[ad_1]

One of the difficult components of proudly owning a enterprise is securing financing. There are many choices–so many who it may change into overwhelming determining which one most closely fits your small business wants. Whereas service provider money advances (MCAs) is probably not the primary funding technique you contemplate, it’s worthwhile to know what they’re and the way they work.

Service provider money advances are a type of enterprise funding offered by various lenders, fintechs, and different comparable corporations. They’re out there to most companies, though admittedly they aren’t at all times a first-choice choice. Nevertheless, the MCA market is anticipated to be value round $26 billion globally by 2029.

On this article, we’ll dive into the world of service provider money advances. We’ll cowl the next matters:

- What is a merchant cash advance?

- How merchant cash advances work

- Advantages of merchant cash advances

- Disadvantages and risks of merchant cash advances

- Comparing MCAs with other financing options

- Tips for choosing an MCA provider

The information to elevating capital

On this information, we’ll share every little thing you want to find out about getting funding to start out or develop your small business

What’s a service provider money advance?

A service provider money advance is upfront working capital that’s offered to a enterprise in alternate for future card gross sales. The advance and related price of the advance (within the type of a flat price or issue price–extra on that later) are remitted by a proportion of your day by day or weekly gross sales.

How do service provider money advances differ from conventional loans?

Traditional loans entail borrowing a sum of cash from a monetary establishment which might be repaid over an agreed-upon time frame with curiosity. They contain complete functions and collateral to assist lenders mitigate danger.

Who’re service provider money advances for?

MCAs are perfect for companies searching for short-term money movement or who want funding for rapid enterprise bills. It’s additionally a helpful choice for companies with a excessive quantity of bank card transactions. Right here’s a fast listing of a number of the different excellent profiles for MCAs:

- Seasonal companies: Companies that want an injection of money movement on account of seasonality and know that the remittance price is proportional to their gross sales

- Companies that don’t have nice credit score: MCAs don’t impression your credit score rating (or construct credit score)

- Companies with restricted tangible property: For enterprise house owners which might be cautious of the collateral necessities that include secured enterprise loans

How service provider money advances work

One of many predominant advantages of a service provider money advance is the velocity at which enterprise house owners obtain funds. In different phrases, the method is sort of easy. Nevertheless, the overall course of can change relying in your MCA supplier.

Vital phrases to know

Holdback price: That is the proportion of your day by day or weekly gross sales that your MCA supplier takes to remit your money advance. This may occasionally even be known as the remittance price.

Issue price: The issue price is the price of the advance expressed in a decimal quantity, and with the advance represents the full quantity to be remitted. For example, if a enterprise receives a $10,000 advance with an element price of 1.2, the full quantity to remit can be $12,000.

Flat price: Just like the issue price, a flat price is the price of the advance. Nevertheless, it’s calculated in another way than the issue price. A flat price is a proportion of your money advance added to the full quantity to be remitted. Within the case of the $10,000 advance, a flat price of 12% would carry the full quantity to be remitted to $11,200. Some suppliers function on a flat price foundation, whereas others use issue charges.

Buy quantity: The acquisition quantity consists of the money advance and its related price, both the flat price or issue price quantity.

One normal rule of thumb: fastidiously assessment the phrases and situations, charges, issue charges and the remittance construction earlier than you proceed along with your software.

get a service provider money advance

- Select your MCA supplier (we’ll talk about this in additional element in a while)

- Full an software.

- Submit related paperwork, normally fee statements and several other statements displaying your small business’s bank card transaction historical past.

- Overview your provide completely. That features the issue price or flat price and every other situations.

- When you signal the settlement, the supplier will usually perform a fast underwriting course of.

- When that’s carried out, you’ll be permitted and obtain the funding shortly after.

- The advance will probably be remitted robotically by your day by day or weekly gross sales till it’s remitted in full.

As with all sort of enterprise funding, you’ll wish to do your due diligence in reviewing the provide and the supplier you go together with. If it’s your first time working with a sure firm, it doesn’t harm to seek the advice of a monetary advisor or comparable skilled to allow them to give the provide one other look earlier than you signal something.

