[ad_1]

Disclosure: Our aim is to characteristic services that we expect you may discover attention-grabbing and helpful. If you buy them, Entrepreneur could get a small share of the income from the sale from our commerce companions.

There are solely two months left till your favourite time of yr: Tax season. Whereas that is a tad early, it is also true that IRS knowledge exhibits an general 15% enhance in common refunds thus far (in response to CNBC Choose). If that really makes you wanting to file this yr, then you may additionally have an interest on this deal on H&R Block’s Deluxe software program.

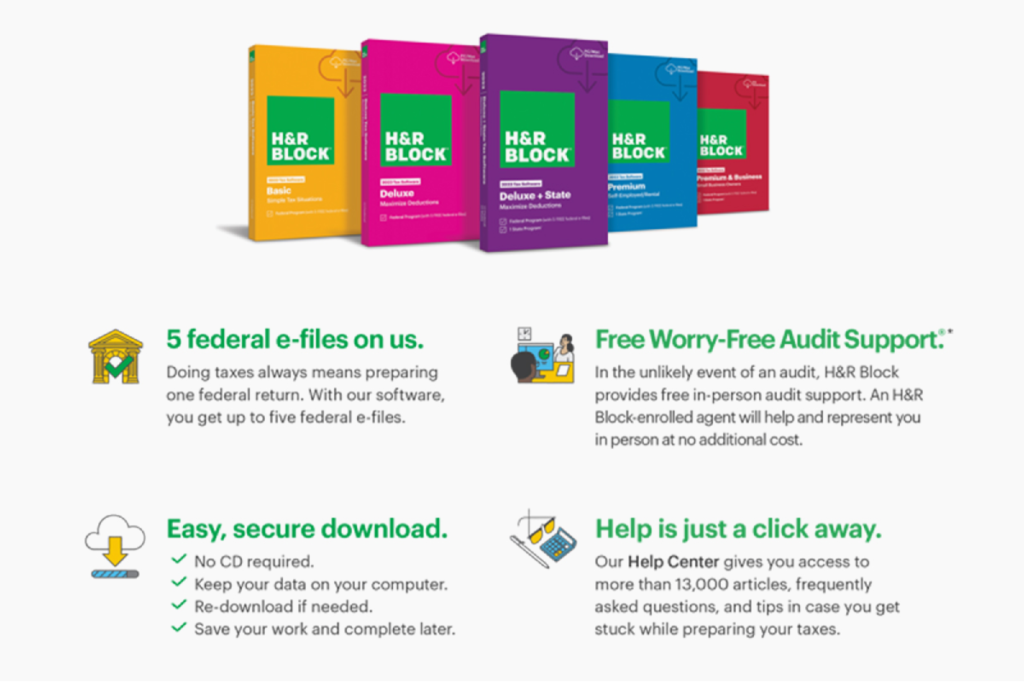

It might allow you to file each your state and federal returns with help on greater than 350 credit and deductions to maximise the quantity you get again — plus a great deal of different perks. For a restricted time, you possibly can get H&R Block Deluxe for only $24.97, usually $49.99.

H&R Block Deluxe: All-around worry-free submitting.

H&R Block Deluxe is designed to be straightforward to make use of, whether or not it is your first time submitting with out an accountant otherwise you’re a seasoned filer. The software program will stroll you thru the state and federal applications step-by-step so you possibly can really feel confidence in its accuracy, and people who used TurboTax or Quicken in earlier years can simply import previous returns and knowledge.

You may additionally get entry to an abundance of assets like 13,000 searchable articles, FAQs, and recommendations on tax preparation. Uniquely, H&R Block may also represent you in-person in the rare case of an audit at no extra value.

In contrast to web-based applications, H&R Deluxe is definitely a downloadable app on your PC or Mac, so it can save you your work and full it later. This is also helpful to reference if you’re submitting subsequent yr’s return.

Use H&R Block Deluxe to file your taxes and maximize your refund, now solely $24.97 (reg. $49.99) on sale till February 11 at 11:59 p.m. PT. No coupon is required.

StackSocial costs topic to alter.

[ad_2]

Source link