[ad_1]

In the event you’re indignant about adjustments to your Delta SkyMiles account or different frequent flyer program, you’re not alone. And now the Biden administration is on the case. The U.S. Division of Transportation (DOT) is within the means of assembly with U.S. airways and plans to “fastidiously overview” complaints concerning airline loyalty packages, as Reuters first reported. If warranted, the DOT vows to analyze “unfair and misleading practices,” an company spokesperson tells Quick Firm.

The crackdown—or, maybe extra precisely, potential crackdown—on these profitable packages coincides with steps quite a few airways have taken to revamp their packages lately, with many altering how members earn and redeem miles and qualify for elite standing. Recognized for years as a software to draw and reward frequent flyers, the packages more and more double in the present day as platforms that reward spending on airline-affiliated bank cards.

Among the many extra high-profile situations, Delta Air Traces drew the ire of customers final September when it introduced sweeping adjustments to its SkyMiles loyalty program, tying elite-status qualification to {dollars} spent and limiting airport lounge entry that had beforehand been obtainable to many Delta bank card holders.

Delta, which later relaxed some of the changes within the face of backlash, cited overcrowded lounges and packed elite-status ranks as a driving pressure for the adjustments—to not point out altering shopper preferences that, it says, warrants rewarding buyer loyalty in additional methods.

And the Atlanta-based service isn’t alone.

A altering loyalty panorama

Quite a few airline loyalty packages have undergone adjustments lately. Many carriers now weigh {dollars} spent extra closely than miles flown in awarding frequent flyer miles or figuring out who qualifies as “elite.”

The pattern largely upends a previous phenomenon that might see a passenger who scored a $150 cross-country flight earn the identical variety of miles as their seat neighbor who paid $500.

Today, the important thing to incomes extra rewards is, typically, to spend more cash. On the similar time, many carriers have additionally upped the variety of miles required for a flight redemption. At this time, as an alternative of mounted, predictable mileage charges, customers hoping to redeem miles typically discover costs that fluctuate the identical manner that money fares do.

All of the whereas, airline loyalty packages have grown dramatically—each when it comes to their membership and their pool of credit score card-carrying clients that earn miles each time they swipe at a restaurant or grocery retailer.

It’s given clients extra methods to earn miles for a future redemption. It’s additionally pushed immense worth in airways’ loyalty packages.

In a 2021 federal submitting, American Airways revealed a valuation for its AAdvantage program at between $19.5 billion and $31.5 billion. Delta final month reported it was on monitor to earn some $7 billion from its partnership with American Specific—triple its earnings from a decade in the past.

“I don’t know of a industrial partnership on that scale within the nation that has that degree of energy,” Delta CEO Ed Bastian marveled throughout December feedback on the Morgan Stanley World Shopper and Retail Convention.

Final summer season, Delta reported it had 25 million energetic SkyMiles members engaged with this system over the previous 12 months. Practically a 3rd of these members have a Delta-Amex bank card.

Scrutiny of frequent flyer packages

The DOT’s revelation that it’s trying into airline loyalty packages got here simply months after two bipartisan U.S. senators penned a letter urging the division—together with the Shopper Monetary Safety Bureau (CFPB)—to do exactly that.

Within the October 30 memo, senators Dick Durbin (D-IL) and Roger Marshall (R-KS) criticized airline loyalty packages’ “unilateral” contracts that enable carriers to vary program phrases at any time.

“These packages incentivize customers to buy items and providers, acquire bank cards, and spend on these bank cards in alternate for promised rewards—all whereas retaining the facility to strip customers of these rewards at any second,” Durbin and Marshall collectively wrote.

Airways for America, a commerce group for the most important U.S. carriers, didn’t provide a remark for this story.

That the lawmakers caught the ear of the Biden administration, although, might not be fully shocking, given its scrutinous method to airways lately.