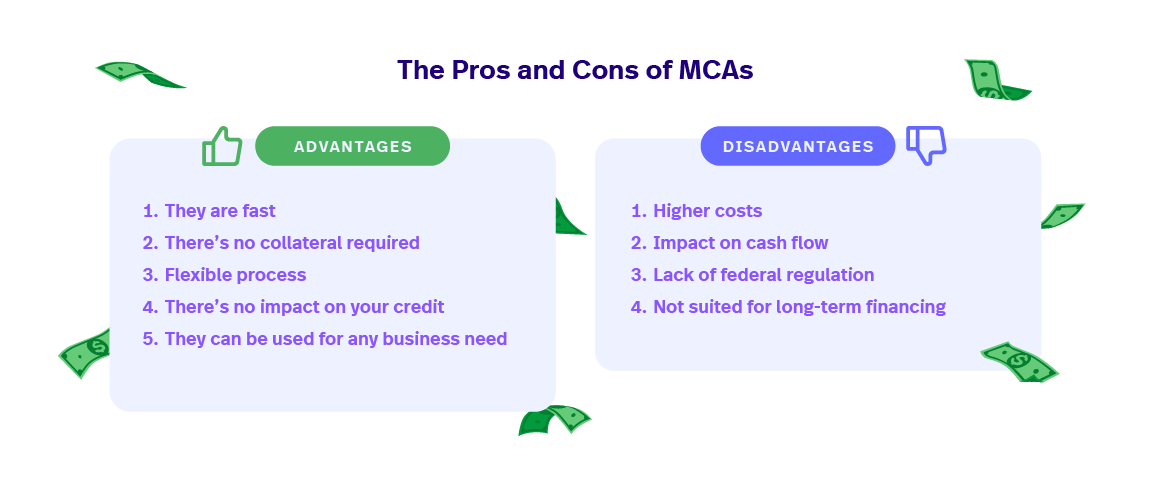

Benefits of service provider money advances

1) They’re quick

For those who’re in search of last-minute capital, MCAs could also be a sensible choice. They’re quick, with funding usually out there inside only a few days of making use of. That is in distinction to some conventional types of financing, which may take a number of weeks for approval, relying on the kind and quantity of funding. The speedy nature of this kind of financing implies that enterprise house owners can fund surprising bills, or last-minute tasks.

2) There’s no collateral required

It is a massive plus for enterprise house owners who don’t have the means to place up any type of collateral that’s required with a secured enterprise mortgage.

3) Versatile course of

Not like with conventional loans, you’re not penalized for ‘late funds’ as a result of there’s no such factor with an MCA. So long as your gross sales are regular, you understand that the advance is being remitted. Even in case you made no gross sales on a given day, you gained’t face penalties.

4) There’s no impression in your credit score

MCA suppliers usually don’t conduct credit score checks. It is a massive profit for enterprise house owners who need funding however don’t have a robust credit score rating. Nevertheless, which means that you gained’t be capable of construct credit score, as you’ll with a mortgage once you make on-time funds.

5) They can be utilized for any enterprise want

With conventional loans, a part of the applying course of can embody submitting a marketing strategy that particulars how precisely you’re going to make use of the funds for your small business. With an MCA, you don’t have to do that. So long as you’re utilizing it for something business-related, you don’t have to elucidate or justify your reasoning for requesting funding.

Disadvantages of service provider money advances

There are a couple of explanation why enterprise house owners don’t usually flip to service provider money advances as their first choice in relation to financing.

1) Greater prices

Regardless of a money advance coming with a one-time price or flat price, these numbers can scare individuals away as a result of they are typically greater than the charges provided by conventional loans. For those who’re contemplating selecting between a financial institution mortgage and MCA, translating the issue price or flat price into the mortgage equal–annual proportion price (APR)–may also help you evaluate prices.

2) Influence on money movement

The day by day or weekly automated withdrawals could impression money movement, making it troublesome to pay for different operational and day-to-day bills. Although withdrawals are proportional to your gross sales, for companies who’re in a interval of low gross sales, it may be troublesome to handle. It’s essential for each enterprise contemplating an MCA to assessment their money movement and any related constraints associated to day by day withdrawals.

