[ad_1]

Totally different choice processes amongst benchmarks can result in vastly different portfolio holdings, as evidenced by the huge dispersion in returns this yr throughout indexes with the identical objectives of monitoring growth or value components.

Cumulative Yr-to-Date Return Distinction: S&P vs. Russell

The efficiency impression of those deviations, even for broad-based benchmarks, is very magnified within the usually extra unstable and fewer environment friendly mid- and small-cap universes.

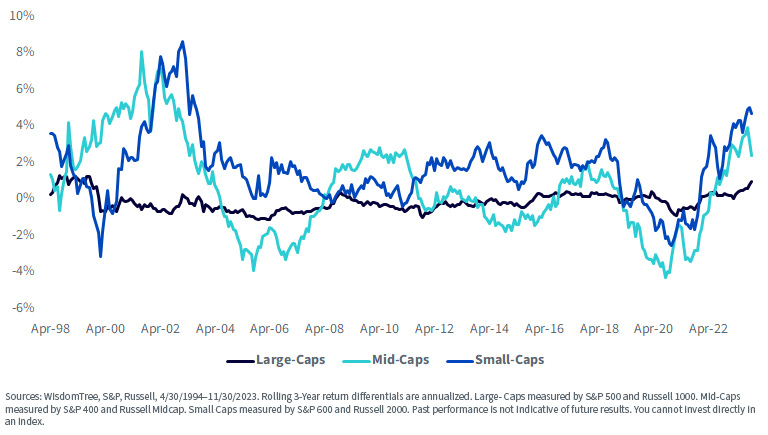

The darkish blue line of the large-cap indexes within the under chart hovers closest to a 0% return distinction. A market cap-weighted index of the five hundred shares from S&P or of the 1,000 largest shares from Russell largely mirror one another.

Nevertheless, shifting past the most important shares, the differentials amplify within the mid- and small-cap indexes, displaying return variations of over 8% in sure rolling three-year durations.

Return Differentials

Rolling 3-Yr Return Distinction: S&P vs. Russell Benchmarks

A significant driver in relative efficiency among the many small-cap benchmarks is the burden that unprofitable firms—that are typically excluded from preliminary inclusion into S&P indexes—account for in every universe.

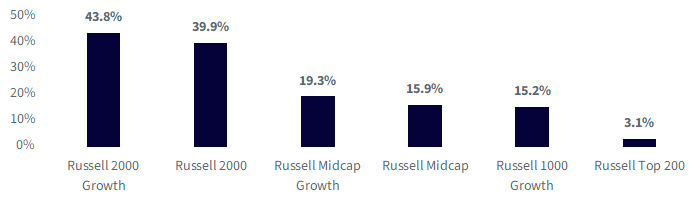

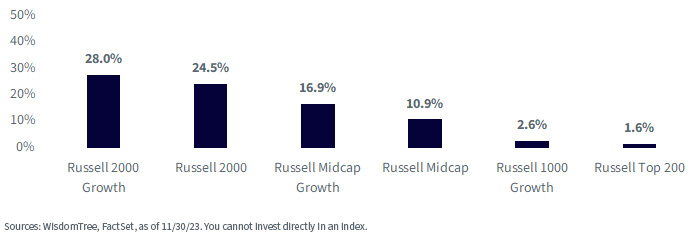

In mid- and small-cap indexes, significantly small-cap development indexes, unprofitable firms could make up over one-fourth of the burden of the index, and over 40% of the corporate rely.

Unprofitability throughout Indexes

Depend of Unprofitable Corporations

Weight of Unprofitable Corporations

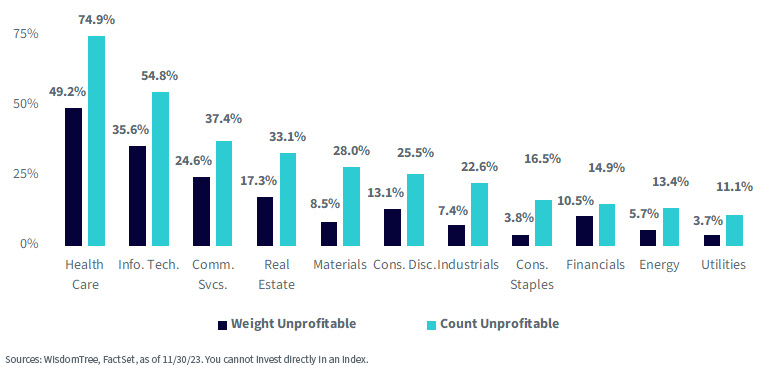

Basically, these unprofitable firms are discovered within the Well being Care and Info Expertise sectors; virtually 75% of mid- and small-cap Well being Care and 55% of Info Expertise firms are unprofitable.

