[ad_1]

A novel phenomenon has emerged in U.S. small-cap equities. Amid the financial restoration throughout the post-pandemic setting, U.S. corporations continued to pay an growing quantity of dividends to shareholders, with out interruption.

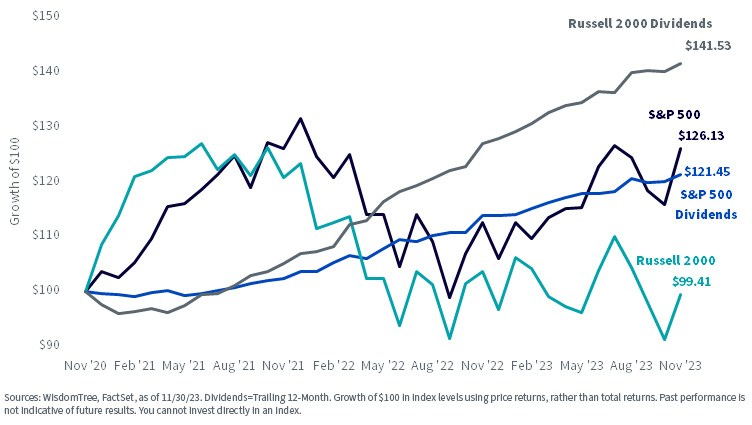

Small caps led the cost, rising trailing 12-month dividend totals for the Russell 2000 Index by over 40% since November 2020, a measure that almost doubled the 21% progress in S&P 500 dividends.

Elementary Disconnect: Small Cap Costs Down whereas Dividends Up >40% over the Final 3 Years

Large-cap fairness costs had their ups and downs over the past three years however principally saved tempo with dividend progress throughout this cycle, regardless of initially overshooting throughout the frenzied bull market of 2021. By November 2023, the S&P 500 price index is up a cumulative 26% over the previous three years whereas its dividends grew 21%. Giant-cap markets appeared to appropriately reward this elementary enchancment.

But this reward is totally absent in small-cap markets. Russell 2000 dividends grew 41% over the previous three years, but the index is nearly flat since then.

This elementary disconnect alerts small-cap equities are getting nominally cheaper regardless of important enhancements in a key driver of returns.

Although we can not forecast when this pattern could reverse, we see the Federal Reserve’s eventual pivot to simpler monetary policy as a catalyst for a broader small-cap rally. Even the market’s response over the primary few days after the December FOMC assembly was a step in that course.

Small caps with dividend progress potential which might be resilient to a number of macroeconomic eventualities warrant additional consideration.

Fortuitously, we not too long ago rebalanced the WisdomTree U.S. SmallCap Quality Dividend Growth Index (WTSDG), which is tracked by the WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS). This assemble applies a high quality focus to the dividend-paying small-cap market to offer dividend progress potential and defensive, resilient traits for volatile durations.

Let’s assess how its composition and fundamentals modified throughout our screening and reconstitution processes.

WisdomTree U.S. SmallCap High quality Dividend Progress Index (WTSDG)

WTSDG expands upon our flagship dividend-weighted methodology by incorporating further parameters to enhance the standard profile and dividend progress potential of the U.S. small-cap universe.

Starting with the WisdomTree U.S. SmallCap Dividend Index (WTSDI) universe, we choose the highest 50% of corporations with the very best mixed rank of progress and high quality elements primarily based on a composite rating. The expansion part of this rating consists of longer-term earnings progress expectations whereas the standard part assesses three-year pattern observations of return on equity (ROE) and return on assets (ROA). The result’s a inventory basket that continues to be value-biased but options “growth-lite” traits that carry it nearer to a core small-cap allocation from a stylistic standpoint.

