[ad_1]

The S&P 500 (SPY) is placing the ending touches on a robust 2023 marketing campaign. That is the 4th straight yr the big cap index has outperformed small and mid caps. Gladly there are indicators that is going to alter which is a really wholesome signal for the longevity of this bull run. 43 yr funding professional Steve Reitmeister explains why in his newest commentary that features insights on this high 11 picks for in the present day’s market. Learn on under for extra.

Shares are as soon as once more flirting with the highs of the yr at 4,600 on the S&P 500 (SPY). And sure, will probably crack above given the constructive seasonal results that comes with typical Santa Claus rally.

Even higher than that’s that FINALLY traders are taking income on bloated expertise and mega cap positions. This cash is being rotated to deserving small and mid cap shares which have woefully underperformed thus far in 2023.

That is one of the best information for traders going into 2024. Extra on why that’s the case on this week’s version of the Reitmeister Whole Return commentary under…

Market Commentary

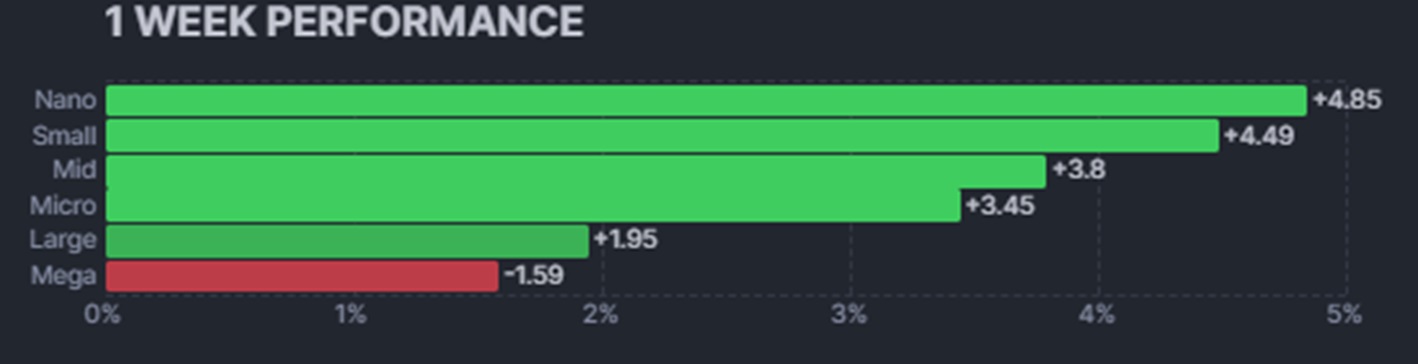

If an image is value a thousand phrases…then let this chart communicate loudly about what was flawed with the 2023 inventory market:

As famous on my own and lots of different market commentators, the 2023 bull market was a little bit of smoke and mirrors. That is as a result of nearly all of the features actually accrued to the mega cap expertise shares like Tesla, Nvidia, Apple, Microsoft and many others. That explains the intense features for that mega cap bar above versus tepid features and even losses for the broader market.

It is one factor for mega caps to guide and others modestly lag. However the practically non-existent features for small caps is sort of troubling. That is as a result of historical past reveals that small caps outperform over time as a result of they develop earnings quicker and that’s rewarded with increased share costs. Heck, that hasn’t been true for 4 years.

Thus, the chart under for the previous week is a VERY welcome aid:

Not solely are smaller shares main the best way, however income are literally being trimmed from these bloated mega cap positions. That is the rotation we have now all been ready for which indicators that this bull market is for actual…and has legs to run additional forward within the coming yr.

However to be clear, it will not be the S&P 500 having a banner yr in 2024. I believe that 5,000 would be the yr finish goal which requires modest single digit returns.

As an alternative, it will likely be the missed small and mid caps main the best way. The place these market indices might present 2-3X the features of their massive cap friends as they play catch up.

The excellent news is that the POWR Rankings is exceptionally good at uncovering one of the best of these smaller shares that sometimes fly below the radar. And that will likely be an enormous a part of our benefit within the coming yr.

The one factor that would derail that’s, in fact, rising indicators of a recession. Which means what if the Fed overstays their welcome and creates a recession earlier than charges begin heading decrease?

