[ad_1]

India confronted international headwinds in 2023 of excessive international inflation, rising interest rates and unstable geopolitics and shined as one of many best-performing markets globally. The Sensex and Nifty, two extensively adopted benchmarks for the Indian markets, grew 19.57% and 21.11%, respectively, in USD phrases.

India’s financial system displayed robust native retail demand, average inflation, secure rates of interest and wholesome international alternate reserves. India additionally loved comparatively wholesome relations with most main economies of the world and cautiously navigated the geopolitical conflicts.

As we glance forward in 2024, we stay assured in our outlook for India as a long-term story, one that might final for years if not many years to return. Nationwide elections are attributable to be held round Could 2024. Present prime minister Narendra Modi is looking for a historic third time period, and we see it as extremely possible the ruling occasion, BJP, will win with a full majority just like the earlier two occasions.

India has benefited from Modi’s pro-business and pro-growth insurance policies, and a secure political atmosphere additional boosts prospects to understand speedy development. We analyzed the efficiency of BSE Sensex, one of many extensively adopted benchmarks of the Indian inventory market, pre and put up elections.

On a median, the Indian markets displayed optimistic efficiency delivering over 31% returns over the yr main as much as, mixed with the yr after election outcomes. That is regardless of the worldwide monetary disaster of 2008, and the COVID-19 drawdown negatively impacting the efficiency resulting in 2009 elections, and after the 2019 elections respectively. We count on this development to proceed with the possible return of the incumbent authorities.

After all, ought to Modi surprisingly lose, among the current beneficial properties would possibly reverse. That appears extremely unlikely, given the state of opposition, as a number of political events, together with some with fully unaligned agendas, have joined arms to forestall a 3rd Modi time period. This was evident over the 5 current elections through which the BJP gained by an enormous majority in three of the biggest states with the best proportion of Lok Sabha (nationwide election) constituencies.

Different vital elements that buyers would possibly need to hold a watch out for in the course of the yr:

1. Price cuts: The Fed’s tempo and timing on rate cuts will influence international markets, and India is not any exception. The faster and better the cuts, the extra capital anticipated to be diverted towards equities, and with a powerful momentum from the earlier yr, India is perhaps one of many high picks within the emerging markets.

2. Crude oil costs: The Indian financial system closely depends upon the import of crude oil. The upper the crude oil costs, the extra stress on India’s international present accounts. Drops in crude oil might assist India’s financial system develop quicker and permit extra room for spending on development and infrastructure. India can be concurrently working to cut back dependency on crude oil by diversifying into ethanol. Over the previous few years, ethanol manufacturing has elevated manifold, and there’s a rising push to extend the utilization of ethanol-blended gasoline to energy automobiles. This might doubtlessly save the nation much-needed money and assist direct it to gasoline financial development and scale back fiscal deficits.

3. China decoupling: India has emerged as probably the most credible contenders to assist diversify manufacturing out of China. Some examples: Apple established a substantial footprint and plans to scale up operations multi-fold, vital investments and subsidies had been launched to draw semiconductor firms from Taiwan, and there are additionally recommendations Tesla is trying to enter India with a US$2 billion funding in a producing facility based mostly within the state of Gujrat.

One of the iconic insurance policies of the present authorities during the last decade has been “Make in India.” The federal government can be pushing laborious to draw extra firms to arrange manufacturing vegetation in India and leverage the success of “Make in India” amongst voters

4. Geopolitical instability: India has been comparatively much less impacted by geopolitical conflicts across the globe. India maintained its impartial stance and efficiently managed to face agency regardless of stress from the West by importing discounted oil from Russia to make sure its power safety whereas on the similar time pitching itself as a better ally to the U.S. to counter the rising China menace.

5. Retail flows: Lately, India witnessed rising participation of retail buyers within the inventory market. There are 80 million distinctive buyers within the Indian inventory markets that make investments via the NSE. Furthermore, the dimensions of mutual fund AUM is at the moment round 24% in comparison with 11% a decade in the past. The robust retail presence helps add stability to the Indian markets within the occasion of world instability and international institutional investor (FII) outflows.

Conclusion

As now we have highlighted repeatedly, we imagine that India is a multi-decade story, and we’re within the very early phases of it. This isn’t to say that buyers ought to count on a clean trip. As with all main fairness markets, the trip is perhaps bumpy however might include vital upside potential for buyers over the long run.

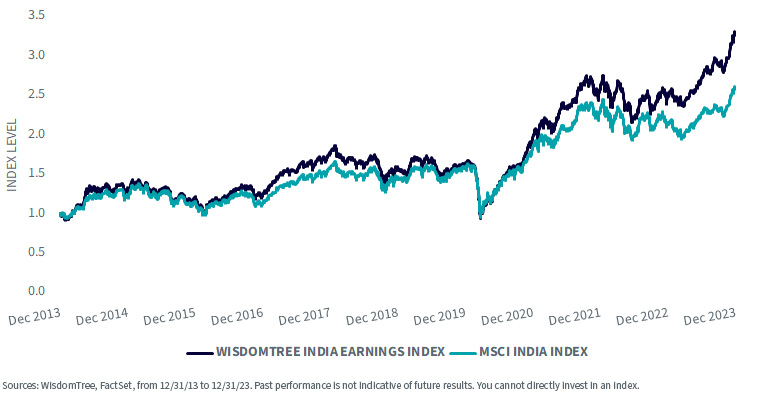

MSCI India outperformed MSCI EM and MSCI China by vital margins during the last 10 years, and we count on the development to proceed. The query then arises, if India could possibly be accessed in a greater approach, might that assist keep away from valuation traps and ship higher efficiency than the market cap-weighted index? We imagine that the WisdomTree India Earnings Fund (EPI), with its broad market and earnings weighting strategy, does simply that and has a confirmed monitor report as one of many earliest India funds (learn extra here).

MSCI India vs. MSCI China & MSCI EM

WisdomTree India Earnings Index vs. MSCI India Index

For the WisdomTree India Earnings Fund’s most up-to-date month-end and standardized efficiency, click on here.

Essential Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. Overseas investing entails particular dangers, comparable to danger of loss from foreign money fluctuation or political or financial uncertainty. This Fund focuses its investments in India, thereby rising the influence of occasions and developments related to the area, which might adversely have an effect on efficiency. Investments in rising, offshore or frontier markets comparable to India are usually much less liquid and fewer environment friendly than investments in developed markets and are topic to further dangers, comparable to dangers of opposed governmental regulation and intervention or political developments. As this Fund has a excessive focus in some sectors, the Fund may be adversely affected by adjustments in these sectors. Because of the funding technique of this Fund, it could make increased capital acquire distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

[ad_2]

Source link