[ad_1]

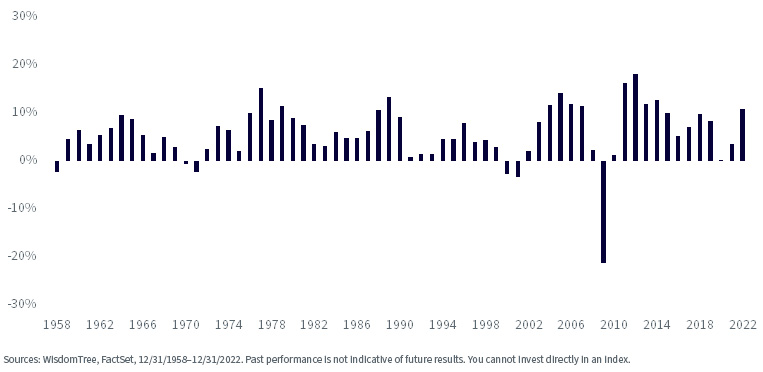

Following its second within the solar in 2022, value returned to the background in 2023, lagging growth for the fifth 12 months prior to now six.

Progress (proxied by the Russell 1000 Growth Index) completed the 12 months sturdy and forward of worth (proxied by the Russell 1000 Value Index), primarily pushed by the Magnificent Seven, a handful of mega-cap tech giants on the forefront of the factitious intelligence (AI) growth.

Progress vs. Worth Efficiency over the Years

The Federal Reserve is predicted to chop charges in 2024, signaling an finish to its most aggressive rate hike marketing campaign for the reason that early Nineteen Eighties. The long-awaited coverage pivot might shift market sentiment in favor of this 12 months’s laggards, corresponding to dividend-paying firms and broader worth.

Within the final 64 years, solely six years noticed declining dividend ranges, and just one 12 months noticed a decline of over 5%. Taking a dividend strategy to worth might present extra draw back assist via dependable revenue than pure worth methods.

Annual Progress of S&P 500 Dividends

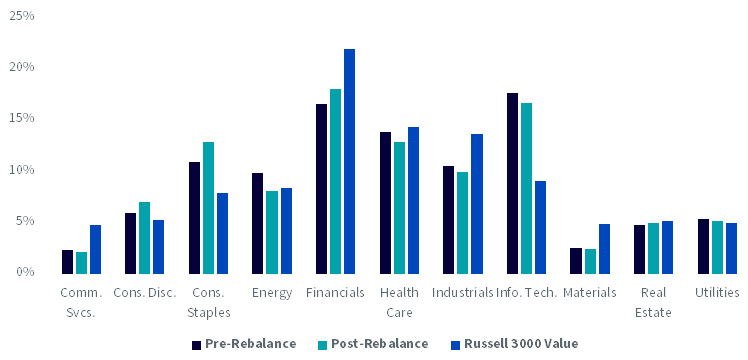

As progress inventory valuations soar with traditionally excessive multiples, dividend indexes sometimes preserve a much less top-heavy allocation than conventional market cap-weighted indexes, rising weights to firms with sturdy fundamentals and defensive qualities, whereas lowering weights to firms thought of overvalued (learn: having the potential to fall in need of lofty expectations).

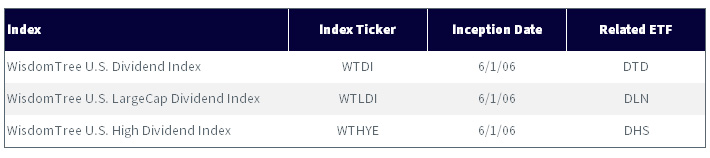

WisdomTree U.S. Dividend Reconstitution

The WisdomTree U.S. Dividend Index (WTDI) is a basically weighted Index that tracks dividend-paying U.S. firms, whereby every firm’s weight is derived from its share of the Index’s complete Dividend Stream®.

The WisdomTree U.S. LargeCap Dividend Index (WTLDI) is comprised of dividend-paying firms from the large-cap section of the U.S. Dividend Index, and the WisdomTree U.S. High Dividend Index (WTHYE) is comprised of the highest 30% of dividend payers within the U.S. Dividend Index.

The WisdomTree U.S. Dividend household, together with the above Indexes, underwent its annual reconstitution in early December. For eligibility in these Indexes, firms should have a market capitalization of a minimum of $100 million and shares should have a median day by day greenback quantity of a minimum of $100,000. Corporations are additionally judged on quality and momentum elements to get rid of probably higher-risk firms.