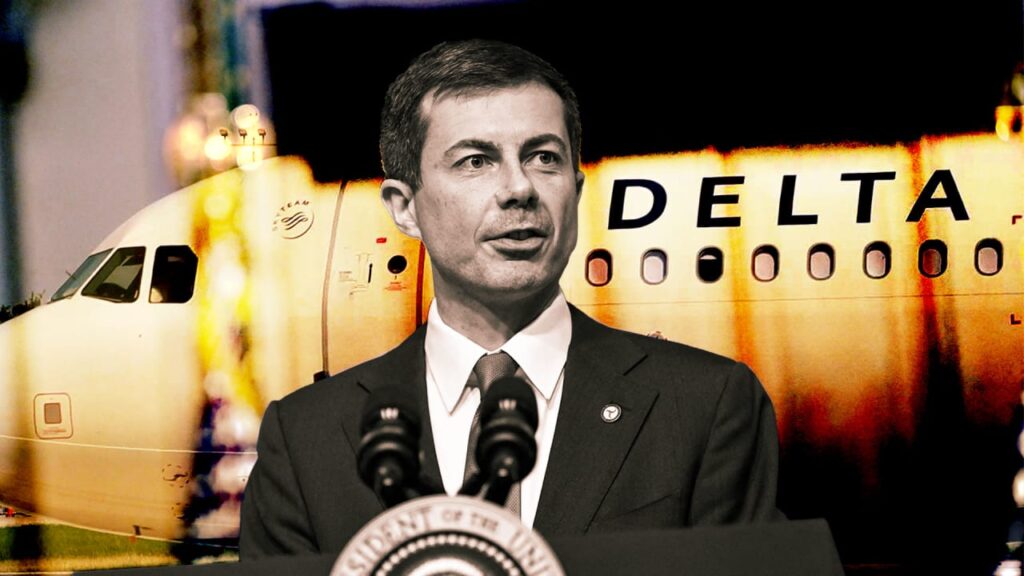

Underneath Transportation Secretary Pete Buttigieg, the DOT has utilized sustained public strain on airways over every thing from refunds and delayed compensation to household seating insurance policies—significantly within the wake of the spate of 2022 airline meltdowns.

The DOT just lately penalized Southwest Airways an unprecedented $140 million for its vacation 2022 meltdown.

In court docket, the Division of Justice (DOJ) efficiently argued final 12 months towards a partnership between American and JetBlue on antitrust grounds, and at the moment awaits a ruling on its problem of JetBlue and Spirit Airways’ proposed merger.

Skepticism of airline frequent flyer packages dates again even additional—many years, actually, argues Rob Britton, a longtime airline govt and trade professional on the college at Georgetown College’s McDonough Faculty of Enterprise.

“Politicians and numerous administrations have been chasing after airways and their frequent flyer packages nearly since their inception,” Britton says. “This entire query of whether or not airways have a authorized capability to vary their program has been settled for 30 years. And the reply is, sure, they’ll, offered that they supply [a] disclosure that’s now fairly routine.”

In actual fact, you don’t must look arduous to seek out such disclosures.

The terms for American’s AAdvantage program, for one, cautions members that the airline has the best to terminate, change or amend the phrases, in entire or partly, at any time (different airways have comparable phrases).

Will frequent flyer packages face new regulatory challenges?

The CFPB wouldn’t touch upon the latest dialogue in Washington. However, in an e-mail to Quick Firm, a spokesperson emphasised that banks utilizing rewards, factors and miles to entice customers to their bank cards “are anticipated to uphold their advertising and marketing presents.”

“The CFPB is trying intently at whether or not bank card issuers are following by means of on these guarantees,” the company mentioned in a press release that didn’t particularly point out airways.

For his half, Britton is skeptical that main federal motion could possibly be on the horizon.

“If we have a look at historical past,” he predicts, “I think there might be a whole lot of dramatic press releases, and lots of people flailing up on Capitol Hill, and it’ll quietly go away.”

[ad_2]

Source link