[ad_1]

It’s been simply over a yr because the launch of the WisdomTree U.S. Quality Growth Fund (QGRW) in December 2022.

This yr’s efficiency offered compelling proof that trying underneath the hood on the nuances of index building issues.

2023 Efficiency

The WisdomTree U.S. Quality Growth Fund seeks to trace the worth and yield efficiency, earlier than charges and bills, of the WisdomTree U.S. Quality Growth Index (WTQGRW).

The Index was designed to determine shares which have traits of each excessive profitability and excessive progress.

Our analysis into historic returns recommended that investing merely in high-growth shares is usually a shedding recreation over the long term. We consider traders ought to as a substitute contemplate investing in high-quality progress shares.

The U.S. fairness market in 2023 was led by these high-quality progress shares, as evidenced by the outperformance of QGRW relative to different measures of progress and high quality.

2023 Whole Returns

For the newest month-end and standardized efficiency and to obtain the respective Fund prospectuses, click on here.

For definitions of indices within the chart above, please go to the glossary.

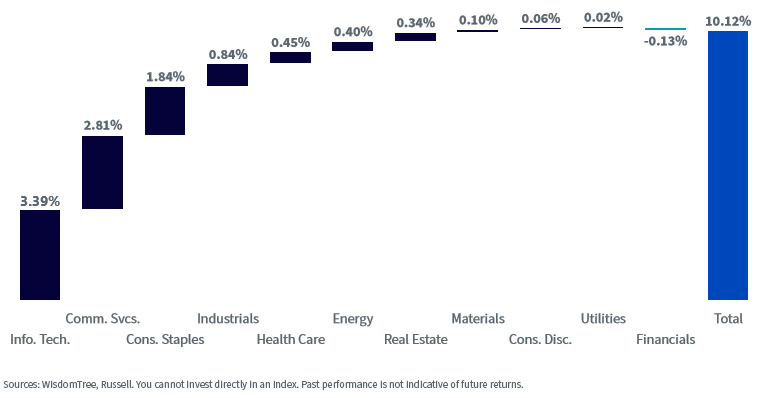

The WisdomTree U.S. High quality Progress Index outperformed the Russell 1000 Growth Index by greater than 1,000 basis points.

Although greater than half of the outperformance was attributed to the tech-focused Data Know-how and Communication Companies sectors, the Index had constructive attribution from 10 of 11 sectors.

2023 Index Attribution: WisdomTree U.S. High quality Progress vs. Russell 1000 Progress

Semi-Annual Index Rebalance

The Index rebalances every June and December. The universe of eligible securities is ranked on high quality and progress elements individually, with the 100 highest-scoring securities chosen.

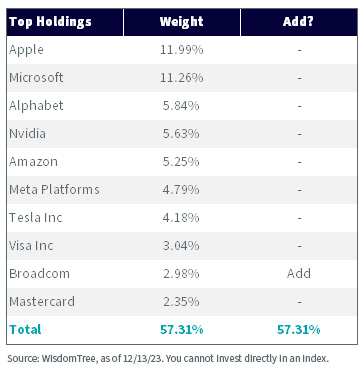

At this December’s rebalance, the one modifications to the highest 10 holdings had been the addition of Broadcom at a roughly 3% weight, offset by the drop of UnitedHealth Group, which had held a 3.3% weight.

The remaining 9 holdings had been unchanged from the rebalance.

WisdomTree U.S. High quality Progress Index Prime 10 Holdings

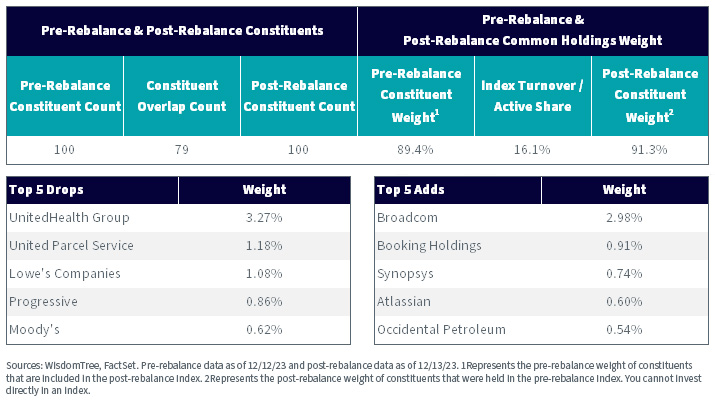

Of the 100 securities held within the pre-rebalance Index, 79 had been maintained, and 21 had been dropped/added. The cumulative impression on one-way Index turnover was 16%.

