[ad_1]

Head of Fastened Revenue Technique

Final week, I wrote in regards to the money and bond markets apparently doubling down on their optimistic expectations for Fed fee cuts this 12 months. Nevertheless, an attention-grabbing growth occurred during the last week: Fed pushback. Now, this doesn’t imply the Fed just isn’t going to chop charges in 2024. It’s simply that the markets had apparently gotten too far forward of their expectations for the coverage maker’s liking. In opposition to this backdrop, traders ought to take into account how you can play this pivot in monetary policy.

Let’s first check out current developments. The chart under highlights how the market’s narrative for the timing of the primary fee minimize has lately modified. Lower than two weeks in the past, the March 2024 FOMC assembly was extensively seen because the timeline for that first minimize, with the chance coming in at nearly 77%. Submit-Fed feedback over the previous few buying and selling periods have pushed that chance right down to 46%, with the Might Fed assembly turning into the brand new frontrunner.

The implied chance for Fed Funds Futures has additionally scaled again fee minimize expectations, albeit simply barely. As of this writing, 5, relatively than six, cuts value a complete of about 125 basis points (bps) look like priced in for this calendar 12 months. In different phrases, the financial coverage pivot remains to be very a lot entrance and heart for the cash and bond markets. In reality, it will likely be attention-grabbing to see how fee minimize expectations play out as 2024 progresses. If upcoming financial/labor market and inflation knowledge proceed to disclose resiliency and gradual progress towards the Fed’s 2% threshold, it might appear cheap for the market to dial again its present outlook to align extra carefully with the Fed’s dot plot, which referred to as for 3 fee cuts this 12 months.

Efficiency knowledge for the latest quarter-end and month-end is offered here.

So, what’s a method traders can place themselves on this fee setting?

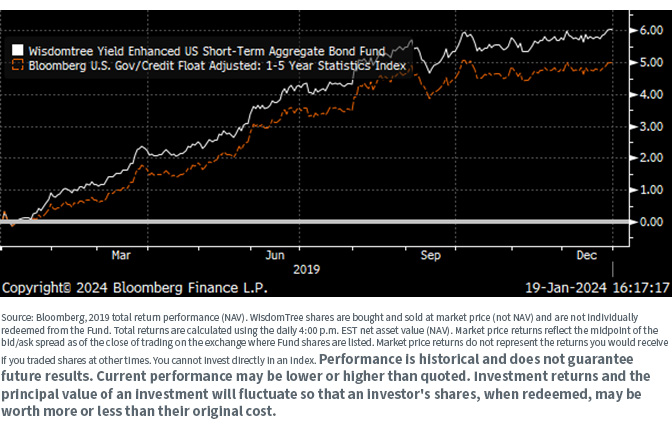

On Offense (Charge-Minimize Technique): WisdomTree Yield Enhanced U.S. Short-Term Aggregate Bond Fund (SHAG)

- Thus, Fed fee cuts and/or fee minimize expectations ought to present by way of right here extra immediately than intermediate/lengthy period.

Conclusion

Our major 2024 theme for fastened earnings is that traders have entered right into a New Rate Regime, reverting to the previous or regular one, the place zero rates of interest are a factor of the previous. It’s an surroundings {that a} technology of traders haven’t witnessed earlier than. And in contrast to 2022 and 2023, the present calendar 12 months brings with it the prospect of fee cuts, not fee hikes.

Essential Dangers Associated to this Article

There are dangers related to investing, together with potential lack of principal. Fastened earnings investments are topic to rate of interest danger; their worth will usually decline as rates of interest rise. Fastened earnings investments are additionally topic to credit score danger, the chance that the issuer of a bond will fail to pay curiosity and principal in a well timed method or that destructive perceptions of the issuer’s means to make such funds will trigger the value of that bond to say no. Investing in mortgage- and asset-backed securities includes rate of interest, credit score, valuation, extension and liquidity dangers and the chance that funds on the underlying belongings are delayed, pay as you go, subordinated or defaulted on. Because of the funding technique of the Fund, it could make larger capital acquire distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

[ad_2]

Source link