[ad_1]

The Tokyo Inventory Alternate (TSE) created a buzz earlier this yr when it pushed listed corporations to lift price-to-book ratios above one, warning that the securities of corporations that fail to take action may face classification as “securities underneath supervision” and even delisting.

Although it’s too quickly to judge the outcomes of the TSE’s efforts to enhance company governance and capital effectivity, Japanese equities had a powerful yr of efficiency.

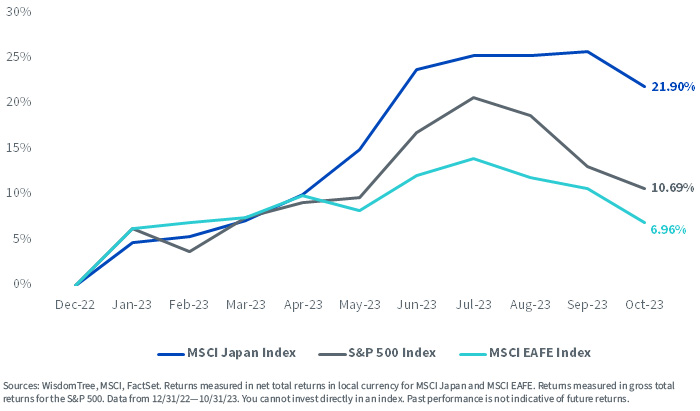

In native currencies, the MSCI Japan Index returned 21.90%, outpacing the S&P 500 Index by greater than 11% and the MSCI EAFE Index by virtually 15%.

Nation/Area Returns, Japan vs. U.S. vs. EAFE

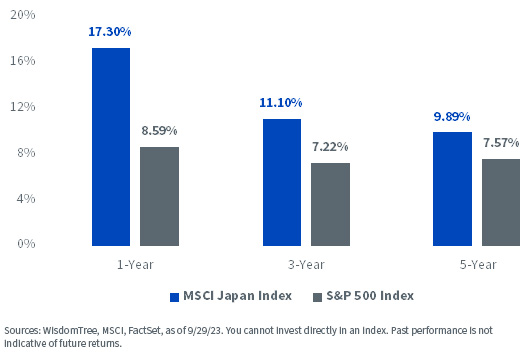

One space of emphasis for activist buyers in Japanese equities is getting corporations to return extra money to shareholders. This push appears to be working.

The weighted-average dividend progress for the MSCI Japan Index has persistently outpaced that of the S&P 500 Index over one-year, three-year and five-year intervals.

Weighted Common Annualized Dividend Development, MSCI Japan Index vs. S&P 500 Index

2023 Index Reconstitution: Japanese Fairness Indexes

The reconstitution of the underlying Indexes of the WisdomTree Japan Hedged Equity Fund (DXJ), the WisdomTree Japan Hedged SmallCap Equity Fund (DXJS) and DXJS’s unhedged counterpart, the WisdomTree Japan SmallCap Dividend Fund (DFJ), was efficient on the shut of November 8.

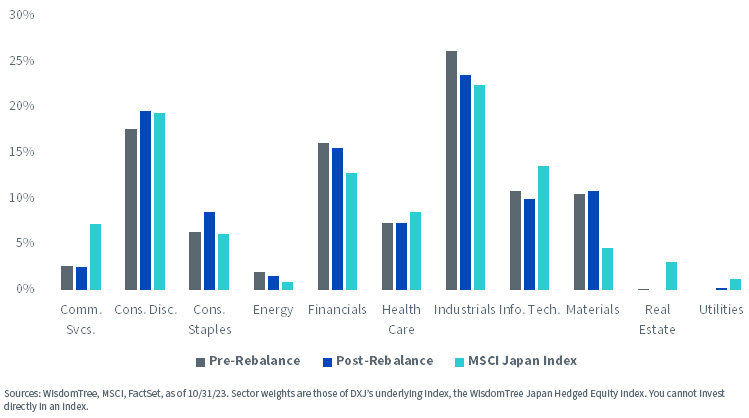

Following the rebalance, DXJ’s Index, the WisdomTree Japan Hedged Equity Index (WTIDJH) largely maintained its sector under- and over-weights relative to the MSCI Japan Index.

Japanese equities carried out properly year-to-date throughout most sectors, and WTIDJH elevated allocations to the Client Discretionary, Client Staples and Supplies sectors. The Index decreased its publicity to Vitality and Industrials.