3) Lack of federal regulation

Service provider money advances aren’t labeled as loans, and subsequently aren’t topic to regulation.

Sadly, some predatory suppliers make the most of the truth that there isn’t a federal regulation of the MCA business. These lenders typically observe misleading ways, and cost retailers unnecessarily. They could deliberately mislead companies with unclear phrases, administrative charges and different surprising prices. That is clearly an enormous stressor for companies who believed that they had signed up for a professional service. That’s why it’s extraordinarily essential to do your analysis earlier than making use of.

4) Not at all times fitted to long-term financing

Conventional enterprise loans could present extra long-term flexibility. On this approach, service provider money advances could be restricted: they’re typically higher fitted to short-term wants, when companies want quick funding for rapid bills or tasks.

Service provider money advances vs. financial institution loans vs. enterprise strains of credit score

Two of the commonest strategies of enterprise financing are financial institution loans and enterprise strains of credit score.

Financial institution loans: Companies borrow a lump sum of cash from a financial institution or different monetary establishment, which they comply with repay with curiosity over a predetermined interval. A financial institution mortgage contains curiosity, a compensation schedule and normally requires collateral (these are secured loans).

Enterprise line of credit score: It is a versatile association that permits a enterprise to borrow funds as much as a set restrict. Retailers have ongoing entry to capital and may use and repay the funds as they require. When it comes to curiosity, they’re charged on the quantity borrowed, which makes this a useful gizmo for each short-term and long-term money movement wants.

Evaluating MCAs vs. financial institution loans vs. enterprise strains of credit score

| Standards | Service provider Money Advance (MCA) | Financial institution Mortgage | Enterprise Line of Credit score |

| Funding Kind | Buy of future card gross sales | Lump sum quantity | Revolving credit score line |

| Compensation Construction | Every day or weekly proportion of card gross sales | Month-to-month mounted funds | Month-to-month minimal funds, revolving |

| Value Construction | Issue price or flat price | Rate of interest and presumably charges | Rate of interest and presumably charges |

| Collateral | Unsecured | Secured or unsecured | Secured or unsecured |

| Approval Course of | Fast approval with concentrate on card gross sales | In depth software, credit score checks, documentation | Utility, credit score evaluation, documentation |

| Credit score Test | Little to no emphasis on credit score historical past | Sometimes requires good credit score historical past | Credit score historical past could affect approval |

| Velocity of Funding | Speedy funding turnaround | Longer processing time | Typically faster entry to funds |

| Flexibility | Fastened phrases, much less flexibility | Fastened phrases with much less flexibility | Revolving, offering ongoing entry to funds |

| Use of Funds | Sometimes unrestricted | Particular use decided by mortgage settlement | Versatile use, relying on the enterprise’s wants |

| Danger of Default | Probably excessive danger on account of day by day withdrawals | Danger of default if month-to-month funds will not be met | Danger of default if minimal funds will not be met |

| Suitability | Companies with constant bank card gross sales | Retailers with secure financials, good credit score historical past | Companies needing versatile entry to capital |

When must you select a service provider money advance?

Moreover, there are a couple of elements to contemplate when selecting a service provider money advance over a financial institution mortgage or line of credit score, together with if:

- You’ve gotten rapid funding wants

- Your online business has a robust historical past of bank card gross sales

- You like to not put up collateral

- Automated fee withdrawals sound good to you

- You don’t thoughts paying greater charges for quicker funding turnaround

- You like your credit score historical past isn’t assessed

Ask your self whether or not any of those, or all of them, apply to your scenario. Looking for the recommendation of knowledgeable may give you additional perception on whether or not an MCA is a greater choice for you. They’ll additionally show you how to discover one of the best supplier–one that’s clear and reliable.

How to decide on a service provider money advance supplier

Now that we’ve lined the benefits in addition to the dangers related to a service provider money advance, let’s speak about how one can select supplier. First, determine your small business wants and ensure they align with what a service provider money advance gives.

