[ad_1]

One of the crucial essential market relationships in 2024 is the rising, constructive correlation between shares and bonds. A rising correlation between these two major asset courses has profound implications not only for complete portfolio diversification in multi-asset portfolios but in addition forward-looking bond yields.

Why Rising Correlations Results in Increased-for-Longer Yields over the Medium Time period

For a lot of the previous couple of a long time, bonds acted as a superb hedge to fairness threat. Dangerous information for the financial system, which may affect earnings, cash flows and infrequently trigger fairness costs to fall, was typically excellent news for bond costs, as rates of interest would usually decline.

Increased financial development, however, ought to result in larger interest rates. But when bonds act as a detrimental beta asset that hedges inventory threat, traders are prepared to pay a premium for that asset and settle for a decrease actual return in trade for the hedge high quality. That is like shopping for customary insurance coverage: we’re prepared to pay premiums for automotive or residence insurance coverage to guard from greater, extra catastrophic losses. Bonds traditionally served that position for fairness threat and traders had been paying for it by accepting decrease yields.

We are able to see this relationship fairly clearly within the common yields over the past 40 years. The next correlation between shares and bonds corresponded with a lot larger common yields, and the bottom yields occurred when bonds had most detrimental correlations.

The typical 10-Yr Treasury yield when correlation was constructive was 6.06% however when the correlation was detrimental, it was 300 basis points decrease.

However Inflation Threat Modified The whole lot

When inflation grew to become the first market concern within the post-pandemic atmosphere, correlations between shares and bonds skyrocketed. We consider this is without doubt one of the major components that can result in charges staying larger for longer.

The market now appears to be like like one commerce, and as bond worth declines/yield spikes turn into a major threat for fairness markets, traders ought to begin on the lookout for various portfolio diversifiers.

Curiously, the U.S. greenback has turn into a a lot better hedge over this era and exhibits the other sample, with correlations to the U.S. fairness markets turning into extra detrimental.

One other means of taking a look at it: a rising greenback is without doubt one of the key dangers to U.S. markets.

Is that this simply an historic accident obvious within the knowledge or is there one thing extra elementary driving this detrimental relationship?

There’s a actual earnings affect at play. Over 40% of income from the S&P 500 comes from abroad. The revenue proportion from worldwide enterprise just isn’t a required disclosure or often reported in firm reviews, however our sense is that the revenue affect is even higher from abroad enterprise than from home revenues, as revenue margins are sometimes larger in world jurisdictions.

A few of our work on long-term earnings growth confirmed a lot of the earnings development within the S&P 500 over the past 50 years occurred when the greenback was declining—and when the greenback was rising, the typical earnings development was a lot decrease.

Diversification from {Dollars}

Some consider a major cause to speculate overseas is as a result of you will get a simple method to fund international foreign money publicity on high of your worldwide inventory publicity.

I’ve lengthy argued that being currency-hedged helps you neutralize your trade charge threat and that within the developed world, you additionally get the advantage of relative rate of interest differentials between the U.S. and international markets on high of the native fairness market return.

As a result of the U.S. has considerably larger rates of interest than Japan (which nonetheless has detrimental charges) you’re paid between 5% and 6% to hedge yen publicity. U.S. traders who’re hedged can earn 5% greater than an area Japanese investor.

For a broad worldwide basket, the mixture internet rates of interest you’re paid to hedge at the moment is about 2.5%.

When you begin with a baseline publicity of unhedged ETFs—which have each inventory and weak foreign money beta already embedded—switching to a hedged ETF could be considered as including a U.S. greenback hedge on high of your prior portfolio.

And our view is {that a} robust U.S. greenback overlay contrasts with the prior portfolio as a result of hedging your foreign money publicity will decrease total portfolio threat ranges.

