[ad_1]

Head of Fastened Revenue Technique

Whereas the Fed didn’t lower charges at its December policy meeting, the way in which the cash and bond markets have reacted post-FOMC, one may very well be forgiven for pondering the speed cuts had already begun. Certainly, most Treasury (UST) yields, particularly alongside the coupon curve, have fallen in a slightly noteworthy trend over the previous few buying and selling periods, as “charge lower euphoria” appears to have taken maintain.

Nevertheless, New York Fed President John Williams (a spokesperson for official Fed coverage) curiously pushed again on this current market motion. He famous that “we aren’t actually speaking about charge cuts” and that it’s “untimely” to consider the March 2024 FOMC assembly because the beginning date for reducing charges. Finally, upcoming financial and inflation information will decide the timing and magnitude of charge cuts, and that can create uncertainty and volatility within the UST market.

That being stated, we’re of the mindset that charge cuts are coming in 2024; it’s only a matter of when and by how a lot. In opposition to this backdrop, we provide two mounted revenue options for navigating what is going to probably lie forward for bond traders within the coming yr from each an offense and protection perspective:

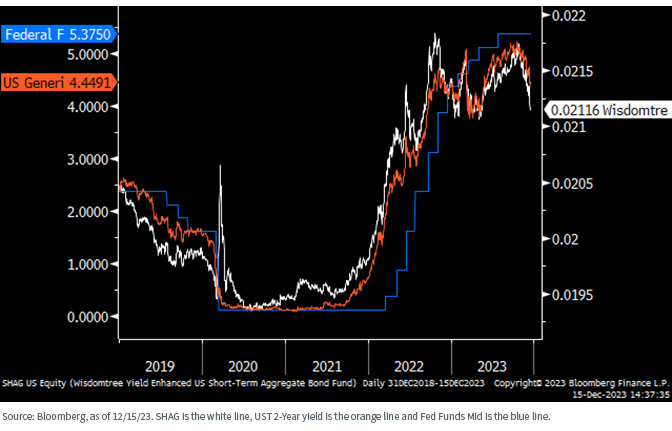

- Thus, Fed charge cuts and/or charge lower expectations ought to present by right here in a extra direct trend than intermediate or lengthy period automobiles.

Correlation of SHAG, UST 2-Yr Yield and Fed Funds Goal Midpoint

- USFR is tied to the UST 3-month t-bill public sale yield, which is instantly tied to the precise Federal Funds Price.

- Why is that vital? As a result of the Fed hasn’t lower charges. The three-month t-bill yield is unchanged post-FOMC vs. declines of roughly 30 basis points alongside the UST mounted coupon curve as of this writing.

- As talked about, we imagine Fed charge cuts are coming, however what if the market is unsuitable in its aggressive pricing on this entrance? Volatility.

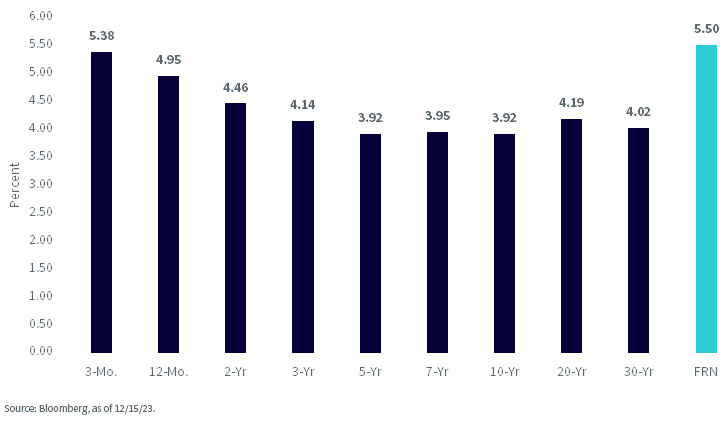

- And don’t overlook, the yield curve continues to be inverted (see under).

U.S. Treasury Yields

Conclusion

As soon as once more, one could make the case that the UST market has already priced in quite a lot of excellent news, so as a way to keep yields at present ranges (and even decrease), validation will likely be essential. In different phrases, future financial and labor market information must reveal a visual slowing in progress, whereas inflation should proceed to point out indicators of additional cooling. These two forces will likely be essential for the Fed to start its course of towards charge cuts.

Essential Dangers Associated to this Article

SHAG: There are dangers related to investing, together with potential lack of principal. Fastened revenue investments are topic to rate of interest threat; their worth will usually decline as rates of interest rise. Fastened revenue investments are additionally topic to credit score threat, the chance that the issuer of a bond will fail to pay curiosity and principal in a well timed method or that unfavourable perceptions of the issuer’s capacity to make such funds will trigger the worth of that bond to say no. Investing in mortgage- and asset-backed securities entails rate of interest, credit score, valuation, extension and liquidity dangers and the chance that funds on the underlying belongings are delayed, pay as you go, subordinated or defaulted on. As a result of funding technique of the Fund, it could make greater capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

USFR: There are dangers related to investing, together with potential lack of principal. Securities with floating charges may be much less delicate to rate of interest adjustments than securities with mounted rates of interest, however could decline in worth. Fastened revenue securities will usually decline in worth as rates of interest rise. The worth of an funding within the Fund could change shortly and with out warning in response to issuer or counterparty defaults and adjustments within the credit score rankings of the Fund’s portfolio investments. As a result of funding technique of this Fund, it could make greater capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link