciating.

Gold may attain $2,210 per ounce, near 10% larger on the time of writing (February 6, 2024). Reaching the lauded delicate touchdown is simpler stated than executed (and that’s the reason now we have so few observations to take a look at). We may face a bumpy street in 2024, with the Fed and markets clearly having a special view of the speed path forward of us. Gold’s hedging capabilities could as soon as once more show to be the antidote to volatility elsewhere.

Options

Regardless of the strategic and more and more tactical advantages of getting gold in a portfolio, discovering an area for gold is at all times a problem. With bond costs having fallen a lot in October 2023, many buyers have opportunistically crammed the defensive portion of their portfolios with Treasuries, leaving much less room for gold. In a yr the place fee cuts are extensively anticipated, buyers are eager to keep up a big publicity to equities.

WisdomTree has developed capital environment friendly options to deal with this downside. WisdomTree Efficient Gold Plus Equity Strategy Fund tracks a broad fairness index and gives gold publicity by gold futures contracts. The inherent leverage in gold futures gives capital effectivity. For instance, $100 invested could be cut up $90 in fairness and a $90 notional publicity to gold futures ($10 in money collateral). The answer permits buyers to search out room for gold with out materially reducing publicity to equities. The WisdomTree Efficient Gold Plus Gold Miners Strategy Fund gives the same answer, changing the broad fairness element with gold miners. Gold miners and gold futures carry out in a different way in several components of the financial cycle and the answer permits buyers publicity to each in a capital environment friendly method.

1 See: WisdomTree Efficient Gold Plus Gold Miners Strategy Fund Investment Case

Essential Dangers Associated to this Article

There are dangers related to investing, together with the doable lack of principal. The Fund is actively managed and invests in U.S.-listed gold futures and international fairness securities issued by corporations that derive at the least 50% of their income from the gold mining enterprise (“Gold Miners”). The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying beneficial properties and losses and inflicting the Fund to be extra unstable than if it had not been leveraged. Furthermore, the value actions in gold and gold futures contracts could fluctuate rapidly and dramatically, and have a traditionally low correlation with the returns of the inventory and bond markets. By investing within the fairness securities of Gold Miners, the Fund could also be inclined to monetary, financial, political or market occasions that impression the gold mining sub-industry, together with commodity costs and the success of exploration initiatives. The Fund could make investments a good portion of its belongings within the securities of corporations of a single nation or area, together with rising markets, and thus, the Fund is extra prone to be impacted by occasions and political, financial or regulatory situations affecting that nation or area, or rising markets usually. The Fund’s funding technique may also require it to redeem shares for money or to in any other case embrace money as a part of its redemption proceeds, which can trigger the Fund to acknowledge capital beneficial properties. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link