[ad_1]

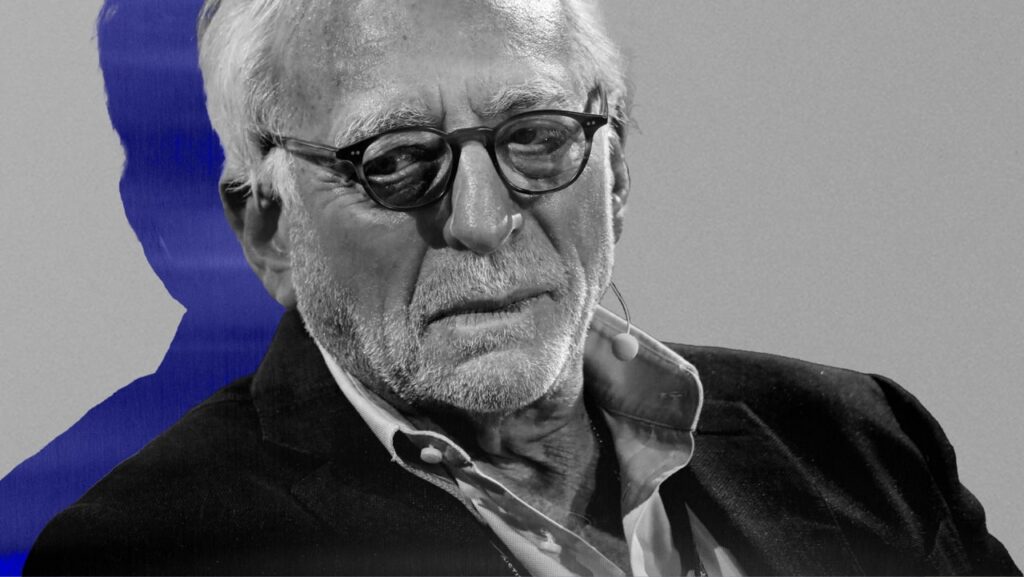

The return of Bob Iger to the function of CEO at Disney was one which each followers and buyers initially cheered. Since that point, although, the inventory has been, at finest, flat—and activist investor and Trian Fund Administration founder Nelson Peltz is just not glad about that.

Peltz has been a thorn in Iger’s facet for a while, first threatening a proxy combat in January of 2023. He known as off that battle the next month, however by October he was threatening one once more. Now, it seems, the warfare is about to start after Disney declined to endorse Peltz’s makes an attempt to affix its board of administrators.

Peltz has launched an internet site, RestoreTheMagic.com, and plans to make use of posts on X (previously Twitter), to make his case to shareholders. (Along with himself, Peltz can be pushing for former Disney chief monetary officer Jay Rasulo to affix the board.)

Proxy fights generally is a bit complicated for those who don’t observe an organization carefully. Right here’s what it is advisable to find out about this one.

What’s a proxy combat?

Proxy fights happen when one group (often shareholders) makes an attempt to strain an organization’s administration or board of administrators to vary. That change might be something from company coverage to management to monetary management of an organization. They’re often began when shareholder(s) really feel their points or complaints aren’t being addressed, which leads them to try to affect a bigger group of shareholders to vote for change on the annual assembly.

Why is Peltz launching a proxy combat towards Disney?

Finally, as you would possibly suspect, it’s about cash. Peltz, in a proxy filing with the Securities and Exchange Commission (SEC), mentioned he isn’t pleased with Disney’s stock performance of late, and he desires a transparent succession plan in place for Iger, who has mentioned he plans to retire in 2026. He’s additionally trying to reduce prices, alter government compensation ranges (tying them to the corporate’s efficiency), and produce again the inventory dividend—and is pushing Disney to be extra clear about its companies.

A little bit over a yr in the past, Peltz made one other try to get on the board of administrators, however relented after Disney unveiled plans to chop $5.5 billion in prices, which led to 7,000 layoffs and modifications to the streaming service. (Iger has since raised the cost cutting target to $7.5 billion.)

Peltz, although, isn’t pleased with the state of issues.

“The corporate is underperforming,” he said on CNBC Thursday. “I made a run at them final yr. They promised they have been going to enhance issues. I took them at their phrase. Issues acquired worse, the inventory went down, outcomes acquired worse. Okay, so no extra. I can’t proceed to offer them extra alternatives.”

Who’s Jay Rasulo?

Rasulo, whom Peltz can be attempting to put in on the Disney board, was as soon as thought-about a doable inheritor to Iger, earlier than Bob Chapek was chosen. He spent three many years at Disney in numerous roles, together with president of parks and resorts, chairman of parks and resorts worldwide, and CFO.

“The Disney I do know and love has misplaced its means,” Rasulo said in a statement final December.

How has Disney responded to Nelson Peltz?

Disney has been political in a lot of its previous statements about Peltz, however when it got here to denying him a board seat, it didn’t mince phrases. “In deciding to not advocate Mr. Peltz, the administrators thought-about numerous elements, together with that in a two-year quest for a seat on the Disney Board, Mr. Peltz had not really offered a single strategic thought for Disney; that his evaluation of Disney appeared oblivious to the continuing secular change within the media trade; that Mr. Peltz’s expertise was primarily in commodity shopper packaged items companies and never the media or expertise sector, that Mr. Peltz had no expertise in a enterprise that’s primarily pushed by artistic expertise and targeted on delivering uniquely memorable buyer experiences; . . . [and that] created important concern relating to how that partnership would impression Mr. Peltz’s agenda as a director,” Disney’s proxy read.

Other than the aforementioned cost-cutting, Disney has additionally employed former Pepsi chief monetary officer Hugh Johnston as CFO. (Johnston helped Pepsi keep away from a proxy combat with Peltz in 2013.)

Can Peltz win his proxy combat with Disney?

You by no means need to rely Peltz out of a combat, however he’s going through an uphill battle. Most proxy fights are unsuccessful. And Iger has solely been on the job (once more) for a little bit over a yr, which shareholders could really feel is an inadequate period of time wherein to show issues round.

Peltz, although, has till the spring to attempt to change shareholder minds—and will definitely level to movies which have underperformed (like Wish) and the inventory worth. The date of the 2024 shareholders assembly has not but been introduced.

[ad_2]

Source link