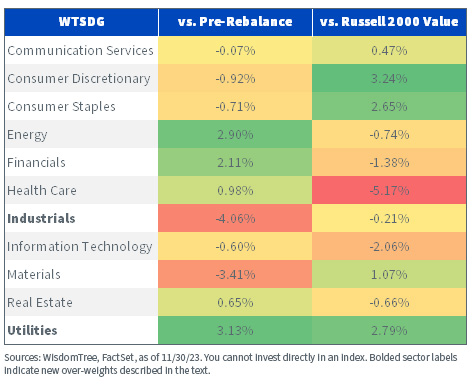

Sector Composition: Put up-Rebalance Comparability

After the rebalance, WTSDG’s modifications are sizable but primarily concentrated inside a couple of sectors. Relative to pre-rebalance information, essentially the most notable additions are in Power and Communication Providers, whereas Financials, Supplies and Actual Property headline the reductions.

In comparison with the Russell 2000 Index, nonetheless, the results are extra seen. Negligible modifications from the pre-rebalance information did little to impression a big present over-weight in Client Discretionary or massive under-weights in Well being Care and Info Know-how versus the broader small-cap market. Notable pickups to Communication Providers and Power, nonetheless, resulted in new over-weights in these sectors, whereas over-weights in Industrials and Client Staples elevated as nicely.

Financials was primarily diminished to market weight by means of the 6.5% discount on the rebalance, whereas an present under-weight in Actual Property was decreased additional and an over-weight in Supplies was pared.

Inside this sector combine, WTSDG delivers barely higher type diversification than the value-oriented indexes mentioned earlier. Although it stays under-weight in small-cap progress heavyweights in Well being Care and Informational Know-how, the emphasis on high-quality, dividend-paying corporations opens it up extra to the Client Staples and Discretionary sectors. It additionally trims its publicity to Financials and Utilities, two sectors which might be extra distinguished in worth indexes.

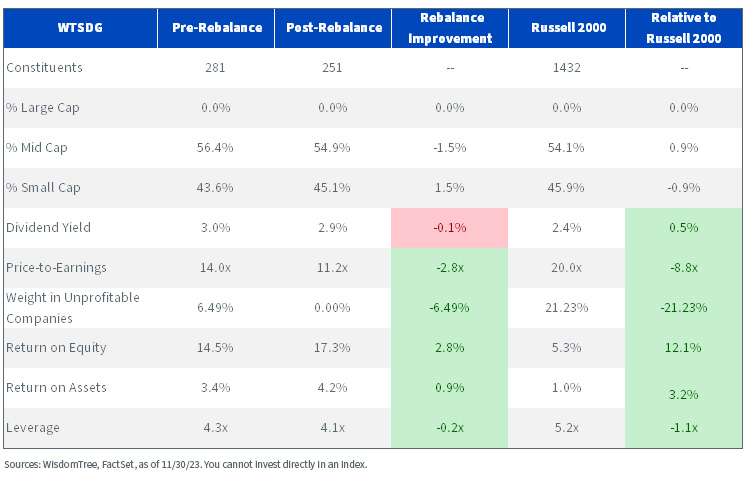

The extra concentrate on high quality rewarded WTSDG’s fundamentals after the rebalance as nicely.

Elementary Comparability after Rebalance

The rebalance as soon as once more decreased the burden in unprofitable corporations again to zero, illustrating the emphasis on environment friendly corporations with sturdy and confirmed operations. It is a key differentiator of the wedding between high quality and dimension, because the Russell 2000 is 21% laden with profitless corporations.

In the meantime, ROE and ROA grew practically 4% mixed relative to pre-rebalance information, and over 15% versus the market. This tandem additionally decreased general leverage multiples by over one level versus the Russell 2000, which is helpful whereas rising curiosity prices actual a toll on small-cap balance sheets.

Usually, buyers may anticipate that an improved high quality profile with innate defensive traits would require a premium valuation to the market, however WTSDG is an outlier. The rebalance trimmed practically three extra factors off its price-to-earnings (P/E) multiple, leaving it nearly 9 factors decrease than the general small-cap market.

We predict this mixture of improved high quality at a major low cost offers a beautiful entry level for allocators in search of broader market participation in 2024.

Essential Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. Funds focusing their investments on sure sectors and/or smaller corporations enhance their vulnerability to any single financial or regulatory improvement. This will lead to higher share worth volatility. Dividends usually are not assured, and an organization presently paying dividends could stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link