Screening for quality (profitability) in a development universe, by design, leads to under-weights to those unprofitable firms.

Unprofitability throughout Sectors

Why High quality for Mid-Caps and Small Caps

Buyers are conversant in the usual worth, blend and development types.

Why high quality?

Many traders usually assume giant cap once they consider high quality.

Excessive-profitability small caps have outperformed high-profitability giant caps over the long term.

The efficiency unfold between high-profitability and low-profitability firms is even higher inside small caps than giant caps.

Cumulative Development of $100

WisdomTree U.S. MidCap and SmallCap High quality Development Indexes

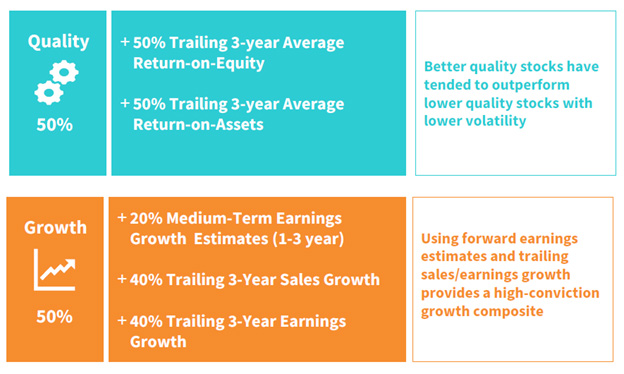

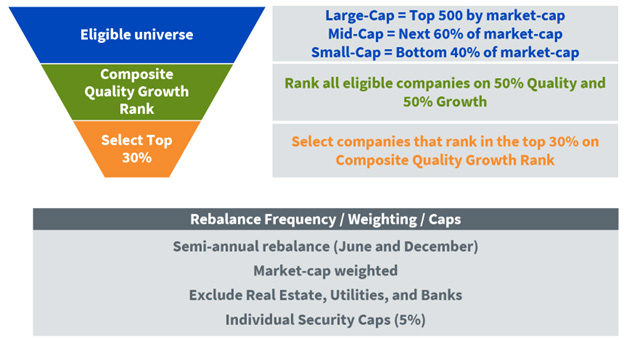

The WisdomTree U.S. MidCap and SmallCap Quality Development Indexes are market cap-weighted Indexes that encompass firms with high quality and development traits.

The Indexes are comprised of the highest 30% of firms with the very best composite scores. Actual Property, Utilities and Banks are excluded from the Indexes as a result of firms from these sectors are inclined to have decrease earnings development and/or excessive earnings volatility (decreasing earnings high quality).

Funding Course of

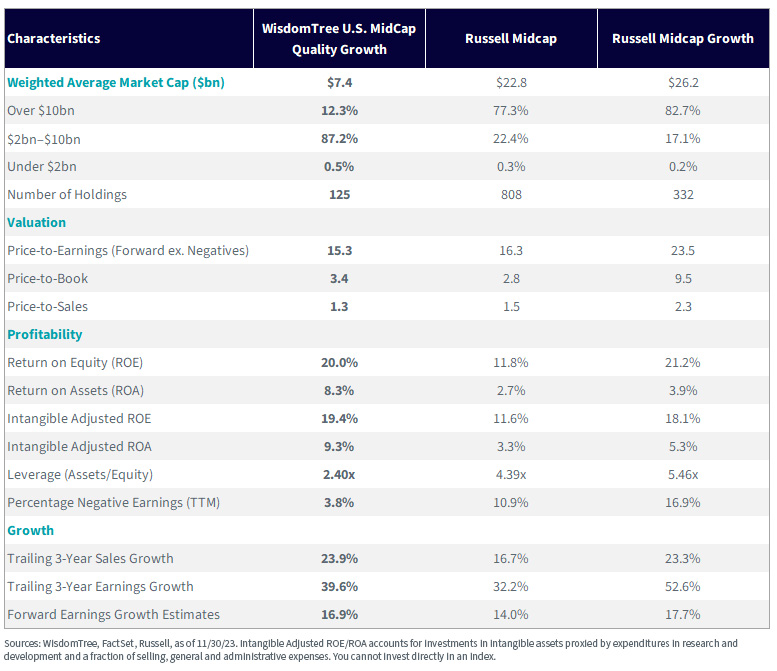

These Indexes are every narrower when it comes to variety of holdings than the corresponding Russell indexes, representing a better conviction high quality development basket that extra selectively weeds out “junkier” firms.

Every Index skews towards a smaller weighted common market cap than the Russell indexes, with the distinction extra pronounced within the mid-cap model, the place the Russell indexes have greater than one-quarter of their weight in firms with over $10 billion in market cap.

