[ad_1]

This text initially appeared on Business Insider.

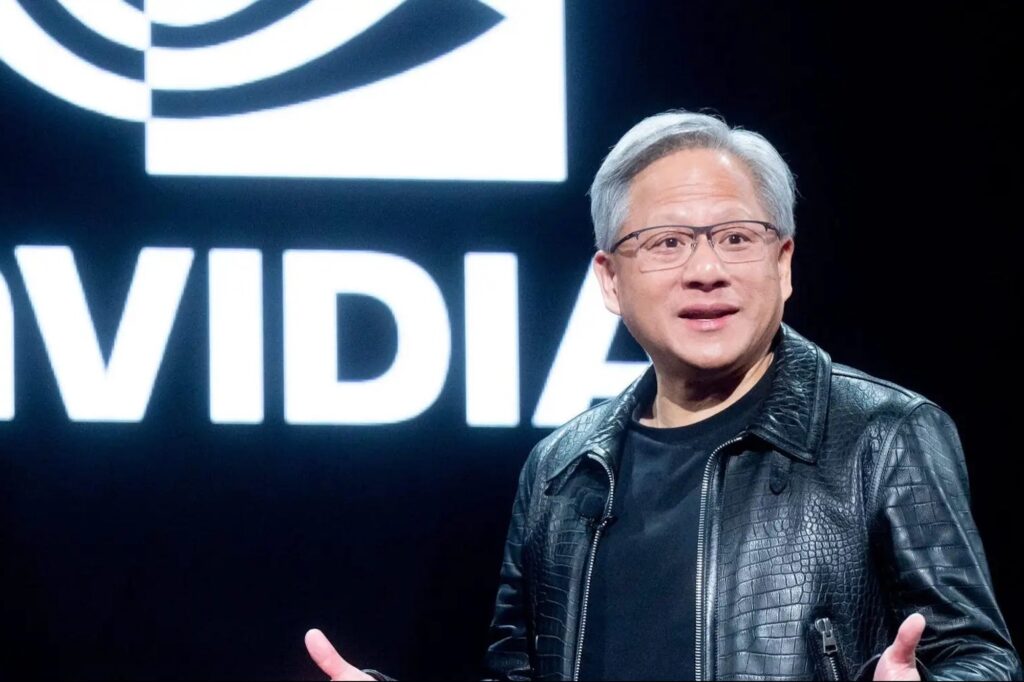

Nvidia simply overtook Alphabet to change into the third most beneficial firm within the U.S.

Nvidia’s shares are up 3.64% previously 5 days alone, giving it a market cap now equal to $1.83 trillion, Reuters reported Tuesday. Alphabet, Google’s mum or dad firm, has a market cap of $1.82 trillion.

The chipmaker’s valuation now trails behind solely Microsoft and Apple.

Nvidia has been on a tear for months, with its refill 51% this 12 months alone. Its market cap surpassed Amazon’s as well on Monday for the primary time since 2002 when each firms have been within the doldrums of the dot-com crash.

An enormous a part of what’s been propelling the chipmaker ahead is the AI growth, which heralded a surge in demand for semiconductors. AI fashions want semiconductors that may run cutting-edge tech, and Nvidia is without doubt one of the largest gamers within the chip trade.

The corporate’s eye-watering ascent has raised its valuation to past that of China’s stock market and is even value Spain’s whole GDP, BofA has famous.

AI hype has bled into different tech shares, too. ARM, one other semiconductor firm, blasted upwards by 81% within the final month, whereas the iShares Semiconductor ETF can also be up 10% since mid-January.

There could possibly be much more upside to Nvidia’s inventory, some analysts say. Financial institution of America has forecasted the share price will hit $800, primarily as a result of “enterprise genAI adoption has but to kick off.” The inventory is at the moment sitting at about $725.

In the meantime, different consultants have in contrast the corporate’s blockbuster positive aspects to that of a dot-com period inventory. Rob Arnott stated the chipmaker is a “textbook story of a Big Market Delusion” — and when the bubble bursts, it should tip the dominoes for a wider market rout.

[ad_2]

Source link