[ad_1]

Within the second half of 2022, nationwide dwelling costs skilled a light correction as a speedy shift from 3% mortgage charges to greater than 6% destabilized a housing market that had simply seen a speedy run-up in dwelling costs in the course of the pandemic housing increase.

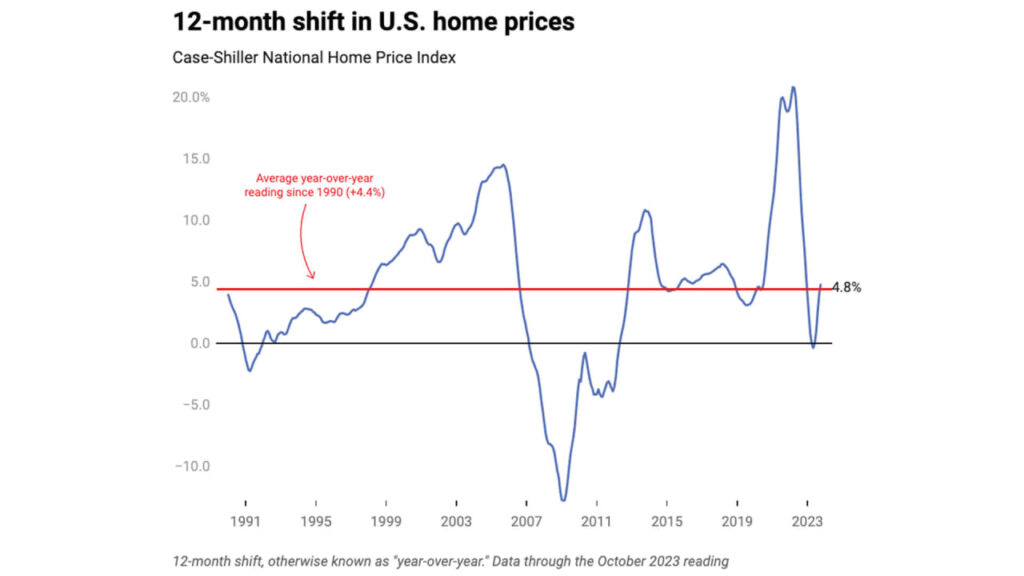

The overwhelming majority of housing economists I spoke to on the time thought that this correction would carry over into 2023 and that nationwide dwelling costs would fall for the 12 months. Nevertheless, that didn’t occur. Relying on the index you have a look at, nationwide dwelling costs rose someplace between 3% and 6% final 12 months, aligning intently with the historic common.

Nik Shah, CEO of Residence.LLC, is one knowledgeable who wasn’t stunned. In November 2022, he instructed me that analysts at his agency had been forecasting that nationwide dwelling costs would rise 4% to six% in 2023. They had been proper, however will they be proper once more in 2024?

ResiClub spoke with Shah to higher perceive what his staff of analysts expects from U.S. dwelling costs in 2024 (Home.LLC is essentially the most bullish amongst the home price forecast models I monitor).

Heading into 2023, quite a few housing economists predicted a decline in U.S. dwelling costs, with some fashions forecasting a multiyear correction resulting in a ten% to twenty% peak-to-trough lower. In distinction, your forecast anticipated a 4% rise in U.S. dwelling costs for 2023, which turned out to be essentially the most correct amongst practically 20 economists I consulted in late 2022. How did you get it proper?

Residence costs elevated in 2023 primarily because of low provide of stock and regular demand for houses, regardless of file “unaffordability.” Whereas dwelling costs did right in some markets, nationwide dwelling costs grew in 2023, precisely as we had predicted.

Like many housing economists, we foresaw a decline in demand for dwelling purchases. Nevertheless, our prediction was higher than everybody else’s as a result of our AI confirmed that the decline in provide would outpace the decline in demand.

We projected that the provision of stock can be actually low in early 2023 as a result of 92% of debtors had been locked into an under-6% charge in late 2022. Plus, debtors have been the most important supply of provide previously few a long time.

We predicted this “lock-in” impact from rising rates of interest manner again in November 2021 due to our AI-modeled eventualities going again 50 years, particularly the tumultuous Nineteen Seventies.

Why do you suppose we’ve not seen a better uptick in lively dwelling listings?

The mortgage charge shock didn’t translate to elevated provide of listings as a result of there are solely three sources of provide, they usually’re all constrained:

- Current house owners, most of whom don’t wish to promote. Why? As a result of 79% of debtors are nonetheless locked in at a sub-5% charge. Why would householders record houses when charges had been larger than 6% all through 2023?

- New development, which is led by giant builders, provided many incentives like mortgage charge buydowns to presell stock resulting in rise in new dwelling gross sales.

- Most delinquencies, which had been nonetheless very low, didn’t convert to foreclosures as house owners with constructive fairness had been incentivized to promote their houses throughout pre-foreclosure.

In terms of U.S. dwelling costs, what are you forecasting for 2024? How do you count on the U.S. housing market to look this 12 months?

Barring a black swan occasion, we predict that the housing market in 2024 will admire greater than in 2023. We mission a 4% to 7% enhance within the Case-Shiller dwelling worth index in 2024 for 2 causes:

- Falling [mortgage] charges will enhance demand. Our AI tasks a 5-million enhance in homebuyers for each 1% drop in charges. In distinction, there are lower than 1.5 million houses listed on the market.

- Housing provide will stay decrease than demand. For resales, our AI tasks that reducing charges will enhance demand far more than rising provide. Plus, there’s an 11% annual drop in development of single-family houses. [And] rising unemployment gained’t materially enhance delinquencies as a result of the credit score high quality and residential fairness of most debtors is pristine.

Whereas we’re bullish in regards to the nationwide dwelling worth index, we’re nonetheless bearish about metros like Austin, Boise, [Idaho], and Denver, as now we have been since 2022.

Are there nonetheless draw back dangers in terms of dwelling costs? And the way do you see that shifting via the following decade?

Whereas we’re bullish about dwelling costs within the 2020s, we’re nonetheless bearish about dwelling costs within the long-term except immigration compensates for declining beginning charges.

Within the 2030s, [housing] demand will begin falling as a result of Gen Zs will make a smaller cohort than millennials plus will face a steeper affordability problem.

On the similar time, provide will enhance as boomers age.

Is there a path to restoring housing affordability? And what does it appear like?

Everybody needs inexpensive housing, however nobody needs their very own dwelling to immediately change into inexpensive.

Within the Roaring ’20s, affordability may enhance however gained’t be mounted. Right here’s why:

A big change in zoning is unlikely as a result of it is actively backed by most householders who make up two-thirds of the whole inhabitants. Constructing extra houses would not essentially decrease dwelling costs as a result of the prices of development—land, labor, and supplies—preserve rising as dwelling costs preserve rising. ADUs and modular houses sound promising however haven’t seen mass adoption for a large number of causes. Even Congress can’t repair affordability for everybody.

Many are praying for a housing market crash. Even when there’s a large dwelling worth crash, will the Fed and Congress simply sit idle? Additionally, in that occasion, who’s extra prone to shortly scoop up houses: Wall Road or Most important Road?

[ad_2]

Source link