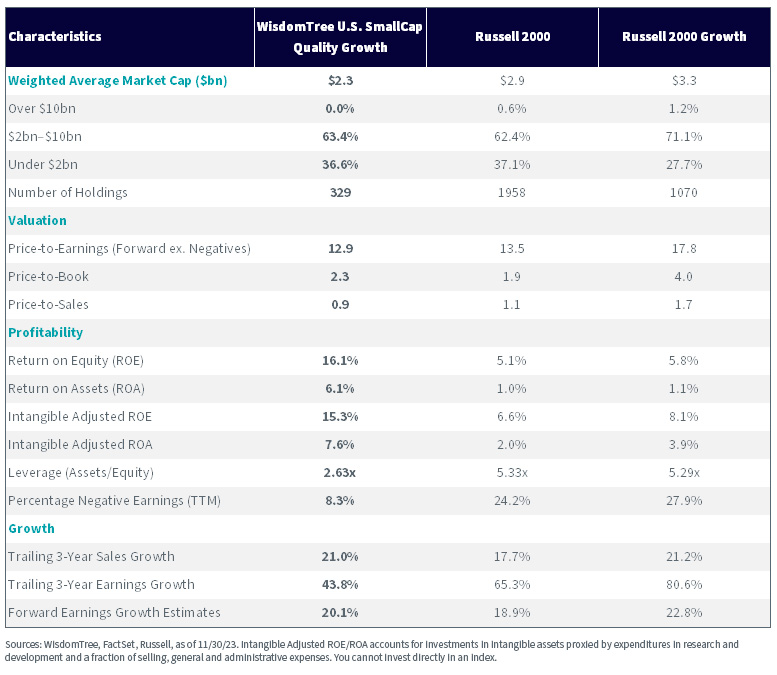

As every Index selects firms which can be each worthwhile and have increased development, we see constantly increased profitability metrics and customarily increased development metrics.

Index Traits

For definitions of phrases within the tables above please go to the glossary.

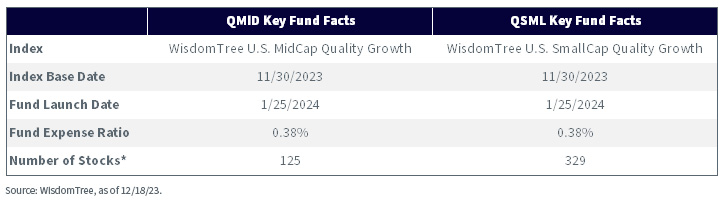

Introducing the WisdomTree U.S. MidCap Quality Growth Fund (QMID) and the WisdomTree U.S. SmallCap Quality Growth Fund (QSML)

The WisdomTree U.S. MidCap Quality Growth Fund (QMID) seeks to trace the value and yield efficiency, earlier than charges and bills, of the WisdomTree U.S. MidCap Quality Growth Index.

The WisdomTree U.S. SmallCap Quality Growth Fund (QSML) seeks to trace the value and yield efficiency, earlier than charges and bills, of the WisdomTree U.S. SmallCap Quality Growth Index.

- Acquire core publicity to U.S. mid- and small-market capitalization firms that show sturdy high quality and development traits

- Keep away from the mid- and small-cap “story shares” with low, or detrimental, profitability

Necessary Dangers Associated to this Article

QMID: There are dangers related to investing, together with the doable lack of principal. Development shares, as a bunch, could also be out of favor with the market and underperform worth shares or the general fairness market. Development shares are typically extra delicate to market actions than different kinds of shares. The Fund is non-diversified and, consequently, adjustments available in the market worth of a single safety might trigger higher fluctuations within the worth of Fund shares than would happen in a diversified fund. The Fund invests within the securities included in, or consultant of, its Index no matter their funding advantage. The Fund doesn’t try and outperform its Index or take defensive positions in declining markets and the Index could not carry out as meant. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

QSML: There are dangers related to investing, together with the doable lack of principal. Development shares, as a bunch, could also be out of favor with the market and underperform worth shares or the general fairness market. Development shares are typically extra delicate to market actions than different kinds of shares. Funds focusing their investments on sure sectors and/or smaller firms enhance their vulnerability to any single financial or regulatory improvement. This may increasingly lead to higher share worth volatility. The Fund is non-diversified and, consequently, adjustments available in the market worth of a single safety might trigger higher fluctuations within the worth of Fund shares than would happen in a diversified fund. The Fund invests within the securities included in, or consultant of, its Index no matter their funding advantage. The Fund doesn’t try and outperform its Index or take defensive positions in declining markets and the Index could not carry out as meant. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link