[ad_1]

From August to mid-October, long-term bond yields injected renewed fears of a repeat of 2022, when fastened revenue and equities each generated meaningfully adverse returns.

WisdomTree launched the capital-efficient household of funds to permit traders to unlock capital and add in portfolio diversifiers. Whereas bonds didn’t diversify shares in 2022 by producing optimistic returns, managed futures methods that provide a “money plus” sort of investing payout did present that diversification.

But when one changed simply conventional and even defensive equities with the Environment friendly Core technique as a result of bonds supplied diversification up to now, that historic bond diversification didn’t work in 2022.

With the dramatic enhance in each nominal and real yields within the bond market, we imagine it has turn into a way more opportune time to think about our capital-efficient household so as to add extra Treasury duration to portfolios.

A Longer-Time period Perspective

For the latest month-end and standardized efficiency, click on the respective ticker: NTSX, VBIAX.

For definitions of the indices within the chart above, please go to the glossary.

Since we launched NTSX in August 2018, core fastened revenue returns (as measured by the Bloomberg U.S. Aggregate Index—LBUSTRUU) have been successfully zero. Regardless of this headwind for the technique, NTSX has delivered on its mandate of producing the leveraged returns of a 60/40 portfolio (60% S&P 500 Index, 40% Bloomberg U.S. Mixture Index). Ignoring the variations in volatility, an investor might have replicated the returns of 60/40 by proudly owning 60% in equities and stuffing the remaining 40% underneath their mattress.

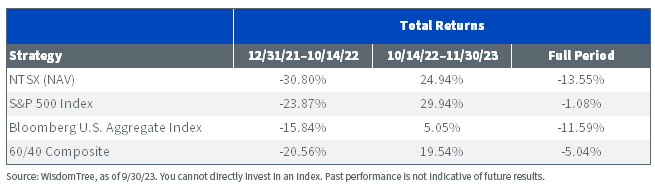

2022 and 2023

Sadly, leverage cuts each methods. Returns in 2022 had been disappointing in just about each market apart from the U.S. greenback and managed futures. Rising charges and falling equities resulted within the worst-case state of affairs for a standalone technique like NTSX. Nevertheless, we predict it’s instructive to separate the interval into two sections: the drawdown and the aftermath.

Wanting first on the drawdown interval, whereas extraordinarily uncommon, adverse whole returns for shares and bonds meant a 60/40 portfolio down consistent with a 100% fairness portfolio. This contrasts with extra regular durations when fastened revenue acts as a shock absorber for shares. For a levered technique like NTSX, this meant a drawdown in extra of equities, which was painful.

In the course of the rebound, equities led the way in which, whereas bond returns had been extra muted. On this state of affairs, NTSX generated returns that exceeded the 60/40 portfolio on account of leverage. For the total interval, NTSX stays beneath ranges seen on the finish of 2021, as fastened revenue returns have been the first driver of adverse whole returns.

Causes for Optimism on Bonds’ Diversifying Potential

The challenges for 60/40 over this era had been largely attributable to fastened revenue returns. Whereas nothing in markets is inconceivable, the percentages that fastened revenue returns proceed to generate these ranges of losses at the moment are decrease than they had been in 2021. That is primarily a perform of the beginning ranges of yields.

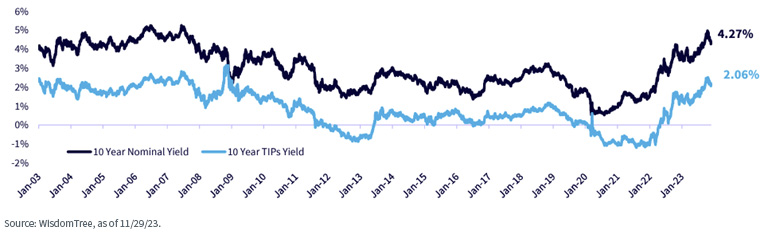

Immediately, with the 10-12 months Treasury close to 4.3%, charges would want to rise by one other 2.57% to six.87% over the following yr to generate the identical losses in fastened revenue skilled in 2022. Whereas not inconceivable, we view this as extraordinarily unlikely.

Actual Yields

Our home view is that inflation will recede over the following 12–24 months, and on the whole, we predict traders can deal with actual yields as an vital indicator for including to fastened revenue allocations. We’ve got among the highest actual yields accessible within the final 20 years after TIPS surged greater than 350 foundation factors from a strongly adverse yield to round 2.1%. These yields will appeal to some degree of purchaser help and hedge the draw back within the economic system higher from right here, in our view.

10-12 months Nominal vs. Actual Yields, 1/2/03–11/29/23

Packaging It All Collectively

After one of many worst sustained durations for fastened revenue returns in latest reminiscence, we imagine the first danger for 60/40 allocations might come from equities. Nevertheless, the timing of this danger is problematic, with many traders searching for to remain invested. In response, traders can acquire publicity to Treasuries through Environment friendly Core whereas on the identical time sustaining publicity to the market. Sure, the danger that equities fall with yields rising would end in adverse whole returns; nevertheless, we imagine the prospect of serious drawdowns in fastened revenue could also be behind us.

Ought to Treasuries start to generate optimistic whole returns over market cycles on account of upper beginning yields, a technique like NTSX may add worth versus a 60/40 strategy or versus a 100% fairness allocation ought to equities begin to turn into extra unstable. In comparison with merely proudly owning a Treasury ETF, the fastened revenue portfolio in NTSX is diversified throughout the yield curve, making traders much less delicate to making an attempt to determine which section of the curve seems most tasty. With charges round 4.5% throughout the curve, we imagine this strategy has the flexibility to outperform within the close to time period in comparison with solely investing on the lengthy finish.

Vital Dangers Associated to this Article

There are dangers related to investing, together with the doable lack of principal. Whereas the Fund is actively managed, the Fund’s funding course of is predicted to be closely depending on quantitative fashions, and the fashions might not carry out as meant. Fairness securities, comparable to widespread shares, are topic to market, financial and enterprise dangers that will trigger their costs to fluctuate. The Fund invests in derivatives to realize publicity to U.S. Treasuries. The return on a by-product instrument might not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage, and derivatives might be unstable and could also be much less liquid than different securities. Consequently, the worth of an funding within the Fund might change rapidly and with out warning, and you could lose cash. Rate of interest danger is the danger that fastened revenue securities, and monetary devices associated to fastened revenue securities, will decline in worth due to a rise in rates of interest and modifications to different elements, comparable to notion of an issuer’s creditworthiness. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

[ad_2]

Source link