This was the concern that led to the bear market of 2022 as a result of historical past confirmed that recession was the most probably end result from such an aggressive charge climbing regime. Oddly, however gladly, this time was totally different. That being the thousands and thousands of staff who selected early retirement throughout Covid which made the employment market extremely resilient.

Mainly anybody who actually needed a job may discover one with a document breaking 10,000,000 job openings posted. And as historical past reveals, so long as shoppers have jobs and cash of their pocket…they’ll spend it.

That is what propped up the financial system in 2023…resulting in no recession and return of the bull market. So long as that image of financial well being stays…so too does bullish inventory market circumstances. However once more, the 2024 playbook requires a distinct group of shares to cleared the path not like 2023.

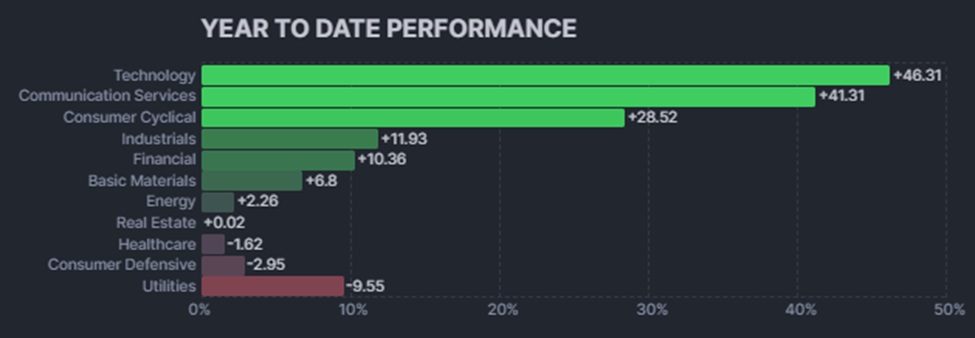

That additionally features a rotation within the sectors that traders will likely be drawn to. Right here is the yr so far 2023 sector efficiency breakdown:

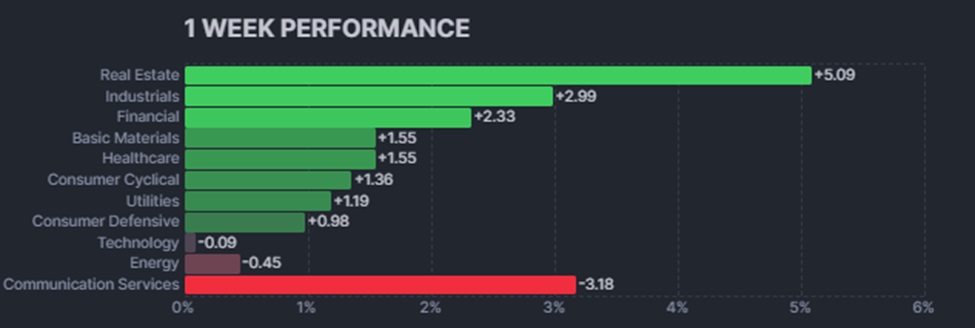

And right here is simply the previous week additional exhibiting the rotation that’s going down:

Actual property is main the best way as a result of charges are going decrease making loans cheaper. There in all probability is extra upside there, however I believe it is the subsequent 3 teams that ought to see continued upside: Industrials, Financials, Fundamental Supplies and possibly sooner or later Vitality will be a part of that occasion.

Placing it altogether, 2023 was a very good yr for traders…however an odd one given the intense underperformance from small caps. This units up 2024 as a superior funding yr for the typical particular person investor for those who look in the correct spots.

Hopefully the data above helps you focus in on these proper spots going ahead. Additionally the highest picks mentioned within the subsequent part ought to assist you to outperform within the yr forward.

What To Do Subsequent?

Uncover my present portfolio of seven shares packed to the brim with the outperforming advantages present in our unique POWR Rankings mannequin.

Plus I’ve added 4 ETFs which are all in sectors properly positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and all the pieces between.

If you’re curious to study extra, and need to see these 11 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares had been buying and selling at $456.73 per share on Tuesday afternoon, up $0.04 (+0.01%). Yr-to-date, SPY has gained 20.75%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Total Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The put up VERY Healthy Stock Rotation Underway appeared first on StockNews.com

[ad_2]

Source link