The DXJ Rebalance: What Modified within the Index

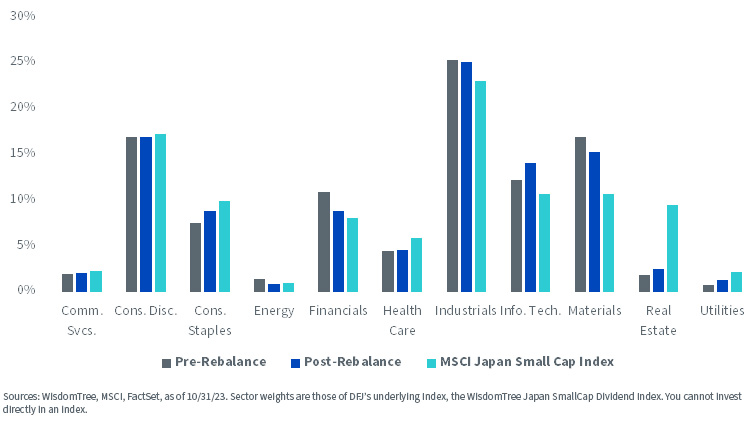

small caps, DFJ’s Index, the WisdomTree Japan SmallCap Dividend Index (WTJSC), elevated allocations to Info Know-how corporations and dropped allocations to Financials, Vitality and Supplies, relative to the MSCI Japan Small Cap Index.

The DFJ Rebalance: What Modified within the Index

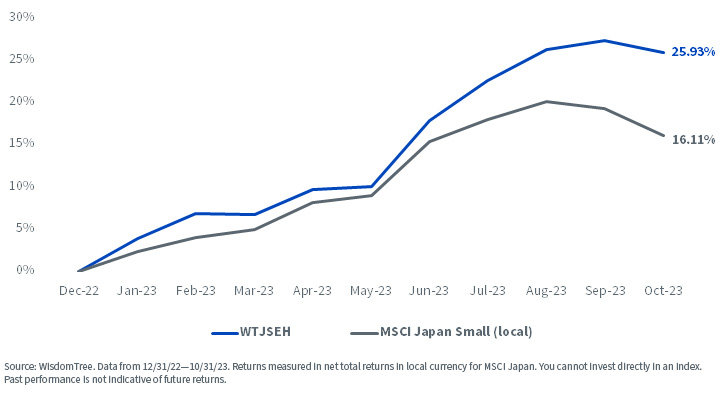

12 months to this point, the WisdomTree Japan Hedged Fairness Index outperformed the MSCI Japan Index by virtually 13%, and the WisdomTree Japan Hedged SmallCap Equity Index (WTJSEH) outperformed the MSCI Japan Small Cap Index by virtually 10%. The WisdomTree Japan SmallCap Dividend Index outperformed the MSCI Japan Small Cap Index by greater than 3%.

WisdomTree Japan Hedged Fairness Index (WTIDJH) vs. MSCI Japan YTD Returns

-vs,-d-,-msci-japan-ytd-returns.jpg?h=401&w=707&hash=EE970C9E36311C95A98EC541679641B6)

WisdomTree Japan Hedged SmallCap Fairness Index (WTJSEH) vs. MSCI Japan Small Cap YTD Returns

WisdomTree Japan SmallCap Dividend Index (WTJSC) vs. MSCI Japan Small Cap YTD Returns

-vs,-d-,-msci-japan-small-cap-ytd-returns.jpg?h=392&w=705&hash=057D2B8ADF960F16369EAF390DF29EBC)

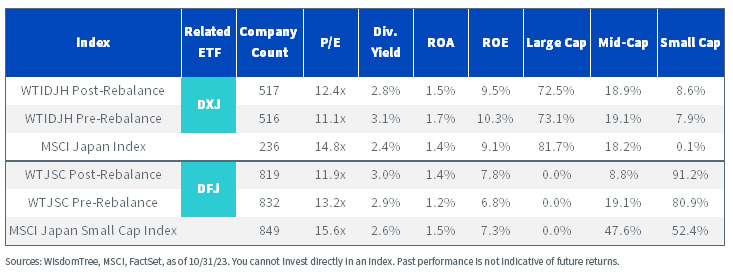

Following the annual rebalance, profitability metrics and distributions of the WisdomTree Japan Hedged Fairness Index stay increased than these of its benchmark, the MSCI Japan Index. The WisdomTree Japan SmallCap Dividend Index noticed enhancements to its dividend yield, return on assets and return on equity following its rebalance, and its price-to-earnings decreased from 13.2x to 11.9x post-rebalance.

Rebalance Fundamentals Comparability

For definitions of phrases within the desk above, please go to the glossary.

For added element on the rebalance of every of the Indexes, please go to their respective Index pages on the WisdomTree web site:

Necessary Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. International investing includes particular dangers, equivalent to threat of loss from forex fluctuation or political or financial uncertainty. The Fund focuses its investments in Japan, thereby growing the affect of occasions and developments in Japan that may adversely have an effect on efficiency. Investments in forex contain extra particular dangers, equivalent to credit score threat and rate of interest fluctuations. By-product investments will be risky, and these investments could also be much less liquid than different securities and extra delicate to the impact of various financial situations. As this Fund can have a excessive focus in some issuers, the Fund will be adversely impacted by modifications affecting these issuers. As a result of funding technique of this Fund, it might make increased capital achieve distributions than different ETFs. Dividends should not assured, and an organization at present paying dividends could stop paying dividends at any time. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

[ad_2]

Source link