[ad_1]

Head of Quantitative Analysis & Multi Asset Options at WisdomTree in Europe

With the tip of every yr comes long-awaited traditions such because the Thanksgiving turkey, Saint Nicholas, Christmas bushes, Hanukkah’s menorah or the New Yr’s fireworks. For traders, certainly one of these traditions are fairness forecasts for the next yr. Not too long ago, as I used to be studying predictions for 2024, I began to marvel how correct final yr’s predictions had been.

Predicting Brief-Time period Strikes within the Market Is a Idiot’s Errand

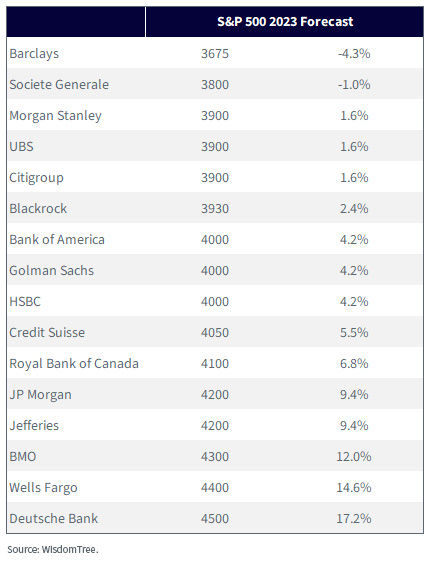

In determine 1, I compiled predictions from 16 forecasts printed on the finish of 2022 by totally different banks and asset managers throughout the spectrum. As a reminder, the S&P 500 gained 24.2% over the total yr in 2023. The outcomes are telling:

- The dispersion is huge, with a 21% unfold between essentially the most pessimistic and essentially the most optimistic, with every little thing in-between.

- Even so, not one knowledgeable obtained it even near proper. Some predictions ended up 28% off.

Determine 1: What Consultants Predicted for the S&P 500 in 2023

So, what ought to we conclude from this? I believe we must always acknowledge that in relation to short-term strikes in markets, “No one is aware of something” and profitable traders are long-term traders who purpose to harness the fairness threat premium over the long run by time-proven, constant methods. Within the phrases of Kenneth Fisher, “Time available in the market beats timing the market.”

Investing for the Lengthy-Time period: Core Methods Anchored in Academically Confirmed Risk Premiums

Lecturers have demonstrated again and again that systematically investing in issue portfolios would have outperformed the market over the long run. Investing in high-dividend shares, high-quality shares or low-cost shares in a scientific method provides traders one of many keys to doubtlessly outperforming the market. It’s value noting that educational analysis has proven that the anticipated outperformance yielded by such approaches has not meaningfully decreased over time, regardless of markets changing into extra environment friendly.

WisdomTree Quality Dividend Growth strategies are an excellent instance of how utilizing this decades-long analysis will help outperform the market and develop traders’ wealth over the long run. One of many causes for these methods’ success is that the funding course of is rooted in educational literature and focuses on a scientific collection of a diversified basket of extremely worthwhile corporations with strong dividend-paying credentials, leaning closely into the standard and excessive dividend components.

WisdomTree High quality Dividend Progress: We Imagine A Core Fairness Technique with a Observe File to Beat the Market over the Lengthy Time period and throughout Areas

Our portfolios are constructed round dividend-paying corporations with the best-combined rank of earnings development, return on equity and return on assets inside a universe of corporations with sustainable dividend insurance policies. Shares are additionally risk-tested utilizing a proprietary threat display screen (Composite Risk Score), which makes use of high quality and momentum metrics to rank corporations and display screen out the riskiest corporations and potential worth traps. Every firm is then weighted primarily based on its money dividend paid (market capitalization x dividend yield), which introduces valuation self-discipline on this high-quality portfolio.

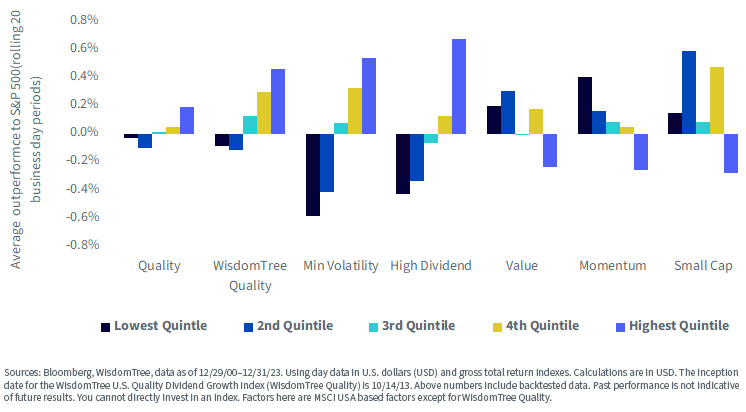

Determine 2 illustrates the historic common relative efficiency of various world fairness components relying on volatility regimes. We observe that some components, like min volatility, are essentially defensive. They traditionally outperform rather a lot when volatility is excessive (and normally markets are down) however they wrestle and underperform considerably in bull markets when volatility is low. Quite the opposite, some components, like small caps, are very cyclical. They do nicely in durations of low volatility however exhibit deeper drawdowns in high-volatility markets, which take a very long time to recuperate from.

Determine 2: Common Relative Efficiency of Totally different International Fairness Components Relying on Volatility Regimes

WisdomTree’s method to high quality, although, seeks to supply a really balanced combine with robust outperformance in high-volatility markets, serving to to cut back drawdowns and time to restoration but additionally some outperformance in different volatility regimes. This mixture is what we name “all-weather.” Such a technique can be utilized as a strategic holding to place time available in the market because it captures many of the upside whereas providing threat mitigation on the draw back.

Key Takeaways

Trying ahead to 2024, S&P 500 predictions stay extremely various from 4,200 (-12%) by JP Morgan to five,100 (+7%) from Deutsche Financial institution. Uncertainty within the markets additionally stays at a really excessive degree. U.S. financial coverage stays extraordinarily unstable and round half the world inhabitants will vote in 2024, together with the U.S. in November. General, and as all the time, we consider like core, resilient fairness investments that don’t depend on realizing the long run needs to be traders’ greatest associates. Investing in high quality and excessive dividend might proceed to be the very best reply for long-term minded traders.

Pierre Debru is an worker of WisdomTree UK Restricted, a European subsidiary of WisdomTree Asset Administration Inc.’s dad or mum firm, WisdomTree, Inc.

[ad_2]

Source link