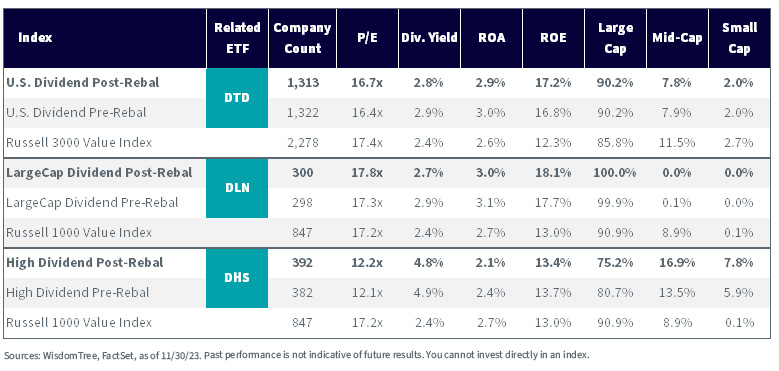

After its rebalance, the WisdomTree U.S. Dividend Index maintained a decrease price-to-earnings ratio than the Russell 3000 Value Index in addition to larger dividend yield and high quality metrics, corresponding to return on assets (ROA) and return on equity (ROE).

Although the WisdomTree U.S. LargeCap Dividend Index trades at a slight premium valuation to the Russell 1000 Worth Index, it has a 5% larger ROE and better dividend yields and ROA to compensate for the larger a number of.

Excessive dividends had been out of favor this 12 months, and a scarcity of publicity to fast-growing mega-cap giants just like the Magnificent Seven brought on the WisdomTree U.S. Excessive Dividend Index to underperform the Russell 1000 Worth Index. Nonetheless, we consider this was merely a results of a method mismatch with what markets rewarded throughout a 12 months marked by slim fairness management and minimal breadth. Nonetheless, the Index nonetheless trades at engaging reductions to its benchmark with double the dividend yield.

Rebalance Fundamentals

For definitions of phrases within the desk above, please go to the glossary.

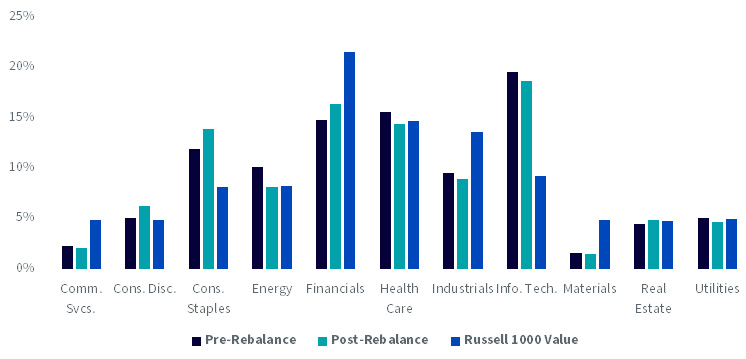

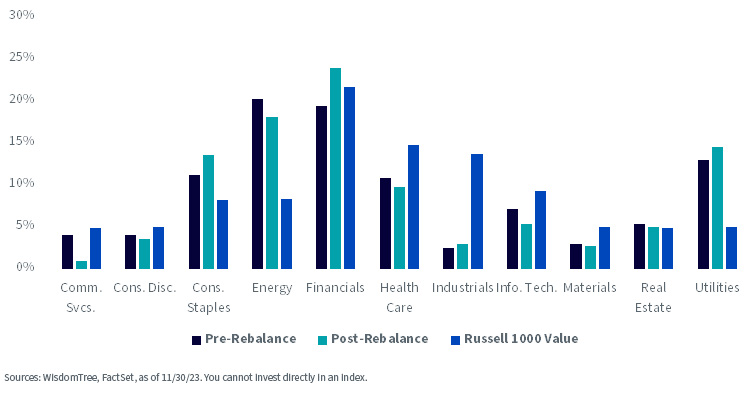

By way of sector allocation modifications, the WisdomTree U.S. Dividend Index and WisdomTree U.S. LargeCap Index largely maintained their sector under- and over-weight allocations relative to the Russell 3000 Worth Index and Russell 1000 Worth Index, respectively.

WisdomTree U.S. Dividend Index vs. Benchmark

WisdomTree U.S. LargeCap Dividend Index vs. Benchmark

WisdomTree U.S. Excessive Dividend Index vs. Benchmark

Necessary Dangers Associated to this Article

There are dangers related to investing, together with the doable lack of principal. Funds focusing their investments on sure sectors improve their vulnerability to any single financial or regulatory improvement. This will lead to larger share worth volatility. Dividends should not assured, and an organization at present paying dividends might stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

[ad_2]

Source link