Holdings Overlap and Turnover for the WisdomTree U.S. High quality Progress Index

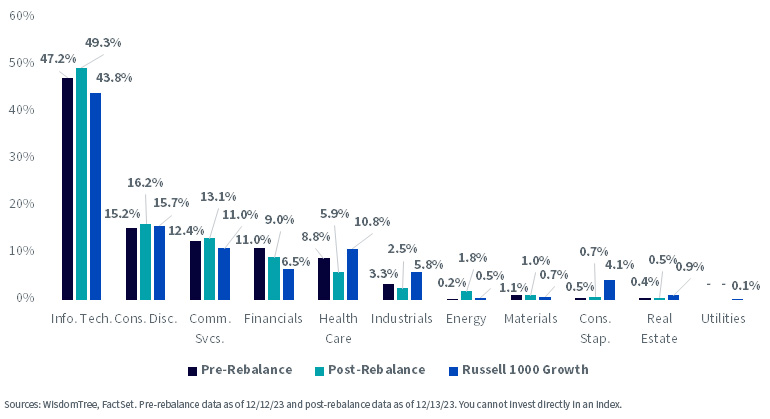

Sector modifications had been modest. The impression of the drop of UnitedHealth might be seen in a decrease weight in Well being Care, offset by a rise in Data Know-how pushed by the addition of Broadcom.

Sector Adjustments: WisdomTree U.S. High quality Progress Index

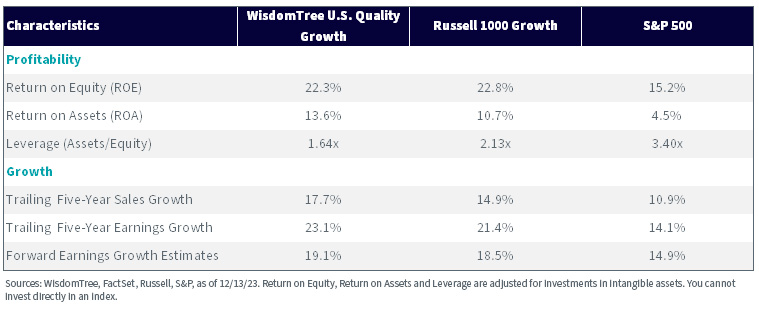

At every semi-annual rebalance, the Index systematically refreshes publicity to those high-quality and progress traits. This may be seen by the numerous enhancements in profitability and progress traits in comparison with the S&P 500.

For instance, the return on assets (ROA) for the Index is greater than twice that of the S&P 500 whereas additionally having a trailing five-year gross sales progress of virtually 7 proportion factors larger.

Index Traits

For definitions of phrases within the desk above, please go to the glossary.

Constructing a High quality Portfolio

The WisdomTree U.S. Quality Dividend Growth Fund (DGRW) was WisdomTree’s first high quality fund launched in 2013.

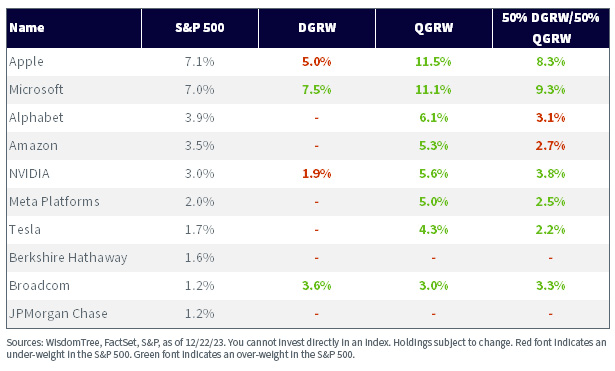

The Fund invests in high-quality dividend-paying corporations, making a extra value-tilted core allocation. As a byproduct of its dividend requirement, the Fund is under-weight in most of the non-dividend-paying mega-cap corporations which are high holdings in QGRW.

For traders using an allocation to DGRW or an analogous value-tilted core allocation under-weight in a few of the non-dividend-paying mega-caps, a mix of DGRW with QGRW might mitigate a few of the under-weights within the portfolio.

S&P 500 Prime 10 Holdings

Essential Dangers Associated to this Article

QGRW: There are dangers related to investing, together with the potential lack of principal. Progress shares, as a bunch, could also be out of favor with the market and underperform worth shares or the general fairness market. Progress shares are typically extra delicate to market actions than different varieties of shares. The Fund is non-diversified; consequently, modifications out there worth of a single safety might trigger larger fluctuations within the worth of Fund shares than would happen in a diversified fund. The Fund invests within the securities included in, or consultant of, its Index no matter their funding benefit. The Fund doesn’t try to outperform its Index or take defensive positions in declining markets, and the Index might not carry out as meant. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

DGRW: There are dangers related to investing, together with the potential lack of principal. Funds focusing their investments on sure sectors enhance their vulnerability to any single financial or regulatory improvement. This will lead to larger share worth volatility. Dividends are usually not assured, and an organization at the moment paying dividends might stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

[ad_2]

Source link