1) Analysis and evaluate

It’s essential to conduct thorough analysis on MCA suppliers. It is best to evaluate their choices, charges and phrases. Be looking out for pink flags, resembling different pointless charges within the effective print. Test buyer evaluations on totally different web sites and ask fellow enterprise house owners about their experiences with MCA providers. Ask your monetary advisors or comparable professionals to give you detailed info or every other perception they might have on the providers you’re contemplating.

These days, many fintech corporations present service provider money advances. For example, POS and fee suppliers like Lightspeed, Shopify and Toast all provide their very own service provider money advance providers. If your small business works with an organization like this–one which you have already got a historical past with and belief your small business with–it doesn’t harm to look into their money advance packages.

2) Perceive phrases and situations

When you’ve selected a supplier, assessment the phrases and situations of the settlement. Pay particular consideration to the flat price or issue price, compensation construction and any extra charges. Non-predatory MCA suppliers shouldn’t cost any further charges, so this can be a pink flag. It doesn’t harm to have the settlement reviewed by a authorized or monetary skilled to allow them to advise of any obfuscations or non-transparent phrases.

3) Test the supplier’s reputability

Though we could sound repetitive, we will’t stress sufficient the significance of creating certain you’re working with a good supplier. Buyer testimonials, evaluations and business scores, in addition to belief scores, may also help you identify whether or not the corporate has a professional observe file of working with companies.

Understanding service provider money advances

All in all, know your small business wants greatest. Take the time to analysis your financing choices so that you could be assured in your selection, whether or not that could be a service provider money advance or financial institution mortgage.

Lightspeed’s service provider money advance program, Lightspeed Capital, is on the market solely to eligible Lightspeed retailers. To study extra about this system, visit our website.

For those who’re not but a Lightspeed buyer, talk to an expert about our POS and Funds answer for companies.

Editor’s be aware: Nothing on this weblog put up must be construed as recommendation of any form. Any authorized, monetary or tax-related content material is offered for informational functions solely and isn’t an alternative choice to acquiring recommendation from a certified authorized or accounting skilled. The place out there, we’ve included major sources. Whereas we work laborious to publish correct content material, we can’t be held answerable for any actions or omissions primarily based on that content material. Lightspeed doesn’t undertake to finish additional verifications or hold this weblog put up up to date over time.

FAQ

1. What’s an instance of a service provider money advance?

A service provider money advance is when a enterprise receives a lump sum quantity upfront in alternate for a proportion of its day by day card gross sales. Right here’s an instance of what that appears like:

Advance quantity: $10,000

Flat price: 12%

Complete quantity: $11,200

Holdback price: 10% (the % of day by day gross sales that’s robotically withdrawn to remit the advance)

2. What’s the distinction between a mortgage and a service provider money advance?

Whereas each present financing, loans contain borrowing a hard and fast sum with curiosity and stuck repayments, whereas service provider money advances contain receiving a lump sum in alternate for a proportion of future card gross sales.

3. Are service provider money advances legit?

Sure, service provider money advances are a professional type of enterprise financing. Nevertheless, it’s essential to fastidiously assessment phrases and prices, and select respected suppliers.

4. Can a service provider money advance harm your credit score?

Typically, service provider money advances don’t impression private or enterprise credit score scores straight, as approval relies on day by day bank card gross sales. Nevertheless, monetary pressure from the remittance course of may not directly have an effect on creditworthiness.

5. Why get a service provider money advance?

Companies could go for service provider money advances for fast entry to capital, particularly if they’ve constant bank card gross sales, want speedy funding or face challenges acquiring conventional loans.

6. What occurs in case you don’t pay again a service provider money advance?

Failing to repay a service provider money advance could result in monetary penalties, elevated charges, and authorized motion. It’s important to speak with the supplier if dealing with difficulties.

7. Are service provider money advances predatory?

Whereas not inherently predatory, some suppliers could make use of unfavorable phrases. Companies ought to fastidiously assessment agreements and select respected suppliers to keep away from potential pitfalls.

8. How are service provider money advances repaid?

Service provider money advances are remitted through a hard and fast proportion of day by day card gross sales, deducted robotically till the agreed-upon quantity, together with charges, is remitted in full.

[ad_2]

Source link