[ad_1]

Head of Mounted Revenue Technique

The previous couple of years have offered fascinating challenges for bond buyers. In 2022 and 2023, mounted earnings portfolios had been confronted with learn how to place for what ended up being historic rate hikes. However now, the pendulum has shifted, and the funding profile has moved to learn how to place one’s bond allocation for rate cuts. In opposition to this backdrop, I believed it might be helpful to supply readers insights on how Treasury (UST) yields function, particularly in relation to the Fed Funds target.

Oftentimes, in conversations I’ve, there’s a perception that no matter occurs to the Fed Funds Rate can be handed alongside to the Treasury yield curve in a similar way. Whereas, directionally, the thought of the Fed Funds Fee and UST yields shifting up or down in tandem is considerably correct, the magnitude and timing of modifications are typically not so easy.

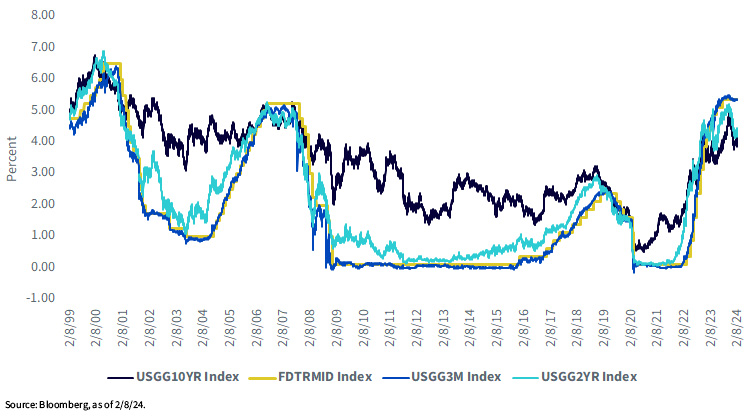

Fed Funds vs. UST 3-Mo, 2-Yr & 10-Yr Yields

Clearly, one begins with the Fed Funds goal fee and/or vary, which represents in a single day cash. Consequently, the nearer the maturity is to Fed Funds, the extra optimistic the correlation goes to be. The above graph highlights the connection over the previous 25 years between the mid-point of the Fed Funds goal vary and the UST 3-month t-bill, in addition to the UST 2-Year and 10-Year note yields. The UST floating rate note is also thought-about on this evaluation given the truth that it floats, or is referenced, to the weekly UST 3-month t-bill public sale.

As you’d anticipate given the above assertion, the correlation between Fed Funds and the 3-month t-bill is very tight, whereas the connection with the 2-12 months be aware can be very positively correlated. Nonetheless, the optimistic correlation begins to minimize significantly the additional one goes out on the yield curve, as illustrated by the unfold between Fed Funds and the UST 10-12 months be aware. Whereas directionally these two charges have a tendency to maneuver in the same manner, the correlation in yields is noticeably decrease when in comparison with maturities which are nearer to Fed Funds.

Intuitively, this makes good sense. A maturity construction that’s not too far faraway from the Fed Funds Fee can be anchored and straight linked to tendencies in in a single day cash (Fed fee hikes/cuts). However, as you proceed to maneuver away from this anchor, different components moreover the Fed start to return into play, and thus, buyers demand a time period premium, or a further return or yield for the potential threat incurred by holding a safety that’s longer-term in maturity. As well as, inflation expectations can also play a visual function on this entrance.

Conclusion

In different phrases, simply because the Fed could lower charges later this yr, it doesn’t essentially imply the UST 10-12 months yield will transfer down in lockstep style. Certainly, historical past during the last 25 years is fairly clear on that entrance. So, when someone says they anticipate charges to return down, you will need to be clear about which fee they’re referring to precisely. Preserve this in thoughts when, and or if, you wish to place your bond portfolio for the potential Fed fee cuts which have been dominating the funding dialog.

[ad_2]

Source link