[ad_1]

Six of the Magnificent Seven have reported earnings up to now this season, and the outcomes have been largely spectacular. 5 out of the six exceeded analyst earnings and gross sales estimates.

Nvidia is the final firm on this group to report, scheduled for after the shut on February 21. Analysts are estimating an earnings per share (EPS) of $4.53, which might characterize year-over-year development of over 400%.

Tesla stands out because the outlier inside this group. The corporate’s earnings miss of three%, coupled with a year-over-year earnings decline of 40% and lowered ahead steering, has contributed to its 25% decline year-to-date.

Tesla has grow to be a sufferer of its personal success. The outsized good points achieved by the Magnificent Seven over the previous a number of years have raised expectations for his or her future earnings development. These sturdy good points have additionally sparked discussions about “focus danger” available in the market in the course of the early a part of this 12 months.

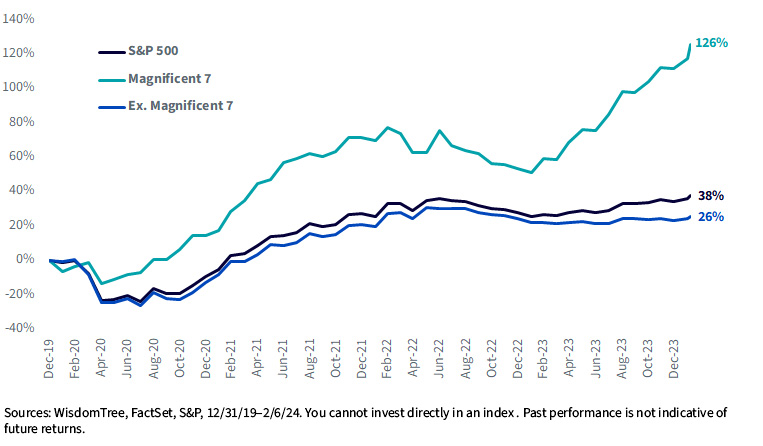

Cumulative Whole Returns

With out the context of the earnings development of those firms, the prior returns chart would naturally counsel an overheated market.

However alongside the big returns of those firms for the final a number of years, there was synchronous earnings development.

The 126% cumulative earnings development because the begin of 2020 is over thrice that of the broader market and virtually 5 instances the S&P 500, excluding the Magnificent Seven.

Preserve this chart in thoughts when making an attempt to counterbalance the sensation that the run-up in these shares is solely primarily based on a number of enlargement associated to artificial intelligence (AI) hype.

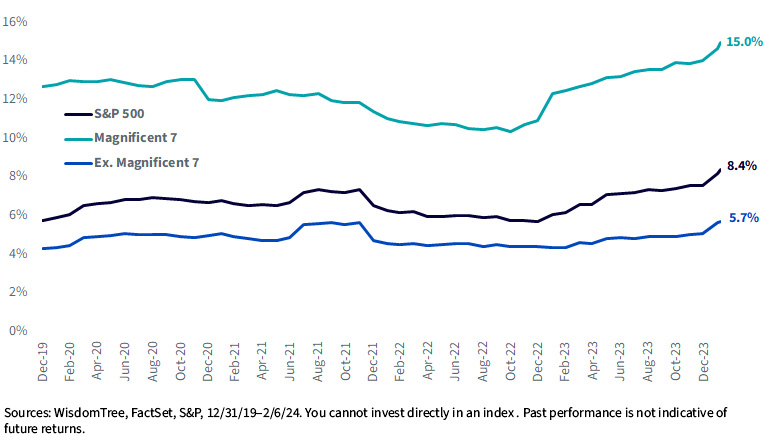

Cumulative Earnings Development

Talking of AI, it’s evident from analyzing analysis and growth (R&D) spending as a proportion of gross sales that these firms are ramping up their funding whereas concurrently delivering on earnings.

Buyers’ anticipation that these investments will repay within the years to return is definitely a contributor to the constructive enthusiasm surrounding these names over the past 12 months.

R&D as Proportion of Gross sales

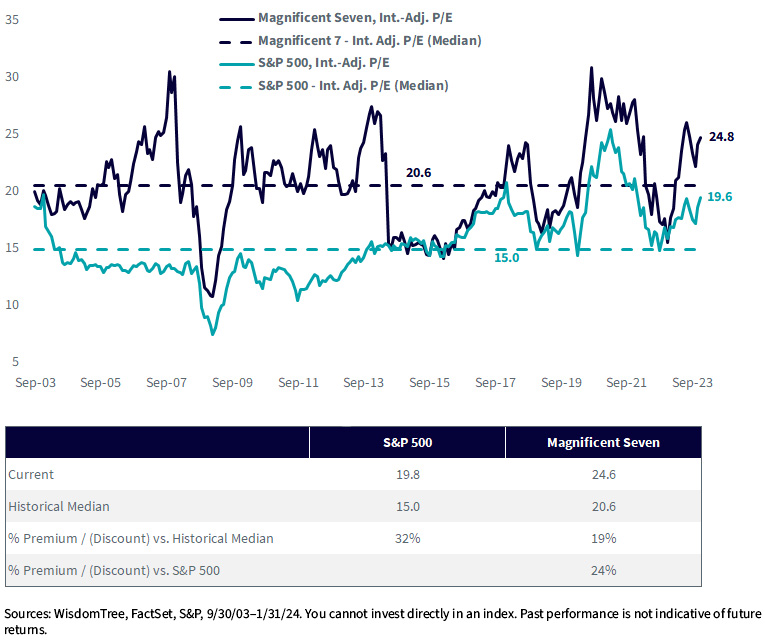

The underside-line query for a lot of traders, significantly these under-weight within the Magnificent Seven over the past a number of years, is whether or not these names have grow to be overvalued. Solely time will give us the definitive reply.

valuations that regulate for investments in R&D—a proxy for investments in intangible property like these associated to AI—our knowledge means that the Magnificent Seven, as with the remainder of the S&P 500, are at elevated valuations relative to historical past.

On the present 25 instances P/E, the Seven are at a 19% premium relative to their historic median. In the meantime, the S&P 500 is at a good steeper 32% premium relative to its historical past.

Briefly, after a robust run-up in large-cap U.S. equities broadly over the past a number of years, there aren’t essentially many bargains available. Nevertheless, if the Magnificent Seven proceed to develop their earnings on the present spectacular fee, they might justify their premium multiples.

Intangible Adjusted Worth-to-Earnings

[ad_2]

Source link