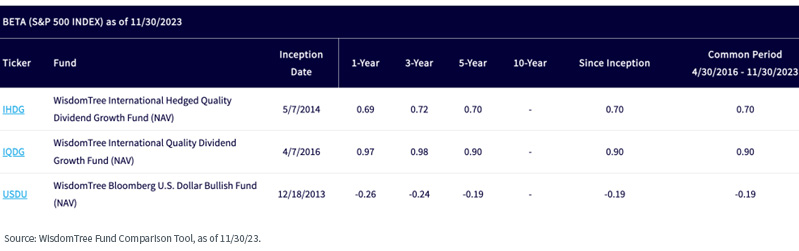

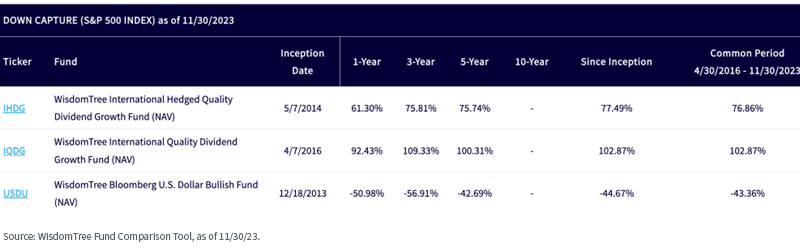

You possibly can see this by evaluating the betas of a fully-hedged worldwide high quality basket, an unhedged model of the identical shares and a robust greenback fund—all with betas in respect to S&P 500. For illustrative functions, we’ll use the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), the WisdomTree International Quality Dividend Growth Fund (IQDG) and the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) because the respective proxies.

During the last 5 years, the robust greenback Fund had a detrimental beta, and the worldwide hedged fairness basket (IHDG), which is successfully including lengthy greenback publicity on high of an unhedged place, had a beta that may be very near the addition of the U.S. greenback Fund (USDU) to the unhedged worldwide fairness ETF (IQDG).

This was notably true on the draw back, the place the U.S. greenback had a detrimental downside capture (it went up), whereas the draw back seize of the hedged technique was significantly improved in comparison with the unhedged ETFs.

Many are hesitant to make a name on the greenback’s path. However the correlation dynamics introduced right here—with bond diversification falling and U.S. greenback diversification to U.S. fairness threat newly rising—argue that currency-hedged ETFs ought to have a long-term position in portfolio allocations, much less for tactical views on foreign money instructions and extra for decreasing total threat ranges.

Necessary Dangers Associated to this Article

IHDG/IQDG: There are dangers related to investing, together with the doable lack of principal. International investing entails particular dangers, reminiscent of threat of loss from foreign money fluctuation or political or financial uncertainty. To the extent the Fund invests a good portion of its belongings within the securities of corporations of a single nation or area, it’s more likely to be impacted by the occasions or circumstances affecting that nation or area. Dividends aren’t assured and an organization at present paying dividends could stop paying dividends at any time. Investments in foreign money contain extra particular dangers, reminiscent of credit score threat and rate of interest fluctuations. Spinoff investments could be risky and these investments could also be much less liquid than different securities, and extra delicate to the impact of various financial circumstances. As this Fund can have a excessive focus in some issuers, the Fund could be adversely impacted by adjustments affecting these issuers. The Fund invests within the securities included in, or consultant of, its Index no matter their funding benefit and the Fund doesn’t try and outperform its Index or take defensive positions in declining markets. Because of the funding technique of this Fund it might make larger capital acquire distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

USDU: There are dangers related to investing, together with the doable lack of principal. International investing entails particular dangers, reminiscent of threat of loss from foreign money fluctuation or political or financial uncertainty. The Fund focuses its investments in particular areas or nations, thereby rising the affect of occasions and developments related to the area or nation, which may adversely have an effect on efficiency. Investments in rising, offshore or frontier markets are typically much less liquid and fewer environment friendly than developed markets and are topic to extra dangers, reminiscent of dangers of opposed governmental regulation and intervention or political developments.

Investments in foreign money contain extra particular dangers, reminiscent of credit score threat and rate of interest fluctuations. Spinoff investments could be risky and these investments could also be much less liquid than different securities, and extra delicate to the impact of various financial circumstances. Whereas the Fund makes an attempt to restrict credit score and counterparty publicity, the worth of an funding within the Fund could change shortly and with out warning in response to issuer or counterparty defaults and adjustments within the credit score scores of the Fund’s portfolio investments. The Fund’s funding in repurchase agreements could also be topic to market and credit score threat with respect to the collateral securing the repurchase agreements and will decline previous to the expiration of the repurchase settlement time period. As this Fund can have a excessive focus in some issuers, the Fund could be adversely impacted by adjustments affecting such issuers. Not like typical exchange-traded Funds, there are not any indexes that the Fund makes an attempt to trace or replicate. Thus, the flexibility of the Fund to attain its goals will depend upon the effectiveness of the portfolio. Because of the funding technique of the Fund, it might make larger capital acquire distributions than different ETFs. Though the Fund invests in very short-term, funding grade devices, the Fund just isn’t a “cash market” Fund, and it isn’t the target of the Fund to take care of a continuing share worth. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link