[ad_1]

On this episode, I interview Ben Miller, the CEO of Fundrise, discussing his revised perspective on the true property marketplace for 2024 and past. The yr 2023 posed challenges for institutional actual property traders, marked by 11 price hikes and a big surge in mortgage charges because the first quarter of 2022.

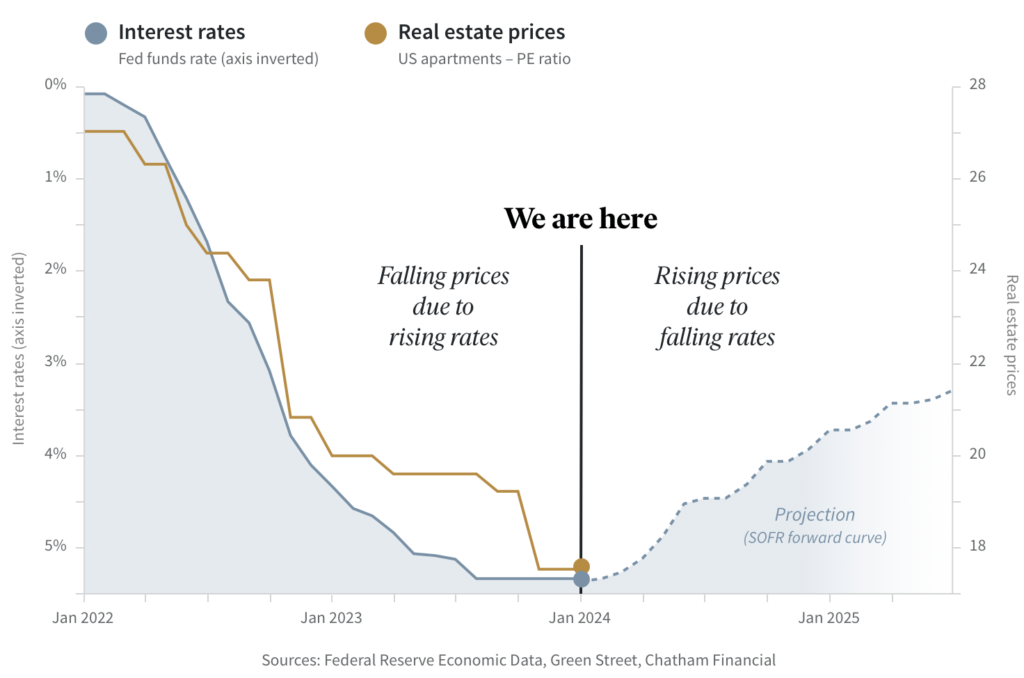

Ben believes October 2023 represented the low level for the true property market after experiencing 18 months of steady decline. His present optimism stems from an anticipated lower in rates of interest.

The next chart supplies a concise abstract of his viewpoint and outlook.

On this actual property market episode, we discover a number of key matters:

- The reasoning behind Ben’s perception that October 2023 marked the underside, and the much less apparent indicators supporting this angle.

- The motivation behind promoting throughout this era, simply after reaching the presumed backside.

- The potential for utilizing one fund’s money to help a deal wherein one other fund is investing.

- Ben’s insights on investing in workplace properties at important reductions.

- Drawing parallels between e-commerce and the work-from-home pattern, highlighting the potential everlasting improve within the worth of residential properties.

- Emphasizing the significance of investing in alignment with macroeconomic tailwinds, not headwinds.

- Discussing the anticipated share upside in institutional actual property costs for 2024.

- Exploring the methodology for calculating the Internet Asset Worth (NAV) of particular properties throughout the fund.

- Recognizing the non-linear nature of great modifications and the significance of staying invested to profit from excessive catalyst moments.

- Reflecting on Ray Dalio’s perspective – “I might quite be roughly proper than exactly fallacious” – particularly within the context of predicting year-end rates of interest.

- Contemplating the perspective {that a} recession is likely to be bullish for actual property as a result of potential fast and intensive decline in rates of interest.

You’ll be able to hearken to the episode on Apple, Spotify, or Google. Or you may click on the embedded participant beneath.

If you wish to dollar-cost-average right into a Fundrise fund, you are able to do so by clicking here. The funding minimal is $10. Monetary Samurai is an investor in Fundrise and Fundrise is a long-time sponsor of Monetary Samurai.

[ad_2]

Source link